Personal Finance

I know nothing is certain but should I include my anticipated $3 million inheritance in my early retirement plan?

Published:

Last Updated:

Reading this Redditor posting in r/ChubbyFIRE immediately brought to mind the old saying, “don’t count your chickens before they hatch.”

The potential for a windfall inheritance can undoubtedly make you want to take your foot off the gas pedal and coast a bit because a large gap in your planning could be filled or put you well over the top. Staying true to your own goals, however, is what will get you there.

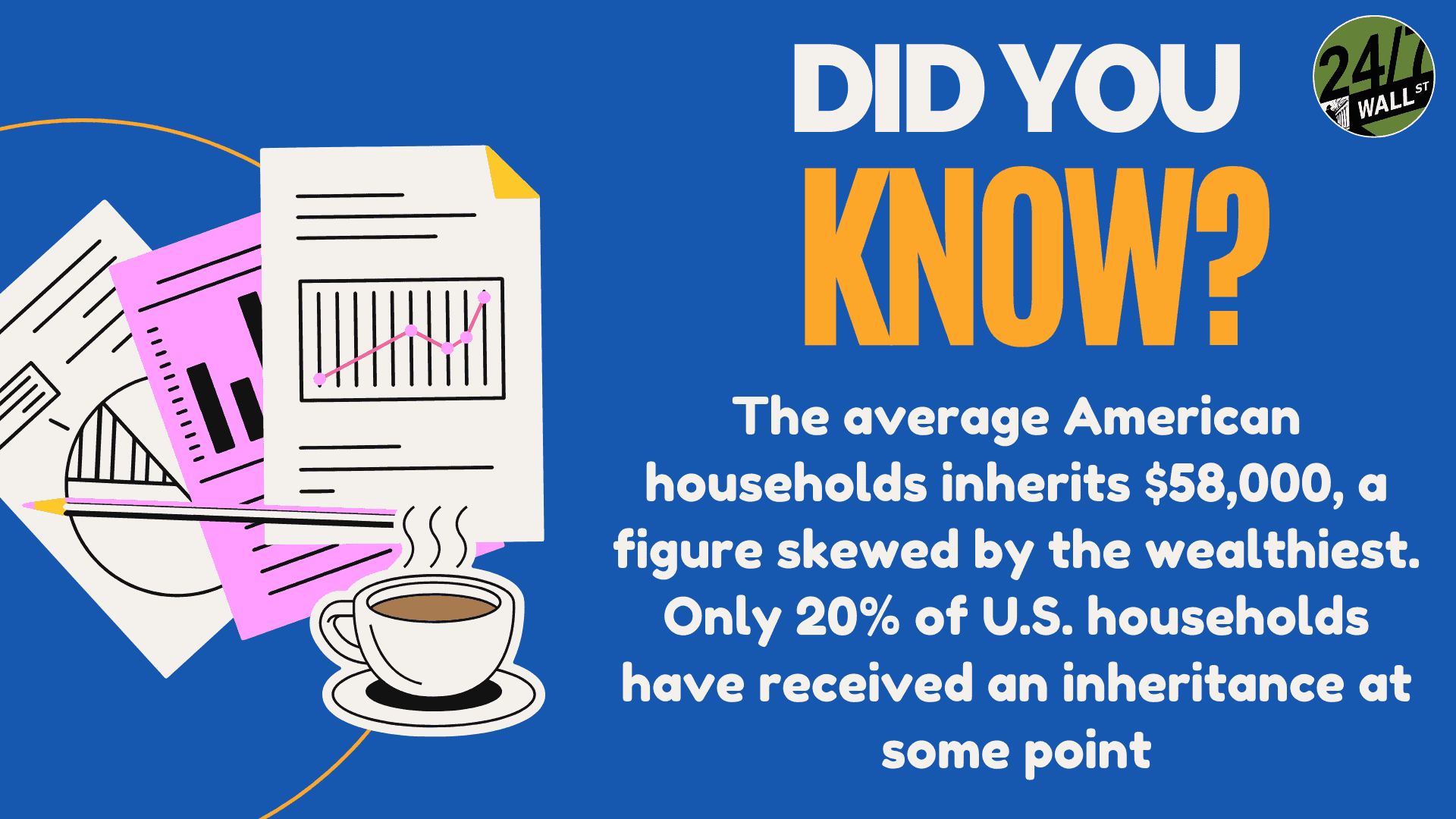

What’s interesting about this Redditor’s post is that the question he asks is not unreasonable. Because his parents are wealthy and healthy, yet have good, long-term care insurance, splitting their $6 million brokerage account as an inheritance with his brother is a very real possibility. Why shouldn’t he at least envision applying at least a portion of the theoretical windfall toward his own FIRE plans?

With both of his parents in their late 80s and in excellent health such that he foresees them living well into their 90s, they have amassed a not-so-small $6 million fortune in the stock market. If they were to die tomorrow, he anticipates he would receive somewhere around $3 million.

The catch is the Redditor has not achieved his own FIRE goals. He is feeling burnt out from his job and would like to step back from it, but he wouldn’t be able to without including the possible cash infusion from his parents’ estate.

He naturally recognizes there is no sure thing, but he also believes it is silly not to consider its impact on his own goals. Because $3 million would not be inconsiderable, should he at least nod towards its existence?

Don’t be like Blanche DuBois in A Streetcar Named Desire and depend on the kindness of strangers — or family members. There is no certainty in life except uncertainty, and the Redditor has a few holes in the logic he is using.

First, he admits he foresees his parents living for another decade or more. That’s a long time to wait because many things could happen. While his parents are healthy now, they might not always be so. And despite having good long-term care insurance, other expenses, medical or otherwise, could force them to tap into their nest egg, depleting its value.

Second, it is a stock market account. While he doesn’t say what the investments are, it still suggests volatility. It means if he eventually receives it, the account’s value could be diminished. The market could fall and not recover for many years. There is a reason the 2000s were known as “the lost decade.” Stocks generated negative returns between 2000 and 2009. The Redditor’s inheritance could be received during such low points.

Last, his real motivation is not necessarily making his FIRE numbers work, but rather not wanting to work anymore. He wants to kick back now, but can’t without including this money.

Because the situation can dramatically change, he can’t ever count on it until he actually receives the money.

Since we don’t know the Redditor’s full financial situation, it’s difficult to make a blanket statement about it. I’m not a financial advisor, so at best what I’m offering is my personal opinion.

Yet it seems clear he wants to take a shortcut to achieving his FIRE goals. Instead, he should do as I to do with my planning: I don’t count on Social Security being there for me when I retire. If it is, all the better, but my numbers view any federal retirement program income as a bonus.

It would be wonderful for the Redditor to get the inheritance, but he can’t count on it. Whether due to misfortune, the stock market, or some other unforeseen event, the money may not be there for him.

That’s why he should keep his foot on the gas pedal, make his FIRE goals on his own, and then if the inheritance ultimately comes his way, he can then think of living a FatFIRE retirement instead of just being Chubby.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.