Personal Finance

I'm 29 and inherited $6m in real estate, but I came from humble beginnings and not sure how to go from here

Published:

As much as we all hope to receive a windfall at one point in our lives, it can be surprising, overwhelming, and even horrifying. In many ways, it sounds great on paper to suddenly have enough money that all of your financial problems are over. However, as we have seen with lottery winners repeatedly, money does not solve everything and, in some cases, creates more problems than it solves.

This is exactly the case with this Redditor’s post in r/fatFIRE, who now finds himself in a position where he is inheriting almost $7.5 million. For someone from a “humble background,” this isn’t just life-changing money; it’s now a massive weight on their shoulders as to what to do next.

What I love most about this post is that everything about it feels natural and raw, as the Redditor admits they are almost lost with how to move forward.

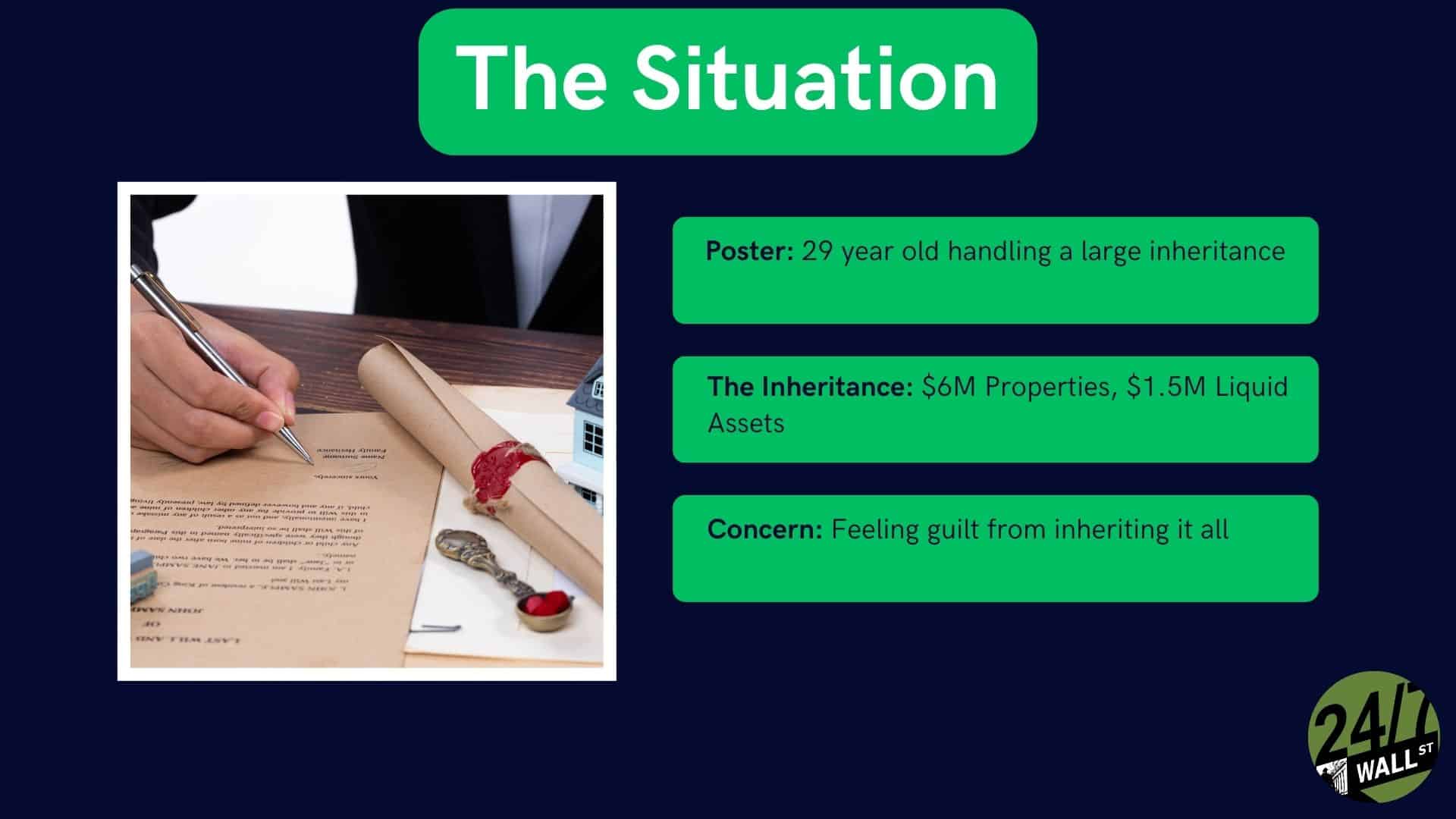

Coming from a humble background, our 29-year-old male Redditor indicated that he received a “fairly large estate.” As a result, he’s about to receive a mix of land and properties valued at around $6 million and liquid assets valued at $1.5 million.

He indicates that while his upbringing wasn’t perfect, his mother did everything she could to move heaven and Earth to ensure he had a good childhood. However, things get interesting because he had what he calls “symbolically adoptive grandfathers,” or a set of brothers who did not have their own children and were a big part of his life.

Looking back on his childhood, he recognizes that these two brothers were making preparations to help him take over their interests when they were both gone. They taught him tax planning, financial stuff, how to be a father, and much more.

With both of these adoptive brother figures passing away, he’s mixed between feeling a sense of guilt that he has inherited so much, all while managing his emotions of missing these essential people in his life.

Look, grieving is a process, and everyone handles the loss of loved ones differently. There’s no right or wrong response as to how long someone should grieve or what they can or shouldn’t feel after losing someone.

However, this person needs to work with a financial planner and the family lawyer who handled the brother’s estate. Even though the Redditor indicates he makes a nice living and can support himself and his mother, this windfall must be appropriately managed. I may not be a financial planner, but it should go without saying that this is exactly who he needs to talk to to help manage the money and see it grow.

He said he has a few options regarding land and property. He needs to know whether any property has outstanding debts, like a mortgage. We know the property’s value, but how much are its yearly taxes? What about maintenance costs?

The liquid assets of $1.5 million will help with any initial expenses, but is there value in selling some of this property and not dealing with its maintenance and care long-term? A tax specialist will be super helpful here to help navigate any tax-related implications of keeping the property or selling it.

Separately, if they don’t immediately need the cash and have $1.5 million liquid, can this money be invested so it can grow? Perhaps consider keeping $250,000 as an emergency fund and investing the rest so it’s working for you. Any combination of this number would work if the lion’s share is invested.

Ultimately, this person needs to take time to mourn these father figures’ loss. I will assume nothing needs to be done with the inheritance immediately, so use this time to understand that it’s okay to feel guilty over receiving such a windfall.

I think this Redditor will soon realize that he shouldn’t feel guilt and that these people loved him enough to make sure he’s okay in life and never has to worry. Not only did these people take care of him while they were living, but now they are looking after him in death as well.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.