Personal Finance

I'm 30 and inherited $2.5 million from my father - I feel like I’m on top of the mountain but I’m by myself

Published:

Last Updated:

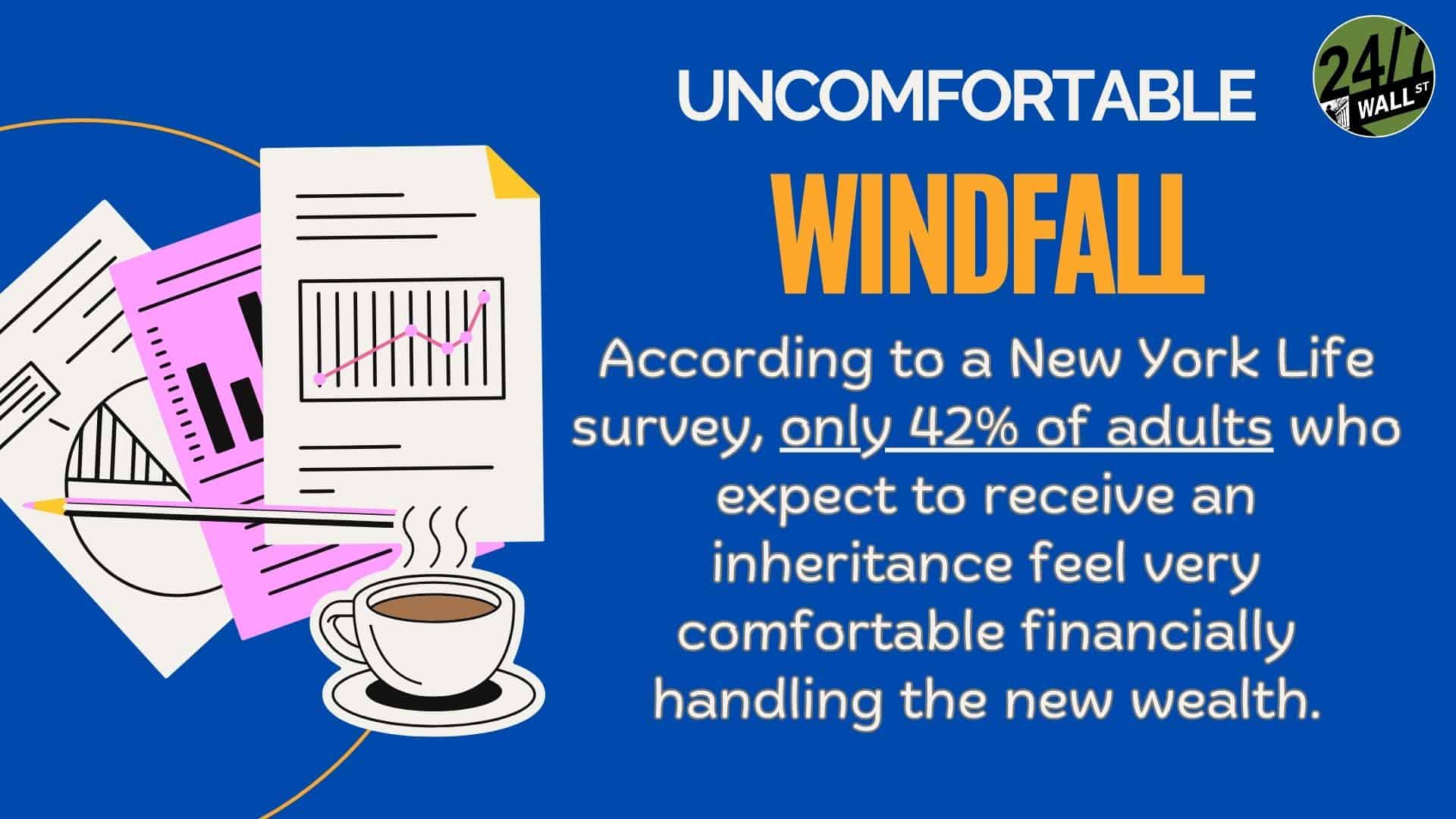

I recently came across this reflective Reddit post, where a 30-year-old shared his experiences following the inheritance of $2.5 million from his late father. I found this post interesting because it not only revealed the financial implications of his inheritance but also dove into the emotional complexities of the situation.

It’s a great example of how money is often just as much about emotions as it is about numbers!

Let’s look deeper at the poster’s journey and what it reveals about finances.

The poster gave us lots of information to look at. His father had saved diligently throughout his life and had sadly passed away from pancreatic cancer (before he could retire for a second pension). After a complicated inheritance split with his father’s former wife, which left him with half of the estate, he is now navigating life with newfound financial stability.

He is very gracious that his father sacrificed to save so much money, but the inheritance has come with some challenges.

Looking at the poster’s financial situation, let’s look at what we can learn and considerations for others in similar circumstances.

The Redditor has wisely chosen to let the inherited funds remain untouched in mutual and index funds. He doesn’t need the money right now, and this approach allows him to take advantage of compounding returns. He is planning on using distributions and capital gains to offset living expenses.

He also maximizes his Roth IRA and TSP contributions. He also maintains a liquidity of $200,000 just in case.

With a military salary of $5,000 per month and additional income from renting a duplex, the Redditor has a strong financial foundation. His mortgage is currently $2,8000, which is large but manageable.

The financial stability has kept him out of survival mode, allowing him to use the money he received from his inheritance on long-term goals.

Using the Monarchy app, he meticulously tracks his budget and net worth growth, aiming for an average return of 6-10%. This disciplined approach has allowed him to maintain control of his finances and move forward with his goals.

Despite his financial success, the Redditor expresses feelings of loneliness and a desire for connection regarding his financial situation. He doesn’t know anyone going through similar struggles with money. While he has online communities, he has yearned for more personal discussions about financial goals.

He is also going to a therapist, but there is still a gap in sharing with his friends and family.

As he plans to marry and start a family, he grapples with the idea of leaving the military to avoid deployments. However, he remembers what it was like for him growing up with his father in the military, and he doesn’t want the same thing for his children.

His fiancée’s reluctance to leave her family adds to the complexity, as they live in a remote area of Alaska. He wants to travel and explore, but his fiancée doesn’t have the same plans. He’s concerned about balancing family stability and his personal aspirations.

The Redditor’s journey serves as a reminder of the intricate balance between financial stability and personal fulfillment. Here are some of my recommendations for his future. Remember, these are just my opinions, not financial advice:

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.