Personal Finance

My parent took out a credit card in my name without my knowledge. It’s ruining my life, what should I do?

Published:

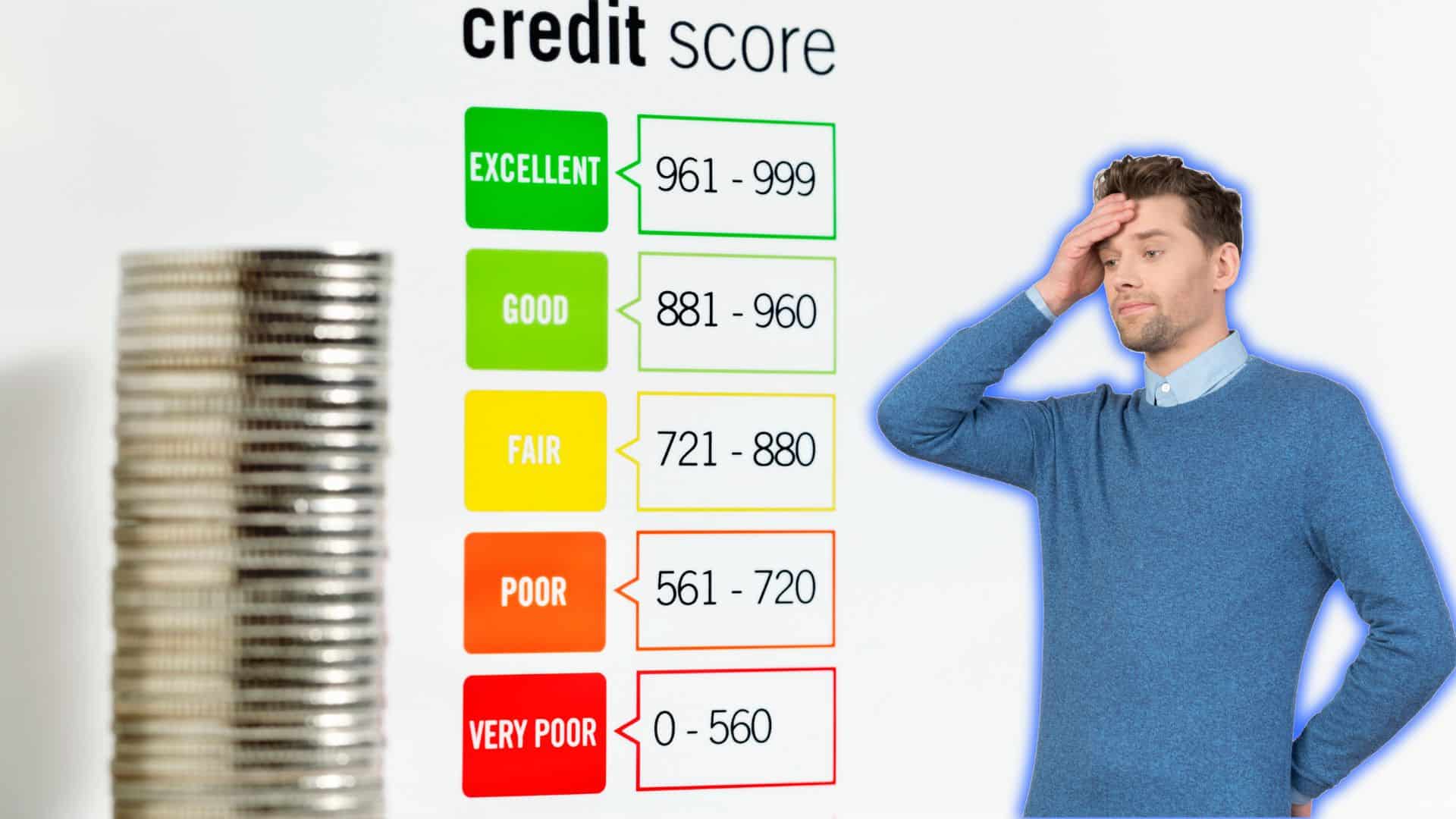

Credit cards have become an insidious yoke of debt around the necks of millions of people, especially usury levels of 20% interest or higher. Since FICO scores were adopted for credit references, they have become a part of the death spiral that can prevent people from getting better jobs, financing a home, or any number of other situations where a credit score is a determining factor in approval. The onerous debt loads imposed by credit card companies have been addressed by President Donald Trump, who proposed a 10% cap on credit card interest. No less a political opposite than Socialist Senator Bernie Sanders praised Trump’s proposal and concurred with its urgency.

An even worse scenario is when your credit score is being eroded due to the acts of other people without your knowledge. In some cases, it could be a case of ID theft, an all too frequent crime in the cyberage. However, in other cases, a relative may have either innocently or malevolently used your data and your credit score is suffering as a result.

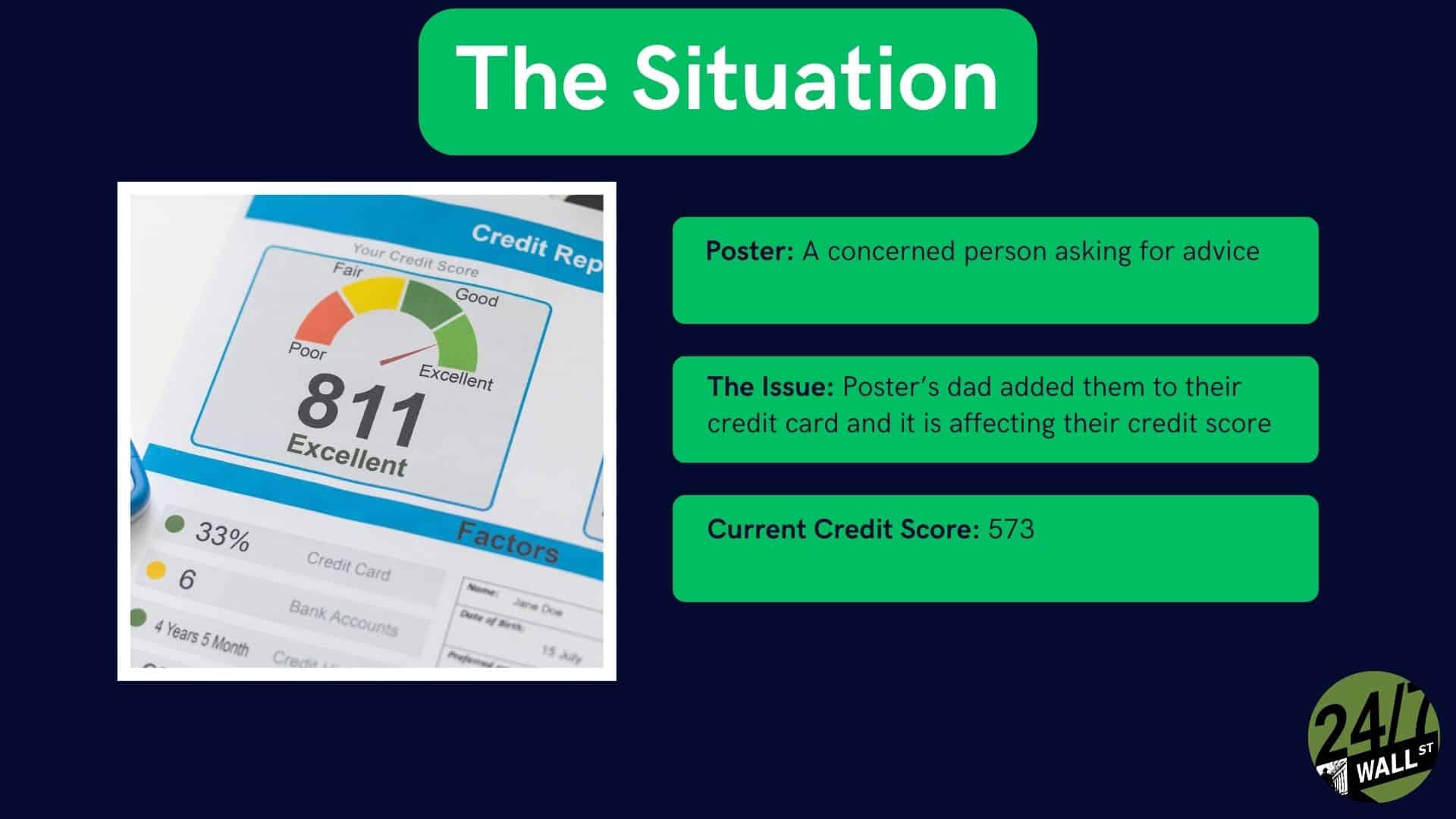

A Reddit poster found out that his FICO credit score dropped precipitously from 800+ to 578. When he checked, he discovered that it was due to his name being on his father’s credit card, which was delinquent for 3 payments.

Understandably distressed, since his name had been added without his knowledge, the poster was worried about what his recourse options were, or if he was screwed. The underlying, but unstated concern was whether or not his father’s actions were an oversight or if there was malicious intent.

The poster clearly has a gamut of emotions and concerns that he does not detail. Barring a previously established rancorous relationship with his father, some of the following are examples of questions that should be examined, especially if the goal is to preserve the family ties while resolving the FICO score impact:

Conversely,

According to Expedia and other agencies, there are few options that the poster has, but there are certain procedures he definitely needs to take immediately to prevent the situation from deteriorating further.

In either scenario, if the poster presumably never used the credit card, since he was unaware of its existence, contacting Expedia, Equifax, and TransUnion is also an important move. Explaining to them the situation and their ability to verify that he never used the card can possibly prompt them to delete the negative data from his FICO score

A discussion between the poster and his father needs to be had very soon. The repercussions and reactions from other family members can get ugly fast, so open communications, honest disclosure, and mutually agreed upon resolution steps are the key to preserving peace among relatives.

This article is intended to be read for informational purposes only. A financial credit professional should be consulted for better-qualified counsel if such advice is being sought

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.