Personal Finance

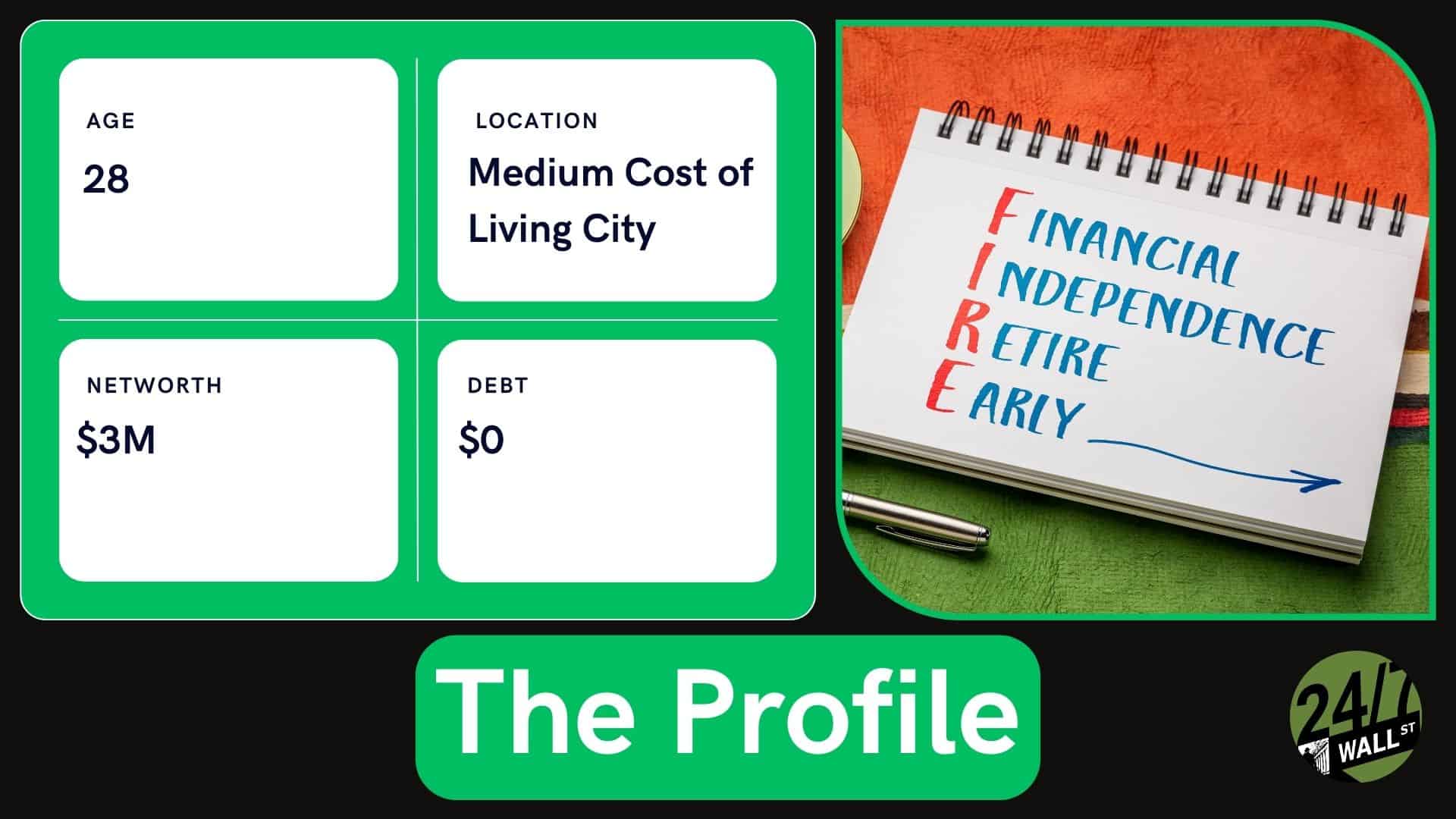

I'm only 28 but a lucky stock pick has pushed my net worth to over $3 million - should I realistically stop working?

Published:

Last Updated:

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

24/7 Wall St Key Takeaways:

Reaching financial independence (or even anything resembling financial independence) at 28 is a huge achievement. However, it does bring out some interesting considerations. A recent Reddit post I came across highlights the challenges of moving from accumulating wealth to managing it effectively.

Whether you’re just starting your FIRE journey or nearing your goal, there’s something everyone can learn from this milestone. Practically everyone will need to manage their wealth at some point.

I’ll cover some of my suggestions below. Remember, these are just my suggestions, not financial advice.

The poster’s $3M net worth is heavily concentrated in one investment with significant unrealized gains. This is a huge problem. While the concentrated position could grow wealth quickly, it also adds a lot of risk. It could go down quickly, too.

Diversify to protect your portfolio from volatility, especially if you’re planning to live on your wealth.

This Redditor knows he probably needs professional advice for their finances. However, he doesn’t know who he’s supposed to go to!

For those with significant wealth, consult a fiduciary financial advisor or a tax professional to explore options like tax-efficient selling or hedging strategies. You’ll preferably want an advisor with some understanding of early retirement.

With a $170K 401(k) and a $60K taxable brokerage account, the poster questions whether continuing 401(k) contributions are useful. Does he need to continue using these taxable accounts when he has so much stocked up?

Despite having quite a bit of money saved, I still recommend using a 401(k), as it reduces your taxable income.

The Redditor currently has around $30K in annual expenses, which is very low. However, he expects this to increase substantially as his life progresses. A family and kids can easily double those expenses.

Transitioning into early retirement requires planning for these higher future expenses and potential market downturns. To minimize risks, a conservative withdrawal strategy must be built.

The poster is considering taking a temporary leave from work but is hesitant about permanently leaving a stable income source. Leaving a job that you find stable is a huge risk. Anxiety over making the jump to retirement is extremely common.

That said, I do recommend part-time work or sabbaticals before fully retiring, especially if you have anxiety over the transition. This allows you to test the waters before jumping right in.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.