Personal Finance

Suze Orman suggests doing these 5 things with your money ahead of the New Year

Published:

Last Updated:

With New Year 2025 just around the corner, make a date with your money.

That’s according to financial guru, Suze Orman, who argues it’s essential to keep your finances well organized. That includes keeping track of insurance policies, health savings, and even your credit card interest rates. Let’s run through each one.

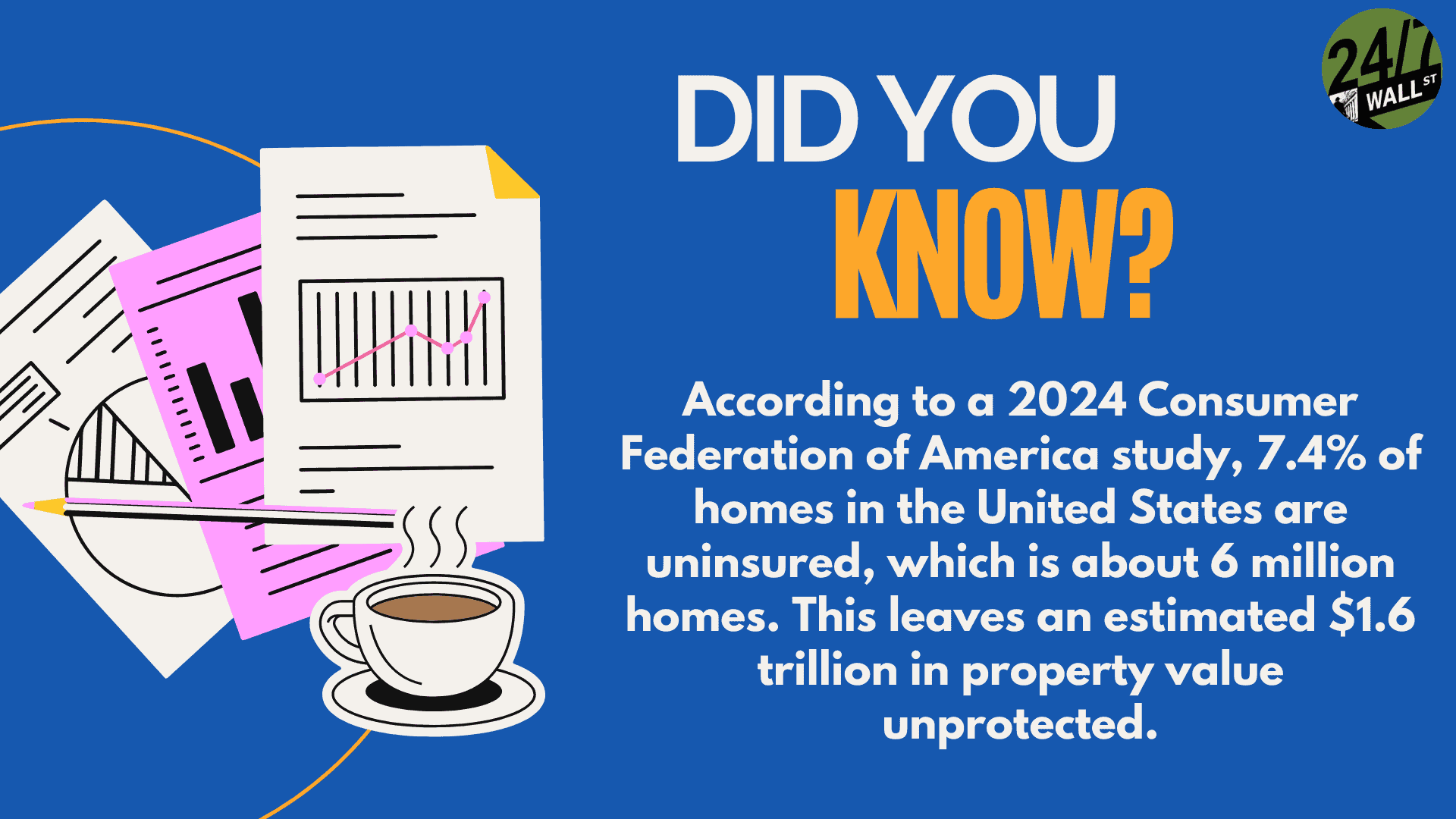

Do your current policies cover everything they should cover? For example, have you increased the policy if the value of your home increased? Or, have you picked up valuable belongings in your rented apartment? If so, you may want to get even more insurance coverage.

At the moment, the average renters’ insurance policy costs. Between $14 and $30 a month, or between $168 and $360 a year, which isn’t terrible. With minimal coverage, most policies cover $30,000 in property damage and $100,000 in liability coverage. Of course, when renting, you want to check in with the landlord to see if there are required coverage amounts.

If you live in an area prone to natural disasters, you must be properly covered, according to Suze Orman. The last thing you want is for a tornado to run through your street and you have bad insurance.

Homeowner insurance will typically cover fires, lightning, hail, windstorms, riots, damage caused by another vehicle, vandalism, theft, volcanoes, frozen plumbing, etc. What it typically does not cover, according to the Insurance Information Institute, are disasters such as floods, earthquakes, wars, nuclear accidents, landslides, mudslides, and sinkholes. Also, if you do live in or near a flood zone, you may want to have flood insurance.

Check on your retirement plans, life insurance policies, and your health savings account, if you have one set up. You want to see if you can increase your policies, and even make sure your beneficiaries are up to date – especially if you divorced the current beneficiary. Unfortunately, there’s really no way to change your beneficiary after you pass away.

If you carry over a credit card balance, you’ll get hit with ridiculous interest rates. Make sure they’re all up to date and start tackling them.

And, if you’re struggling with debt, there are solutions.

One is to focus on the smaller balances first. That way, you free up even more cash for the heavier debt. Then, once the smaller debts are paid off, you now have new cash flow to tackle to make extra payments on higher interest balances.

Granted, that’s easier said than done at the moment. I get it. But slow and steady win the race.

Two, you could make just minimum payments on all of your debt and put a chunk into the expense with the most interest. Or three, you could take out a consolidation loan, wipe out all of the outstanding debt, and have one balance. Not only could this allow you to manage your debt a bit better, it may also allow you to put extra funds into an emergency account.

According to Orman, as quoted by Oprah.com, “See if you can qualify for a balance transfer card that offers a low or 0 percent introductory interest rate for the first six to 12 months. If you can get a good deal, move your high-rate debt to that new card. Do not use the card for any new charges, and push yourself hard to pay off the balance as soon as possible. If you don’t qualify, no worries. Always pay the minimum due on each card, on time, every month.”

“It’s impossible to map out a route to your destination if you don’t know where you’re starting from,” Orman told O, The Oprah Magazine, as quoted by GoBankingRates.com. To know where you’re headed, you’ll need to get a panoramic view of your finances, what Orman calls a “before” snapshot to shape the “after.”

“You’ve heard me say this a million times, but I want you to open every single financial statement — bank, credit card, mortgage, 401k, brokerage account — and take a look. Only when you have everything in front of you can you set priorities about what to do next.”

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.