Personal Finance

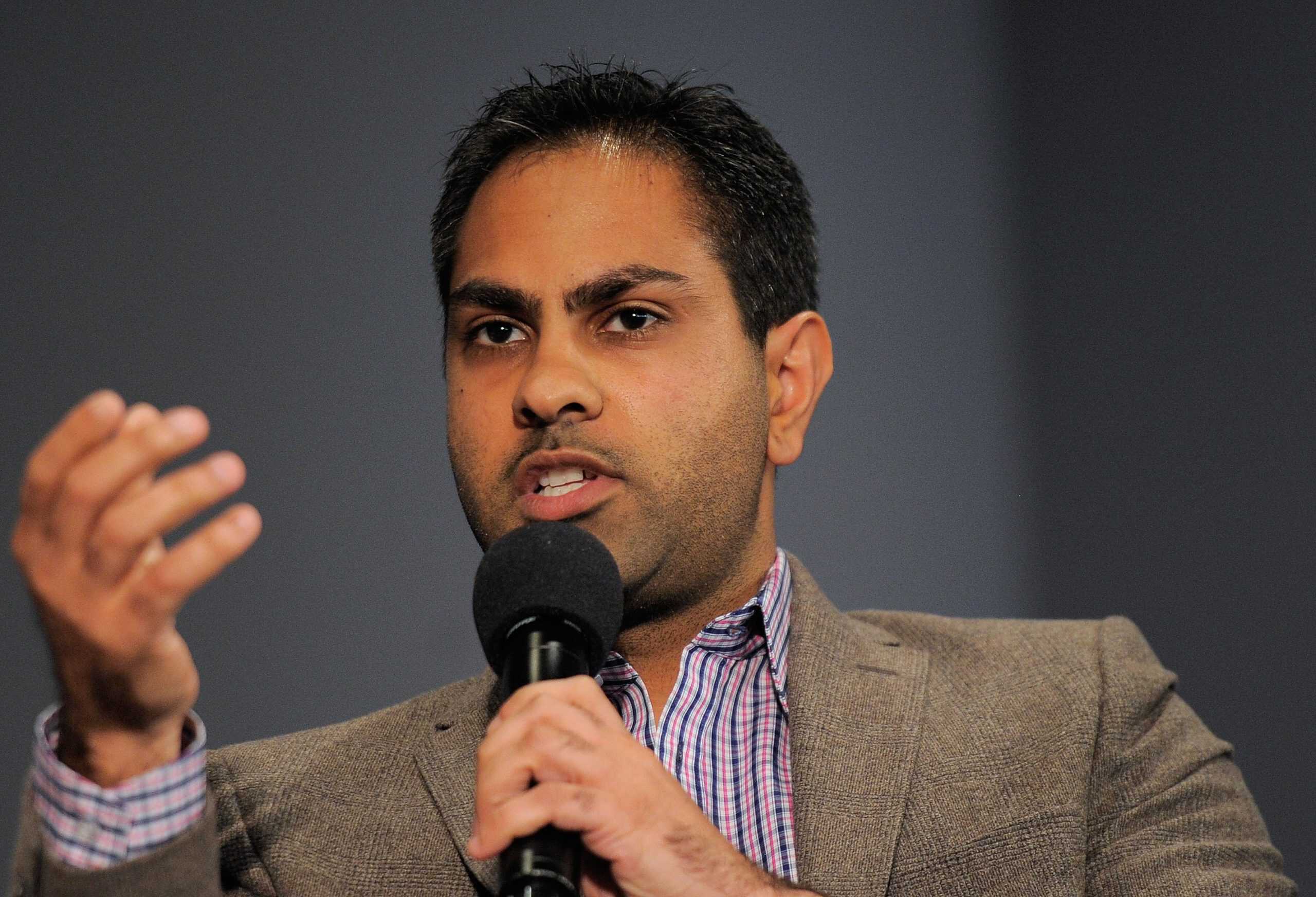

Ramit Sethi says that even if you're not a millionaire, buying a house you can't afford will end up costing you millions

Published:

Last Updated:

I recently came across a very interesting YouTube video by Ramit Sethi that claimed purchasing a house you can’t afford could literally cost you millions of dollars – even if the house you bought isn’t worth a million!

How could this be? Let’s take a look:

When it comes to buying a house, it’s easy to get caught up in the emotions of finding the perfect place. But when you purchase a home that’s beyond your financial means, the consequences can quickly escalate.

The cost of buying a home isn’t just the purchase price. Yes, it means a higher monthly payment, which could strain your budget. But, this could lead to your cutting back on other financial goals, like retirement and investing.

If an unexpected expense arises, like a car repair or a medical bill, it could push you even further into debt!

You also have to consider the opportunity cost of that home. You’ll have more money tied up in a home and less money available to invest, which could potentially cost you a lot in the long run. Whether it’s the extra interest paid on a higher mortgage or the missed opportunity to invest in stocks, bonds, or a retirement account, the long-term cost adds up.

Over 30 years, the total cost of owning that home can also become inflated by property taxes while your ability to invest in making money diminishes. This lost investment chance can cost you hundreds of thousands of dollars, if not millions.

So, how do you avoid this? The key is to know your numbers before purchasing a home. You must have a clear understanding of your income, monthly expenses, debt obligations, and financial goals. If you don’t have a budget established, now is a great time to get one ready.

Look at all this information realistically. Don’t stretch it, either. It’s easy to say, “Just $100 more won’t be a big deal,” but that is a slippery slope.

A good rule of thumb is to keep your total housing costs (mortgage, taxes, insurance, and any other related expenses) under 25-30% of your monthly take-home pay. Don’t forget to consider housing repairs, too, which can be costly.

Buying a home within your means provides tons of benefits beyond just stress reduction. This gives you the opportunity to grow your wealth and plan for the future. You free up your money to contribute towards your financial goals, like saving for retirement of investing in the stock market.

Plys, your lower housing cost helps you build your financial resilience. If the market shifts or your income changes unexpectedly, you’ll have a cushion ready to help you adjust.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.