Personal Finance

1 in 3 Americans Don't Know Their Full Retirement Age for Social Security

Published:

Last Updated:

Social Security is the foundational financial support system for many Americans. According to the bipartisan Economic Innovation Group, “Nationally, Americans received $3.8 trillion in government transfers in 2022, accounting for 18 percent of all personal income in the United States. That share has more than doubled since 1970.”

Based on surveys conducted since 2002, national pollster Gallup has found between 80% and 90% of retirees rely upon their Social Security checks to pay at least some of their bills.

Yet for a system most people will rely upon in retirement to make ends meet, many are ignorant of how best to optimize their benefits. A Nationwide Financial survey found that fully one-third of all Americans don’t know the age they are (or were) eligible to receive full benefits.

It’s not their fault. Congress has changed the rules many times since the program began. From changing the full retirement age to taxing benefits, raising tax rates and the earnings base needed to collect benefits, keeping up with the modifications is difficult. It’s not surprising people eventually shrug and say, I’ll worry about it when I get there.

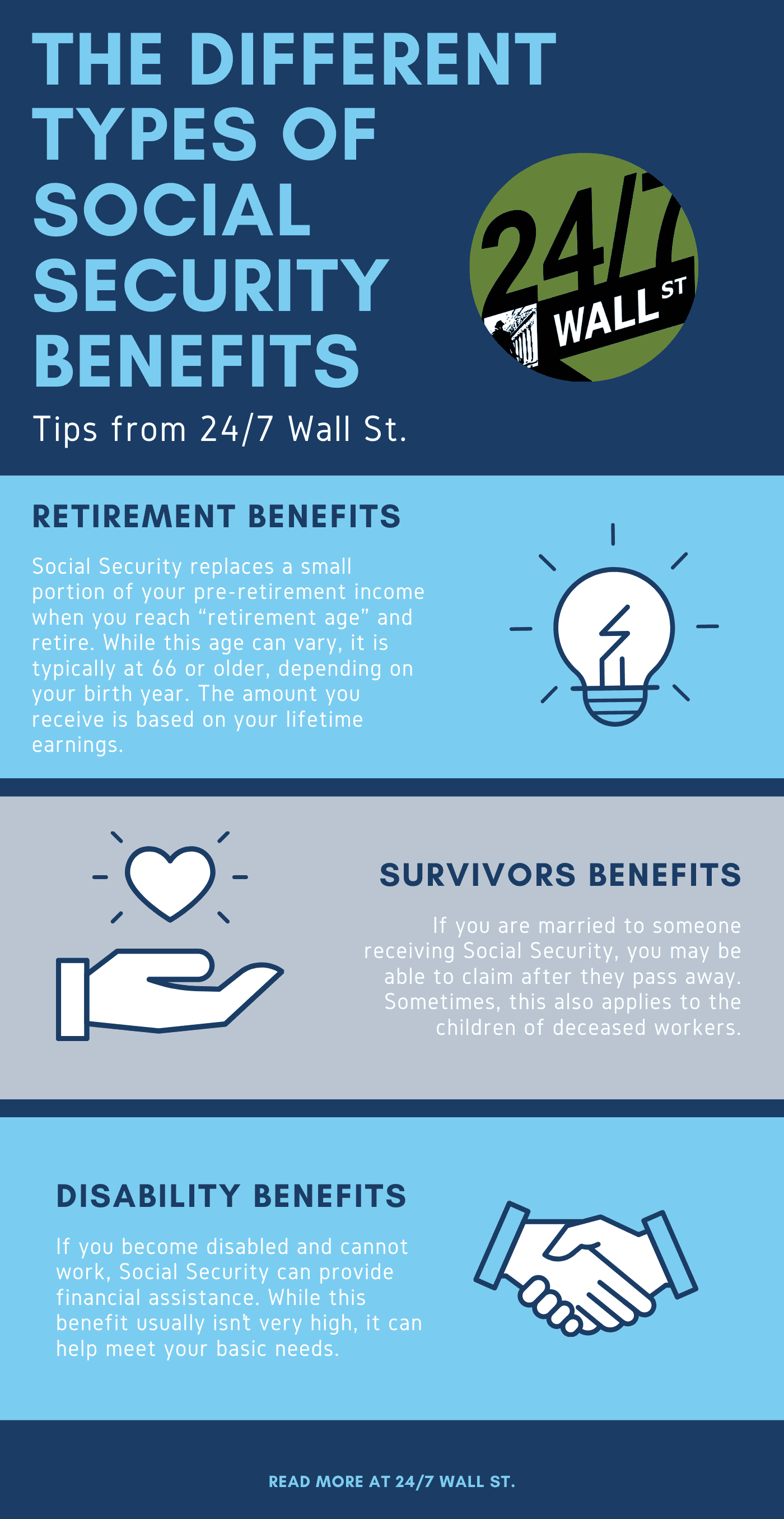

Full retirement age is the age when you can claim your standard benefit from Social Security. If only it was that simple. There are several tests the Social Security Administration uses to determine how much you can receive, including your earnings history, your work history, full retirement age, and the claiming age.

Claiming age is not the same as full retirement age. Claiming age is when you can first receive retirement benefits — age 62 — but it’s not when you can receive maximum benefits. That’s age 67 for people born in 1960 or later. You can also delay claiming benefits until age 70, which will result in a higher monthly benefit, but comes with its own set of choices to weigh.

| Birth Year | Full Retirement Age |

|---|---|

| 1943–1954 | 66 years |

| 1955 | 66 years and 2 months |

| 1956 | 66 years and 4 months |

| 1957 | 66 years and 6 months |

| 1958 | 66 years and 8 months |

| 1959 | 66 years and 10 months |

| 1960 and later | 67 years |

Your earnings and work history are critical components, though. You need to have worked at least 35 years or Social Security will penalize you. SSA will then take the highest earnings made during those years to calculate the benefit you’re entitled to receive.

But to complicate matters, there are advantages and drawbacks to taking benefits at each age. For example, taking benefits at 62 will see your benefits permanently cut by 25% to 30%. Taking them at 65 reduces the amount benefits are cut significantly, but subjects you to an income test, meaning you can only earn a certain amount of outside income before your benefits are reduced. For every $2 to $3 earned above the limit, your benefits are reduced by $1.

Waiting till age 70 will net you as much as 32% more than you would receive at full retirement age and you can also earn as much outside income as you want. However, you have to delay receiving benefits by up to eight years, you risk dying before collecting, and you may not be able to fully enjoy retirement and the benefits received as much as you would by taking them at an earlier age.

So it is not as simple as people just being ignorant about when to take Social Security. It’s actually a complex matrix of weighing the benefits received and the disadvantages from doing so at various ages.

Arguably the best thing someone can do is plan to not rely upon Social Security at all. Ignore its contribution from your planning calculations while living below your means, avoiding debt, and plowing as much money into retirement accounts so you can survive and thrive without Social Security.

The next best step is to speak with a financial planner that specializes in retirement planning. They can look at your whole financial situation and help you arrive at an optimal decision that reflects your particular needs.

Last, read articles and websites that provide information about Social Security. There are also online calculators that can help you estimate your benefits and allow you to make informed decisions about when to claim your benefits. No one knows your situation better than you. It’s in your best interest to be as knowledgeable about what’s due you before the need arises.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.