Personal Finance

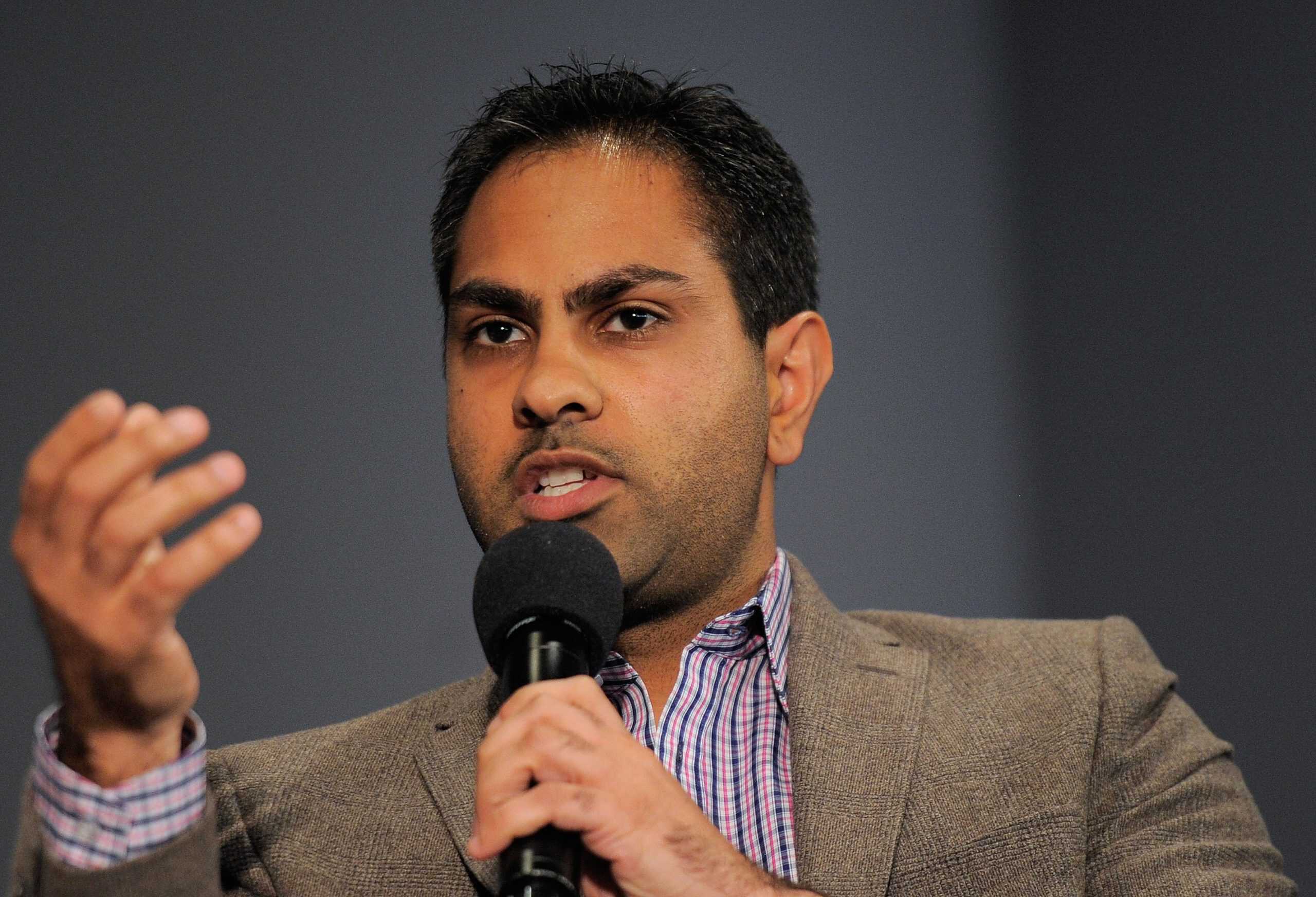

If you want to be a millionaire by your 60's, Ramit Sethi says you just have to start by saving $14 a day

Published:

If you start investing just $14 a day in your 20s, you’ll be a millionaire by retirement.

That’s according to author and financial coach Ramit Sethi.

It’s simple math, he says. He notes, “In 40 years, with a low 0.2% management fee and assuming a 7% return, you’d have just over $1,000,000.”

People go, “OMG, I have to invest over $400 per month?!” But most people don’t think ahead — this doesn’t even take into account the raises you’ll get over your career, he added. When you do get those raises, invest 80% of it.

In addition to investing $14 a day, Ramit Sethi also says that financially successful individuals need to track just four numbers to be wealthy. That includes your fixed costs, long-term investments, savings, and your spending amounts.

Fixed costs refer to your essentials, like rent, taxes, car payments, utilities and food. All, according to the financial coach should be no more than 50% to 60% of your after-tax income. He also suggests adding a margin of safety for emergencies.

With your fixed costs in that range, you can put about 10% into long-term investments. You can also put about 10% into savings or an emergency fund. He also notes, “That money compounds. It will grow like you wouldn’t believe. There will be a point where you will make more from your investments than from your income,” as quoted by MoneyWise.

Now, with 80% of your after-tax income dedicated to those categories, you have about 20% to contribute to spending on whatever you need or want.

If you follow the rules above, you’re already off to a great start.

But there are more things you can do to become wealthy. At the top of the list, you should stop idolizing rich people and instead, learn from what they do.

One of the top ways rich people retain wealth is by taking a close look at their finances. They know exactly what’s coming in and what’s going out. They know how much they make, how much they owe in debt, how much they’re investing, and how much they’re saving.

You should know the same.

Two, rich people have systems in place for their money. That includes automating earnings, bills and investments. The money is just automatically shifted without worry. By doing so, you can free up more money that you know is coming in.

In addition, “Rich people plan for the future and they look forward to it,” Sethi said. However, he believes it’s not the money that makes the rich optimistic — it’s their confidence in being able to create a plan and fulfill it, as pointed out by GoBankingRates.com.

In short, if you want to succeed and become wealthy, plan ahead.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.