Personal Finance

My husband just inherited $7 million - what kind of retirement can we have?

Published:

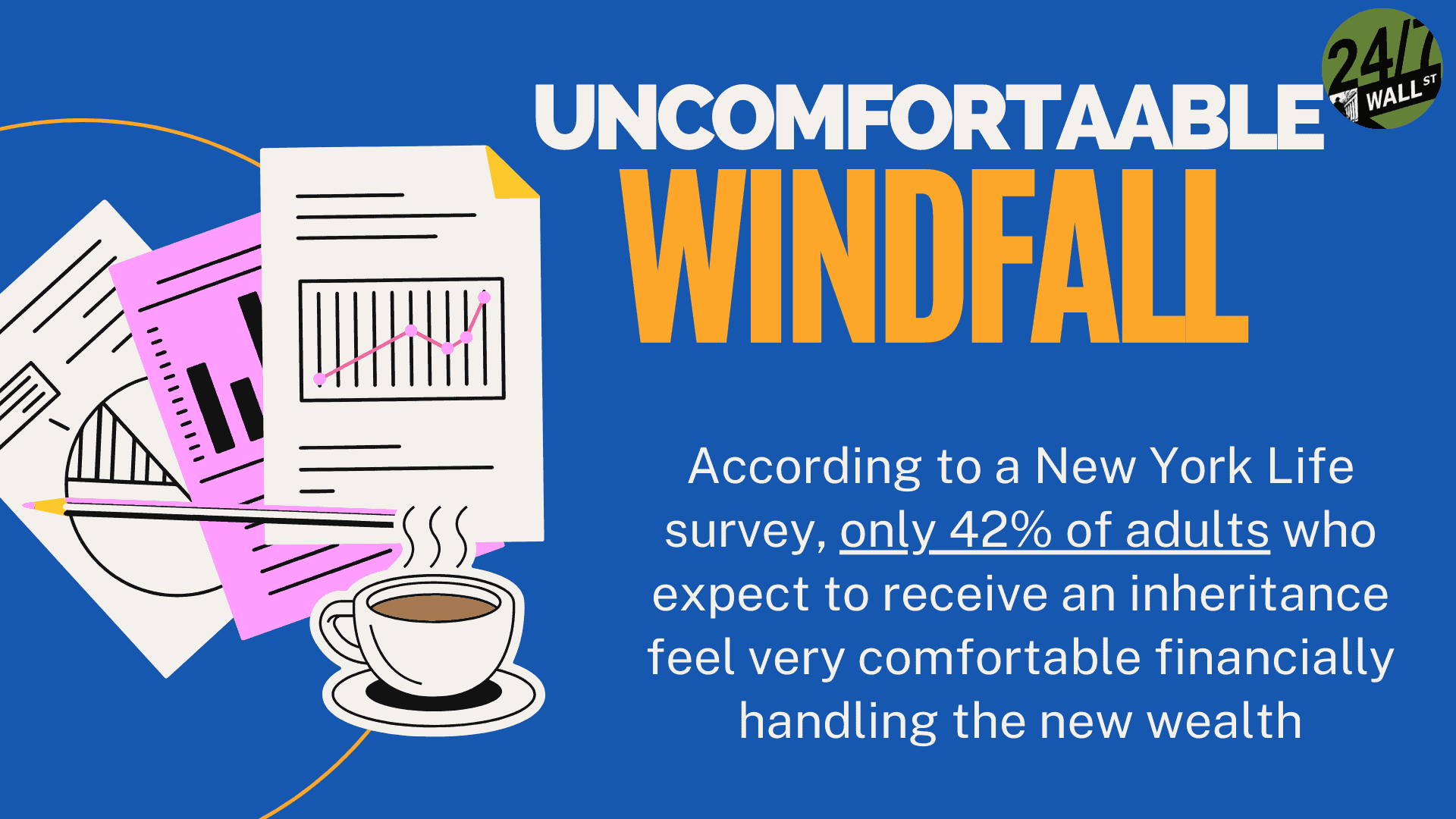

There should be little argument that many of us long to be “suddenly rich,” but the reality is that without a winning lottery ticket, it’s unlikely to happen. Instead, we’ll have to live vicariously through this Redditor in the r/faFIRE subreddit who posted about an estate the wife’s husband received totaling approximately $7 million.

For a comfortably middle-class husband and wife, this changes their entire outlook on retirement. They went from making a combined $145K a year to now being able to contemplate an early retirement. With only $350K in retirement savings, early retirement looked far off, so any stress about continued savings was lifted.

I love this post because it shows what can happen to good people who are suddenly blessed with something amazing. However, before giving our take on the situation, let’s break this down further.

Okay, here’s what we know from this Redditor: They are “solidly middle class” and have no children. We’ve noted their current income level and retirement valuation, so we know they were not in any situation to contemplate early retirement without this windfall.

We know the husband is in his early 50s, and the wife, the poster, is in her 40s. She emphasizes that her job as a medical consultant is stressful, and she hopes to take a sabbatical soon. She makes no bones about it: She wants to take a year off or start working on other projects.

The caveat to the wife going and doing her own thing is that it would likely reduce her annual income from around $90K annually to between $30-40K. As she’s okay doing this for another ten years, I figure the potential is at least another $400K in income over that time. As the husband would retire, it would be their sole income, and the rest of their expenses would be paid via interest earned on the inheritance. The wife estimates that the principal will make them around $200K a year, and their expenses are less than 50% of that.

As a reminder, I’m not giving financial advice and more of an opinion, so everything I say should be taken with a grain of salt. Always consult a certified financial planner before making any big investment decisions. This said, the couple’s ability to live off less than half of their potential interest earnings makes sense. Living on roughly 3% of their total net worth sounds about right, and it doesn’t feel like either spouse, in this case, is talking about doing anything silly with the money. The only mention of anything big is around house repairs and paying off the mortgage, which the poster estimates would cost around $600,000.

In this case, assuming no other big purchases, they are living off 3% of $6.4 million or $192,000 a year. If it were me, and I wish it were, I would consider stepping away from the stressful job and taking it easy. So long as they keep their expenses in check, they’ll be returning money to the principal every year, which should help them feel less guilty about any big trips or one-off purchases like a new car in the future.

I think the best case here is for them to both step away from stressful jobs and ease into retirement. Keep a budget tracker going and watch for any big expenses. If they are careful, they can live very comfortably for the next few decades while allowing for some adventures later in life. Of course, I’ll emphasize again that consulting a financial advisor should be the absolute first step to ensure you have concrete numbers to go off of before making any life-altering decisions.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.