Personal Finance

I'm Afraid Social Security Will Run Out of Money. Is My Retirement Doomed?

Published:

Last Updated:

If you were to ask a room full of retired people whether they’re worried about the future of Social Security, there’s a good chance at least half would say yes. And they wouldn’t be too far off base.

The unfortunate truth is that Social Security is facing some financial challenges that could come to a head in about a decade’s time. It’s important to know what those challenges entail and how they might impact your retirement. But you should also know that the situation may not be nearly as hopeless as you’d think.

Key Points from 24/7 Wall St.

If you’re worried that Social Security is going to run out of money completely, let’s stop right here for a reality check. Although Social Security is facing a decline in payroll tax revenue (its primary source of funding) as baby boomers exit the workforce in the coming years, there will still be a steady stream of workers providing replacement labor and paying into the program.

Put another way, Social Security can’t run out of money as long as workers continue to earn income and pay taxes on their wages. So the worst-case scenario for Social Security in the coming years is benefit cuts. There’s really no scenario that has benefits disappearing completely.

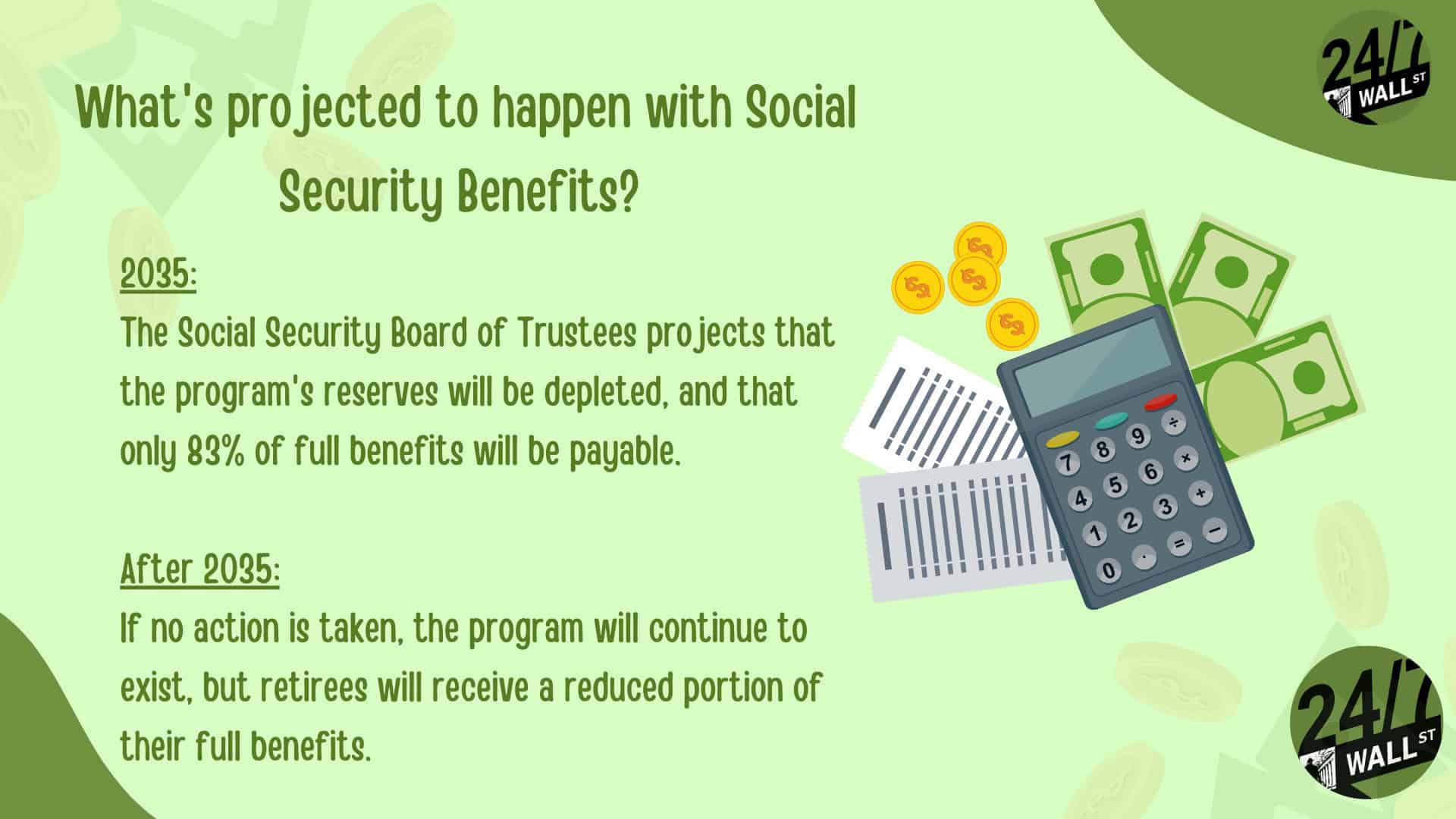

Recent estimates put the extent of Social Security’s potential cuts at about 20%. That number could of course wiggle in the coming years, since benefit cuts aren’t expected to be on the table before 2035 at the earliest.

But it’s also important to remember that lawmakers have Social Security on their radar. And they’re aware that sweeping benefit cuts could result in a large number of older Americans being plunged into poverty and having to utilize other government resources to compensate. What this means is that there’s a good chance lawmakers will find a way to prevent Social Security cuts, or at least keep them to a minimum.

Social Security cuts could upend your retirement if those benefits are your only anticipated source of income. So don’t put yourself in that position.

If you’re still working, ramp up your IRA or 401(k) contributions. For the latter, take advantage of a workplace match.

And no matter what account you’re using for your retirement savings, go all-in on stocks during your wealth-building years for maximum growth. You can shift over to more stable investments when retirement gets close, but rely on stocks to grow your savings while retirement is still fairly far off.

Also look at other income sources that may be available to you later in life. Part-time work is allowed while on Social Security, though there are earnings thresholds that apply to seniors who hold down jobs and collect benefits prior to full retirement age. You could also invest in an income property if it’s something you have the head (and patience) for.

There’s really no need to worry about Social Security running out of money. Should you worry about benefit cuts? That depends on you. But the better a job you do at lining up other income streams, the less the potential for Social Security cuts should be a point of concern.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.