Personal Finance

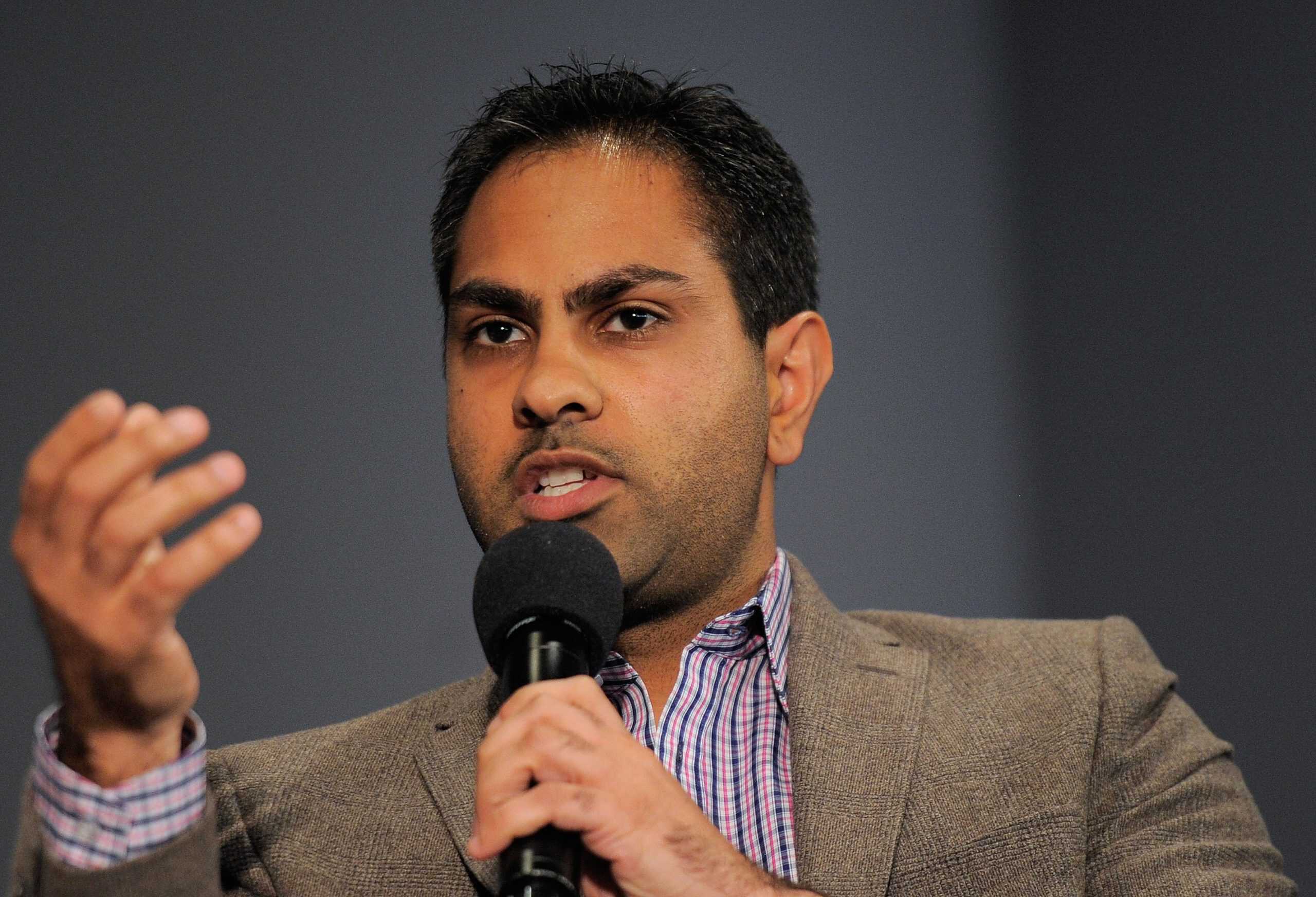

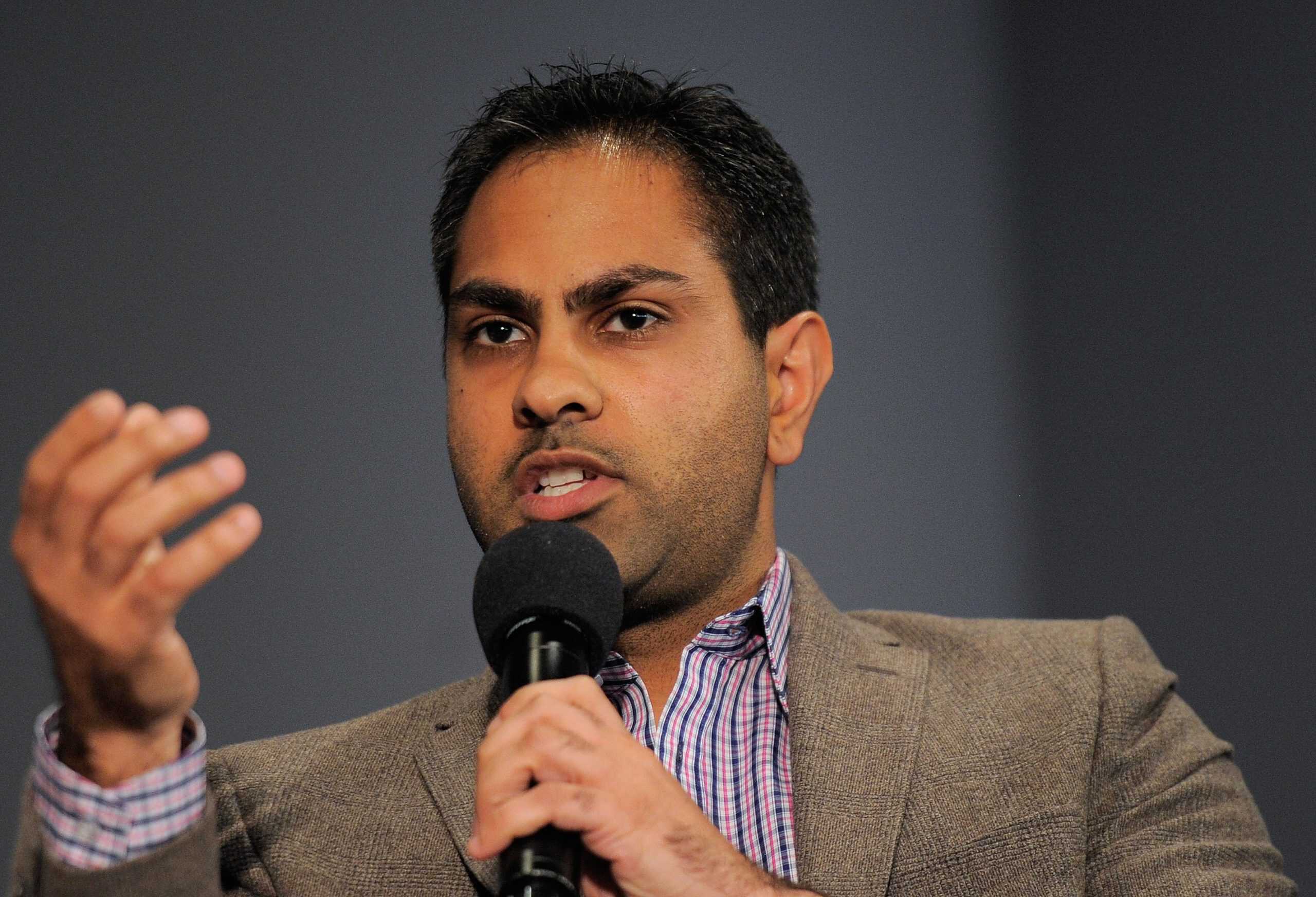

Ramit Sethi says that even if you're not a millionaire, buying a house you can't afford will end up costing you millions

Published:

24/7 Wall St. Key Takeaways:

I recently came across a very interesting YouTube video by Ramit Sethi that claimed purchasing a house you can’t afford could literally cost you millions of dollars – even if the house you bought isn’t worth a million!

How could this be? Let’s take a look:

When it comes to buying a house, it’s easy to get caught up in the emotions of finding the perfect place. But when you purchase a home that’s beyond your financial means, the consequences can quickly escalate.

The cost of buying a home isn’t just the purchase price. Yes, it means a higher monthly payment, which could strain your budget. But, this could lead to your cutting back on other financial goals, like retirement and investing.

If an unexpected expense arises, like a car repair or a medical bill, it could push you even further into debt!

You also have to consider the opportunity cost of that home. You’ll have more money tied up in a home and less money available to invest, which could potentially cost you a lot in the long run. Whether it’s the extra interest paid on a higher mortgage or the missed opportunity to invest in stocks, bonds, or a retirement account, the long-term cost adds up.

Over 30 years, the total cost of owning that home can also become inflated by property taxes while your ability to invest in making money diminishes. This lost investment chance can cost you hundreds of thousands of dollars, if not millions.

So, how do you avoid this? The key is to know your numbers before purchasing a home. You must have a clear understanding of your income, monthly expenses, debt obligations, and financial goals. If you don’t have a budget established, now is a great time to get one ready.

Look at all this information realistically. Don’t stretch it, either. It’s easy to say, “Just $100 more won’t be a big deal,” but that is a slippery slope.

A good rule of thumb is to keep your total housing costs (mortgage, taxes, insurance, and any other related expenses) under 25-30% of your monthly take-home pay. Don’t forget to consider housing repairs, too, which can be costly.

Buying a home within your means provides tons of benefits beyond just stress reduction. This gives you the opportunity to grow your wealth and plan for the future. You free up your money to contribute towards your financial goals, like saving for retirement of investing in the stock market.

Plys, your lower housing cost helps you build your financial resilience. If the market shifts or your income changes unexpectedly, you’ll have a cushion ready to help you adjust.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.