Personal Finance

We're in our 40s and wanted a target of $3 million net worth but ended up saving a lot more - how do we stop moving the goalposts?

Published:

The problem with retirement planning for some people is there is always another green field just over the next hilltop. Despite reaching their destination, they can’t give up the feeling that going just a little further will mean an even more perfect location to stop. And once there, they find yet another horizon point just ahead.

That is the situation a Redditor faces on r/fatFIRE, a subreddit for those looking to retire with a financial cushion that allows for luxurious living. His problem is he keeps moving the goalposts further away.

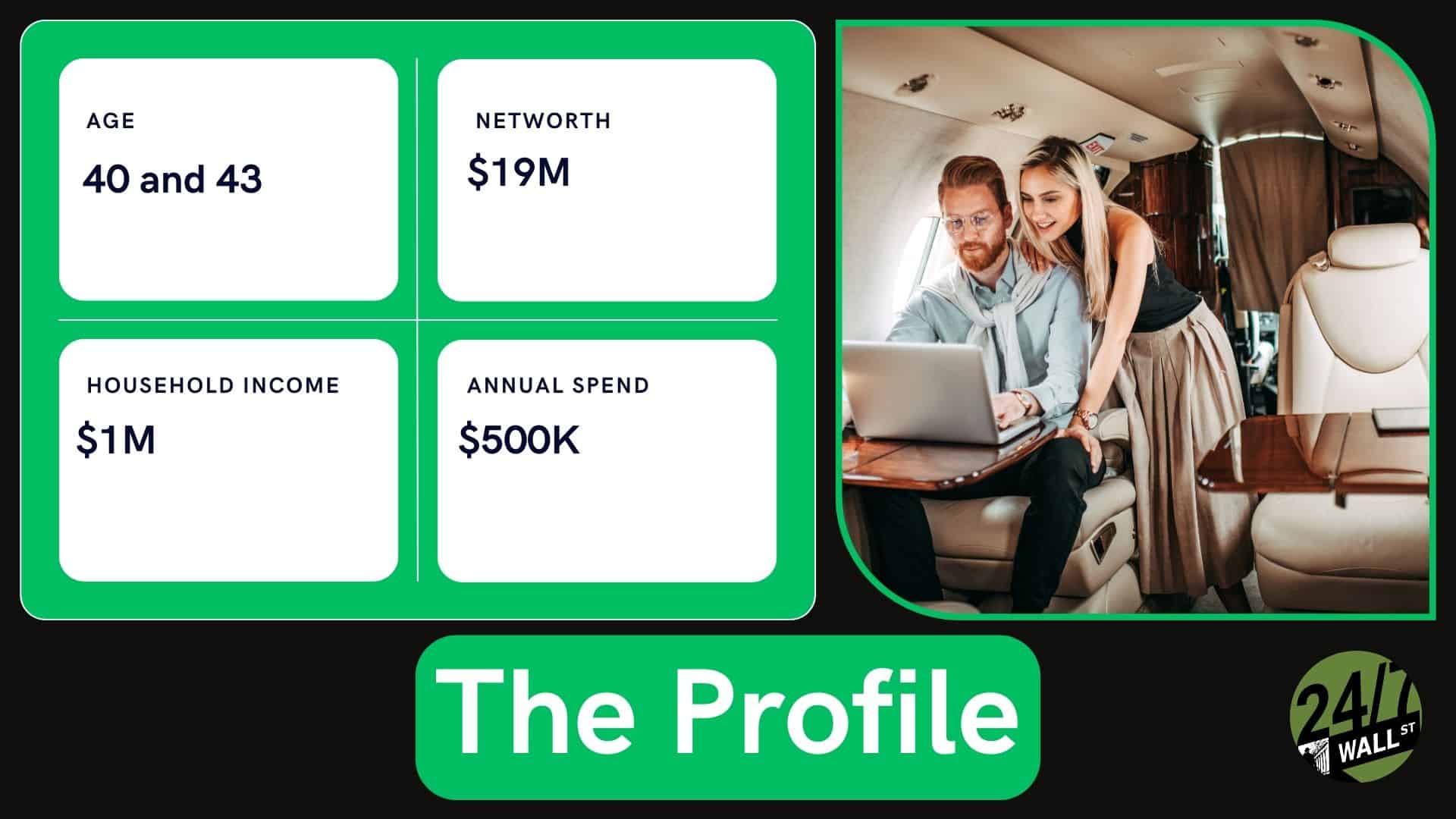

Last year, the Redditor expected having a net worth of $3 million would be a target because at the time he was worth just $1 million at the time. Then he achieved his goal — and then some — by hitting a $5 million net worth, only to decide $10 million was just right. Now that he has a net worth of $19 million and is in his early 40s, the Redditor wants to know how you finally pull the cord and jump off the treadmill without thinking there is still more to achieve.

Here’s my advice to those in a similar position. Now I’m not a financial planner and this is just my opinion, but there comes a time when you have to realize enough is enough.

Certainly ensuring that we have plenty to survive retirement in fine style is a worthwhile goal. But when you’ve conquered all the mountains, it is important to know when it is time to leave. Padding your lead doesn’t achieve anything and actually puts you at risk of missing out.

Illness or death is always possible at any time. It is a different situation when you have to work just to get by, but when you’ve achieved your goals, you risk not enjoying the fruits of all you have accomplished.

Far too often we allow our job to become our identity. Instead, we need to determine what our priorities are and what we want out of life. The Redditor doesn’t hate his job, but with several kids running around, he finds his energy sapped and his available time diminished.

Which is another reason to not gild the lily when you’ve already achieved your goals several times over. Being there in the moment for your children is just as important to them as it will be for you after they’ve grown.

Yet cutting ties with your job doesn’t have to be abrupt. Consider taking a leave of absence or a sabbatical with the idea of returning within a year. It will mentally prepare you for the transition. When the time finally arrives to return to work, undoubtedly your mindset will be adapted to its new routines, making the final separation easier.

Yet that also means don’t use your leave to sit at home all day. That’s a prescription for boredom and makes wanting to get back into the game tough to overcome. Instead, find what you enjoy doing outside of the office and make that your priority. Discovering something new and fun that you never had the time before to try can erase the thought of ever going back.

Sure, you can keep on working and moving the goalposts further away so that you are always saving more. But you run the risk of health problems cutting into your ability to finally enjoy all that you’ve worked for.

Putting off retiring until some hazy time in the future will mean you never quit. Make your net worth goal hard and fast so that when you hit it, it is non-negotiable to go back. Having a deadline that’s sooner rather than later will allow for less time to change your mind.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.