Personal Finance

I currently have over $10 million but am wondering if I should go for $50 million - is there a big difference?

Published:

Last Updated:

In a perfect world, we would all have enough money to retire early and enjoy traveling, relaxation, and, hopefully, grandchildren. Even though everyone has different financial needs and goals, there is a real question about how much you need to feel comfortable.

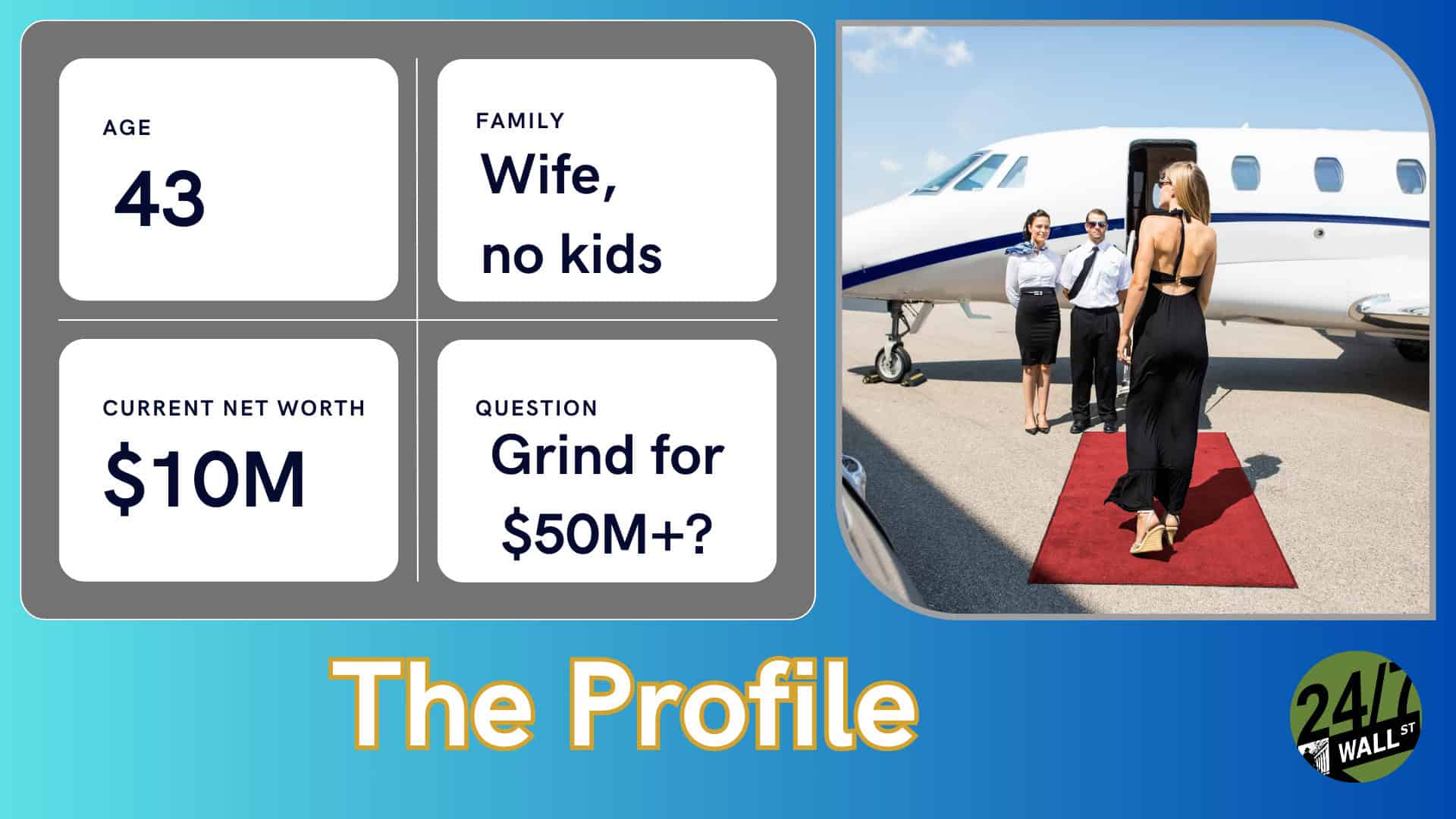

In the case of one Redditor on their way to having a net worth of $10 million, the question is whether they should stop there or keep going with a goal of $50 million. While this sounds like a big difference on paper, how does it affect you in the real world?

For the Redditor looking at this situation, please note that this isn’t financial advice but rather this author’s opinion about the difference in your lifestyle if you have $10 million, $20 million, or $50 million ten years from now. According to your scenario, you have no children and are not materialistic, which is a great thing as you don’t have to worry about making crazy purchases.

As someone with children, I would go for it to have an even more comfortable buffer to pay for college, weddings, and set up trusts for grandchildren. However, as you don’t have those concerns, this is more about the life you and your wife will lead and not necessarily a legacy you are building for yourself.

According to your initial comments, you don’t think much about flying private now, but it’s possible down the line. So, first things first, as one commenter suggested, you should make a list of everything you want to do with your money. Does flying private interest you in the future? What about big purchases like a fancy car or multiple homes? Only you know exactly what might be on your bucket list, and even if you are not a consumerist today, there must be something out there you want in the future.

Let’s be clear: at $10 million, you should feel a lot of financial security. You are not worrying about where your next meal will come from or whether or not your next mortgage payment will be missed. This said, there is no question that $50 million, or even $20 million, as you suggest, is a different level of comfort. When you hit the $20 million mark, you likely won’t be as worried about market fluctuations or other situations like a real estate downtown since you can weather these with a much larger buffer.

One of the major pieces of feedback about living the FIRE (Financial Independence, Retire Early) life is about feeling satisfied. If you are satisfied at $10 million, will you feel more satisfied at $50 million? Anything north of $20 million would satisfy me more than $10 million since I worry about market downtowns taking me down to $6 or $7 million. However, I wouldn’t have the same level of concern even if I dropped to $15 million. The question nobody else but you can answer is whether or not you would feel entirely fulfilled at $10 million and can enjoy your life.

According to your comments, you might not be considering it, but your ability to make passive income between $10 and $50 million has significantly increased. The same goes for $20 million, as doubling your net worth would still open the door for larger passive income opportunities. Whether buying more real estate or investing in other business opportunities, the more you earn now will impact your ability to earn even more when you stop working full-time.

The biggest question, and you mentioned it already, is whether or not you want to handle the stress of working for another ten years. Your initial goal has you worth $10 million ten years from now. If you didn’t FIRE until 53, or another ten years from now, can you handle the stress of “extremely hard work,” as you put it? The pro of doing so is that you can significantly increase your net worth, but the major con is that your stress level is only likely to go up, not down.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.