Personal Finance

I'm Getting $3,000 a Month From Social Security. How Much Savings Do I Need?

Published:

Last Updated:

One of the trickiest aspects of planning for retirement is not knowing how much money to save for it. And the younger you are, the harder it can be to get a handle on your future expenses.

One thing you can do, though, is get an estimate of your monthly Social Security benefit. That estimate is available to you if you create an account on the Social Security Administration’s website.

The average retired worker today collects 1,924.35 per month. But if you’re a higher wage-earner, you may be in line for a much larger monthly benefit.

If you discover you should be getting $3,000 from Social Security, it potentially takes some of the pressure off you to save. But it’s important to know what nest egg to aim for.

The amount of money you need for an enjoyable retirement will depend on you and no one else, so don’t start searching online to see what the average senior has saved or what the average American thinks they’ll need. Those numbers won’t do you much good because every single person’s situation is unique.

Instead, try to picture your ideal retirement, and get as specific as possible. What part of the country do you see yourself living in? Will you own a larger home or a smaller one? Will you need a car? And how do you see yourself spending your days?

These are details only you can put together. But once you have them in place, you can start to run some numbers to see how much savings to aim for.

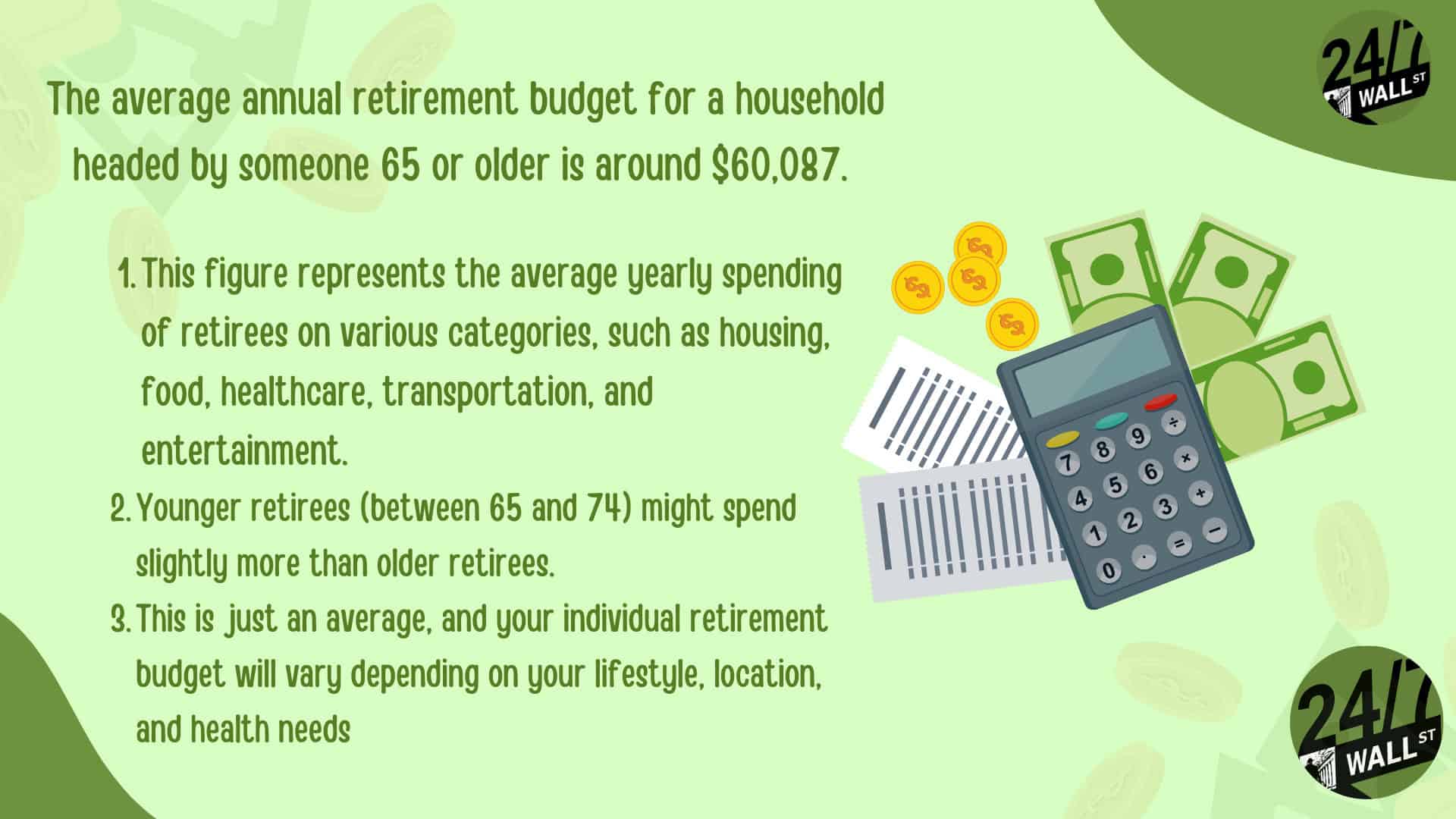

Of course, there are certain expenses all retirees should anticipate — things like food, healthcare, and utilities. And don’t forget to pad your retirement budget to account for unplanned expenses.

If you own a home in retirement, at some point, it’ll need repairs. And even if you’re healthy, you’ll probably have a year here and there with higher-than-typical medical bills. Factor these things into your numbers as well. From there, you can come up with an annual retirement budget and then subtract your Social Security income to get closer to a savings target.

Say that budget has you spending $72,000 a year. If you’re getting $3,000 a month, or $36,000 per year, from Social Security, it means your benefits should cover half of your annual expenses. That also means $36,000 a year will need to come from your IRA or 401(k), or wherever you’re keeping your savings.

If you use the 4% rule as a baseline for managing nest egg withdrawals, that allows you to multiply $36,000 by 25 to arrive at a $900,000 savings goal. But remember, you will want to build in wiggle room for unanticipated expenses, so padding that figure and rounding up to $1 million isn’t a bad idea in this situation.

The more money you get from Social Security in retirement, the less you might have to save. So remember, there are steps you can take to lock in a higher benefit. These include extending your career once your earnings have peaked and delaying your Social Security claim past full retirement age for a boosted monthly check.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.