Personal Finance

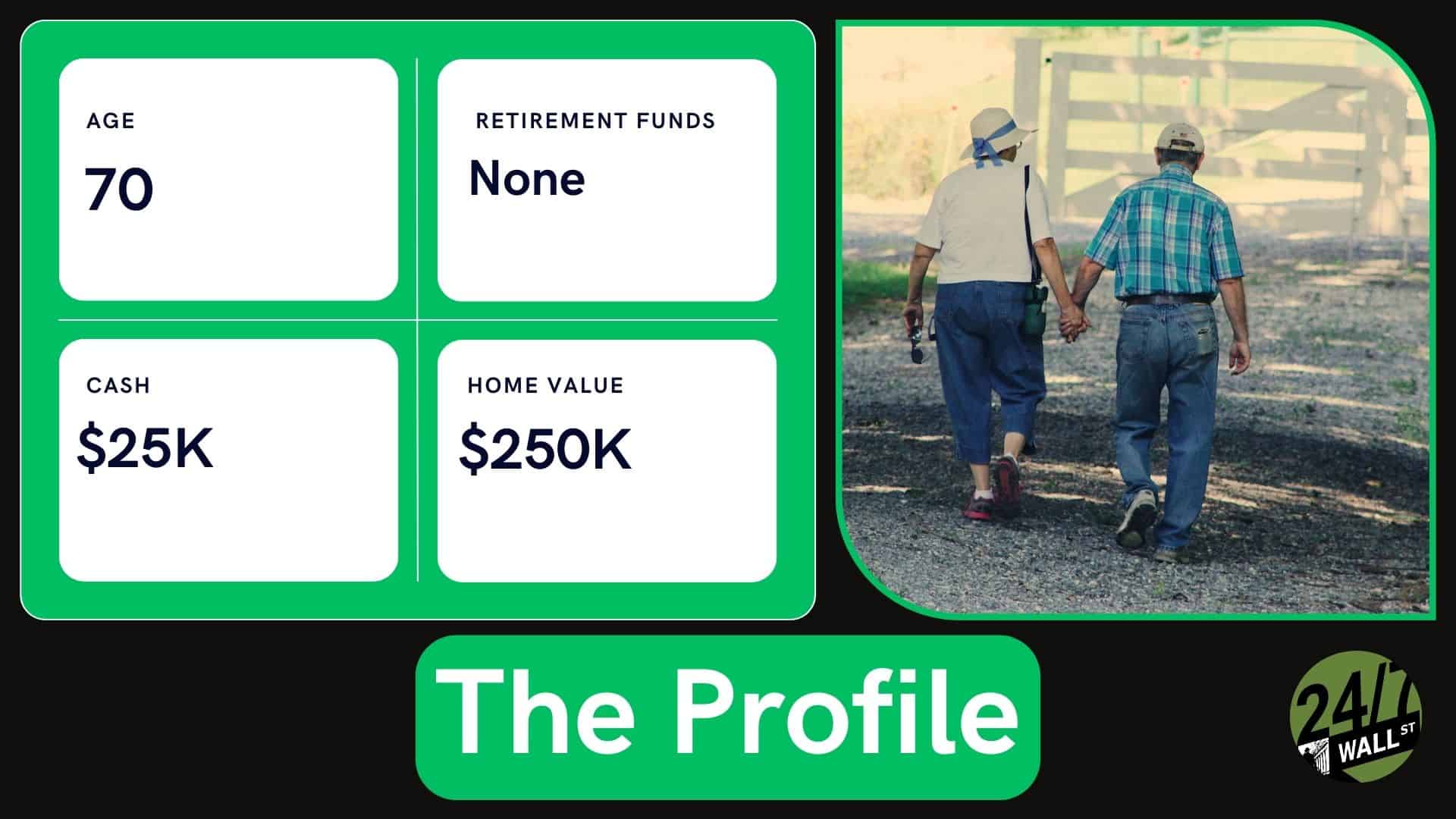

I'm 70 years old with nothing saved for retirement and only $25k in the bank - what should I do?

Published:

Last Updated:

With the ever-rising costs of living and the threat of even more inflation on the horizon should supersized Trump tariffs really be waiting for us around the corner, it’s becoming increasingly difficult to save up after one’s monthly expenses have been covered.

Indeed, while inflation and rates are on their way down, many Americans are still in a tough place financially, with some living paycheck to paycheck. And as we continue to age, one’s financial anxiety only stands to increase, especially if one is “behind” on retirement. The good news is that there is hope for those who are behind and well above the traditional retirement age.

In this piece, we’ll look into the case of a couple of limited means in their 70s who reached out to personal finance guru and radio show host Dave Ramsey in search of advice.

They’ve got $25,000 in cash with no major investments and some relatively bite-sized debts (think car debt and the remainder of what’s owed on their home). With both family members working part-time while collecting benefits from Social Security, the couple has the means to improve their financial situation.

Indeed, it’s never a good idea to have too much high-interest debt weighing one’s personal budget down. Though it’s never a good idea to do away with one’s emergency fund, I do think Ramsey is right on the money when he suggests the couple find ways to raise cash to eliminate the debt load. Indeed, such debts can really weigh someone down as they enter their later years.

The good news is that the couple is not drowning in debt by any stretch. Paying off the home and car is within striking distance. Though selling the vehicle strikes me as a very smart financial decision, I can’t speak to the amount of utility (enjoyment) the roadster brings to the couple. Either way, Ramsey gave it to the couple without sugar-coating the situation: they must sell the roadster and use the proceeds to pay off debt.

Additionally, Ramsey encouraged the couple to cut out discretionary spending, most notably eating out.

I couldn’t agree more, especially given how ridiculously expensive many restaurants have become post-inflation. Arguably, eating out is the most significant drain on the couple’s monthly balance sheet. If they ate at home instead, they would likely be surprised at just how much extra cash they’d have at the end of the month.

Cutting dining out won’t help move the needle on retirement anytime soon, however.

While Ramsey and others may deem the couple as “broke,” I’d argue that they’ve got assets (most notably, a home that’s almost paid off) and passive income in place to make things work.

Arguably, living as though one is broke would be the best course of action so that the couple can catch up and (hopefully) put themselves in a spot so that they can work less into their late 70s. Indeed, a comfortable retirement may be out of the cards, but a less stressful partial retirement isn’t, especially if they’re willing to make some lifestyle “downgrades.”

If health issues limit their ability to keep working full-time, perhaps downsizing to an apartment would make sense to crush the debt and start a retirement fund. Whether that entails buying a cheap condo or renting, I think there are ways for the couple to turn the ship around.

I agree wholeheartedly with Ramsey when he suggests getting aggressive with paying off debt and staying the course to get things in order. Perhaps renting could be an option if the couple is serious about shoring up cash and crushing the remainder of their debts.

Further, I’d also encourage someone in a similar situation to consult the advice of a low-cost or pro bono financial planner. That way, the couple will have a game plan to achieve their definition of financial success, given their difficult situation.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.