Personal Finance

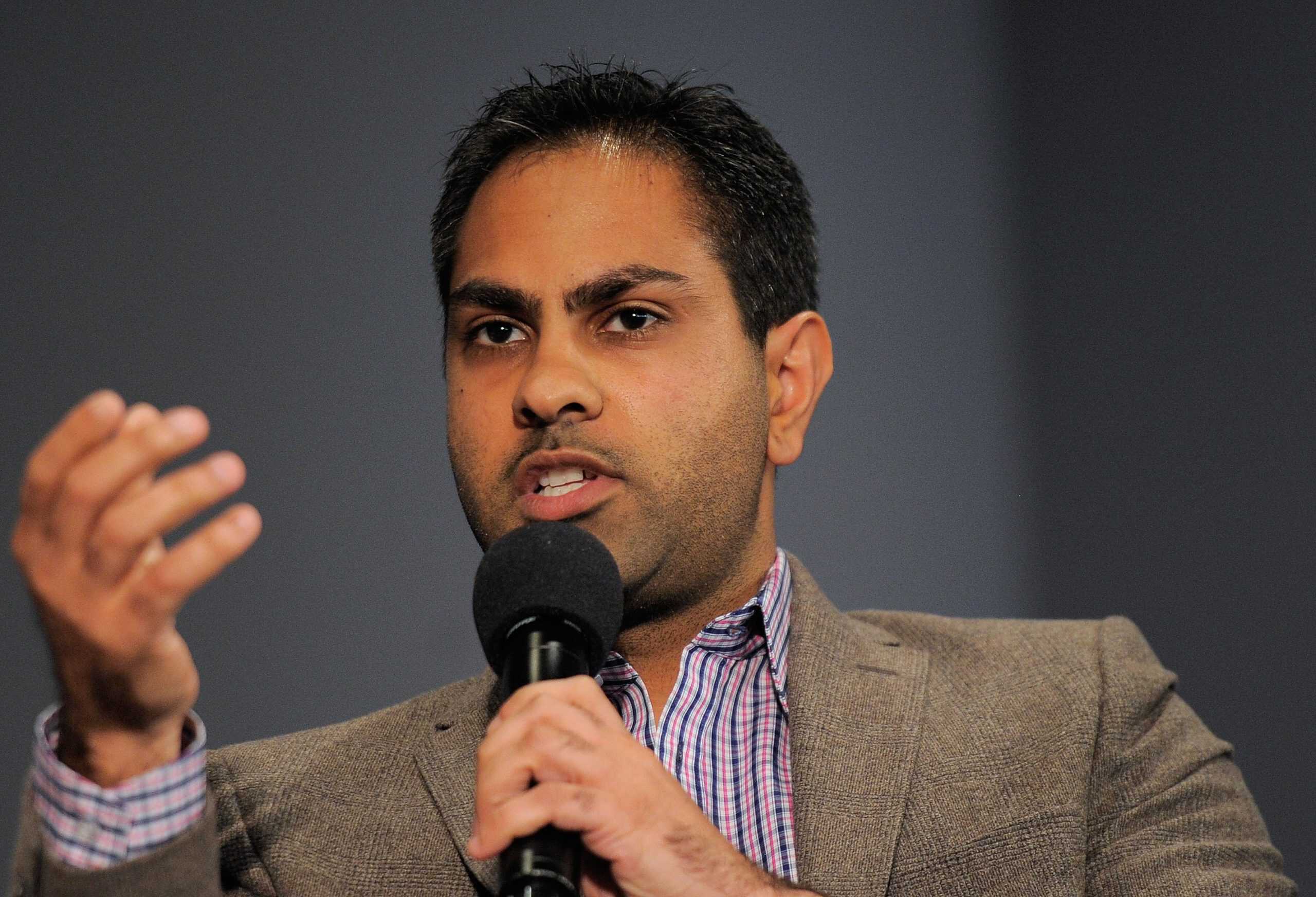

These Are the 5 Rules Every Rich Person Uses to Make Money, According to Ramit Sethi

Published:

Last Updated:

If you want to get rich, stop idolizing rich people, says money expert Ramit Sethi.

Instead, learn from what the rich actually do to become – and stay rich. In fact, here are five rules Sethi says every rich person uses to make money.

The rich know how much money they have coming in and going out, which you can also do by answering key questions. How much do you make? How much do you owe? What percentage of your income is being invested? How much are you saving? What are you spending your money on, and where can you spend less? Rich people also consult with financial advisors. They also diversify their wealth across multiple financial avenues, including high-yield savings, money market accounts, diversified investment portfolios and even real estate in many cases.

Rich people automate their money so it’s automatically shifted into other accounts without having to think about it. They do it with savings, investments and bills. You can do this with direct deposits, automatic credit card payments, expense tracking apps, and bill autopay.

In addition, as he once noted on X, “I spend less than one hour/month on my own finances.”

He also suggests setting up a system where 85% of your salary goes into your checking account, while 10% goes into a retirement account. The other 5% can go to an emergency fund or a higher-yield savings account. Then, once you figure out where to put your money, automate it all. Set up auto transfers. Set up automatic credit card, car, mortgage and tuition payments.

That way you don’t even have to constantly manage your money. Also, by automating direct deposits to your savings, for example, it’ll actually get to your savings without you thinking about it or considering using it in a frivolous way.

“Rich people plan for the future and they look forward to it,” Sethi said, as quoted by GoBankingRates.com. “However, he believes it’s not the money that makes the rich optimistic — it’s their confidence in being able to create a plan and fulfill it.”

Plus, planning ahead provides you with peace of mind. It can help you get more done, increase your productivity, prioritize, and help save time and money along the way.

Also known as the Pareto Principle, the 80/20 rule is the idea that 80% of outcomes come from 20% of causes. With it, Sethi advises that you focus more on the most impactful parts of your finances rather than the minor details of your finances.

In addition, as he reported on Success.com, “Optimizing your spending can seem overwhelming, but it doesn’t have to be. You can do an 80/20 analysis, which often reveals that 80 percent of what you overspend is used toward only 20 percent of your expenditures. That’s why I prefer to focus on one or two big problem areas and solve those instead of trying to cut 5 percent out of a bunch of smaller areas. Here’s how I do this with my own spending. Over time, I’ve found that most of my expenses are predictable. I spend the same amount on rent every month, roughly the same on my subway pass, and even basically the same monthly amount on gifts (averaged out over a year).”

Don’t focus just on the cost of something, but more on the value. By doing so, it’ll help you determine if that something is really worth the expense.

Ramit Sethi also offers advice on easy money rules. For one, always have a year of emergency funds in cash. Two, save 10% and invest 20% of gross annual income. Three, spend what you have only when you have it while ditching the high-interest credit cards.

In addition, as also noted by GoBankingRates.com, “One of the biggest ways people ruin their finances is by buying things they can’t afford. Sethi pointed out that housing and vehicles are the two most likely causes of financial trouble. When people decide to buy houses or cars, they look at the monthly mortgage or car loan payments and decide that it’s something they can deal with. However, there are more than just monthly payments.”

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.