This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive

compensation for actions taken through them.

compensation for actions taken through them.

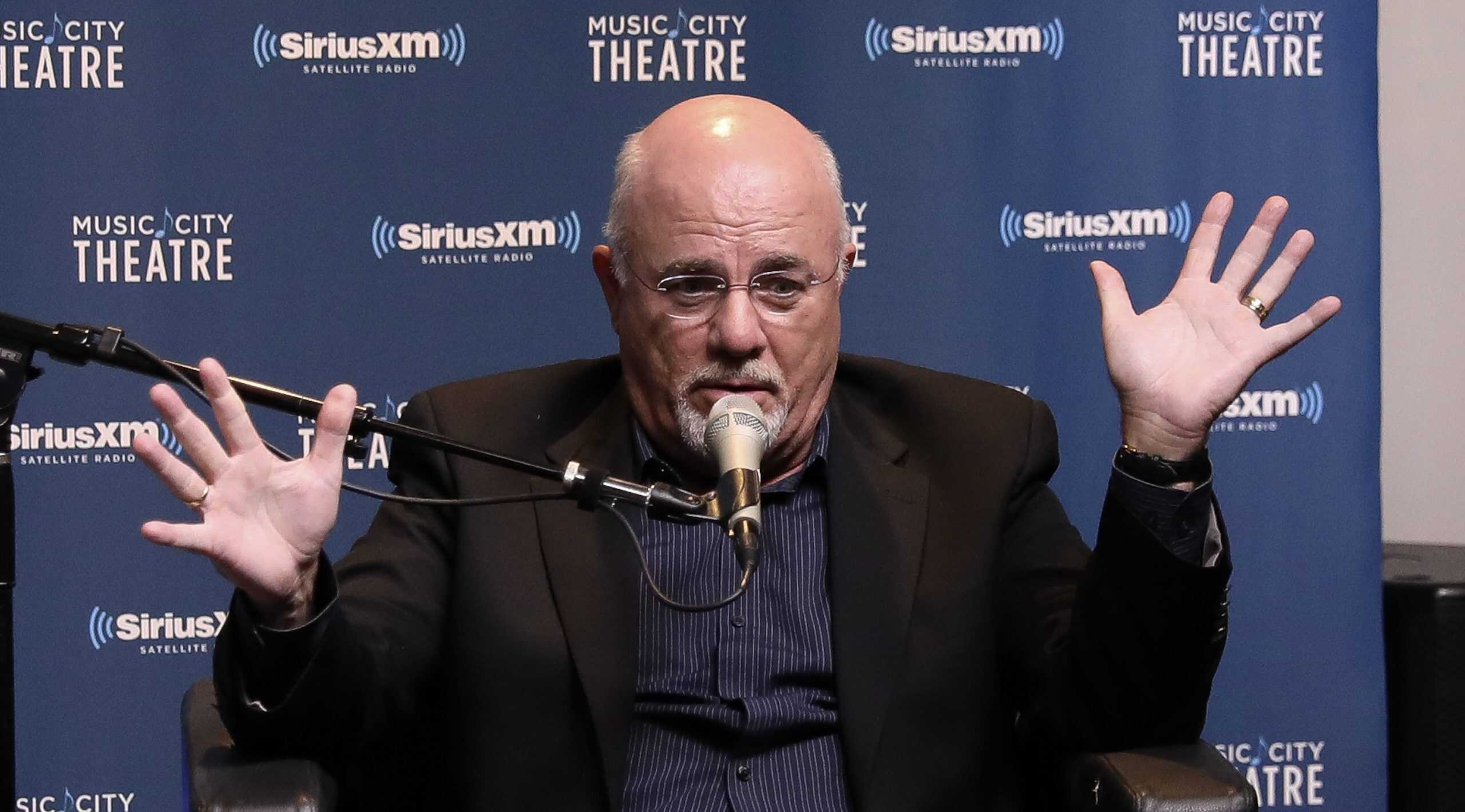

Investors may not agree with everything Dave Ramsey has to say.

But his advice is still worth listening to.

After all, he’s worth about $200 million and reportedly owns about $600 million in real estate. Anyone that can do that is well worth hearing out.

Key Points About This Article:

- Dave Ramsey told listeners that debt is not only a financial burden but a roadblock to their future wealth.

- “Your most powerful wealth-building tool is your income. And when you spend your whole life sending loan payments to banks and credit card companies, you’re making everyone else wealthy, and you end up with less money to save and invest for your own future.”

- Also: Take this quiz to see if you’re on track to retire(Sponsored)

Most recently, he told his listeners that debt is not only a financial burden but a roadblock to their future wealth. As he said on his Instagram page, “Your most powerful wealth-building tool is your income. And when you spend your whole life sending loan payments to banks and credit card companies, you’re making everyone else wealthy, and you end up with less money to save and invest for your own future.”

He also argues that credit cards, student loans, car payments and even borrowing money is all just “stupid.” Of course, when you have a net worth of $200 million and $600 million worth of real estate, not everyone can avoid those types of debt.

Instead, Ramsey argues that the only good debt is paid-off debt.

“Trying to save and invest while you’re still in debt is like running a marathon with your feet chained together,” he says, as quoted by GoBankingRates.com.

In short, do your best to avoid debt.

How to Get Out of Debt Using the Debt Snowball Plan

Unfortunately, there are millions of us stuck in debt. It’s just how it is.

But if you want to get better control of that debt, according to Dave Ramsey, use the debt snowball method – where you pay off your debts in order of smallest to largest. In doing so, list out all of your debt, including student loans, car payments, mortgages, credit cards, etc.

Then, as noted by Ramsey Solutions, “Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum payments on your other debts).”

Then, repeat that over and over again until you drive down your overall debt.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.