Personal Finance

I've been pouring money into my 401(k) and it's nearly $1 million - but is it actually too much?

Published:

Last Updated:

A Reddit post entitled, “Is there such a thing as too much in 401(k)s?” caught my attention today. This post was in the subreddit r/ChubbyFIRE, which is for people who have a target portfolio of $2.5 million–$5 million and are upper-middle-class.

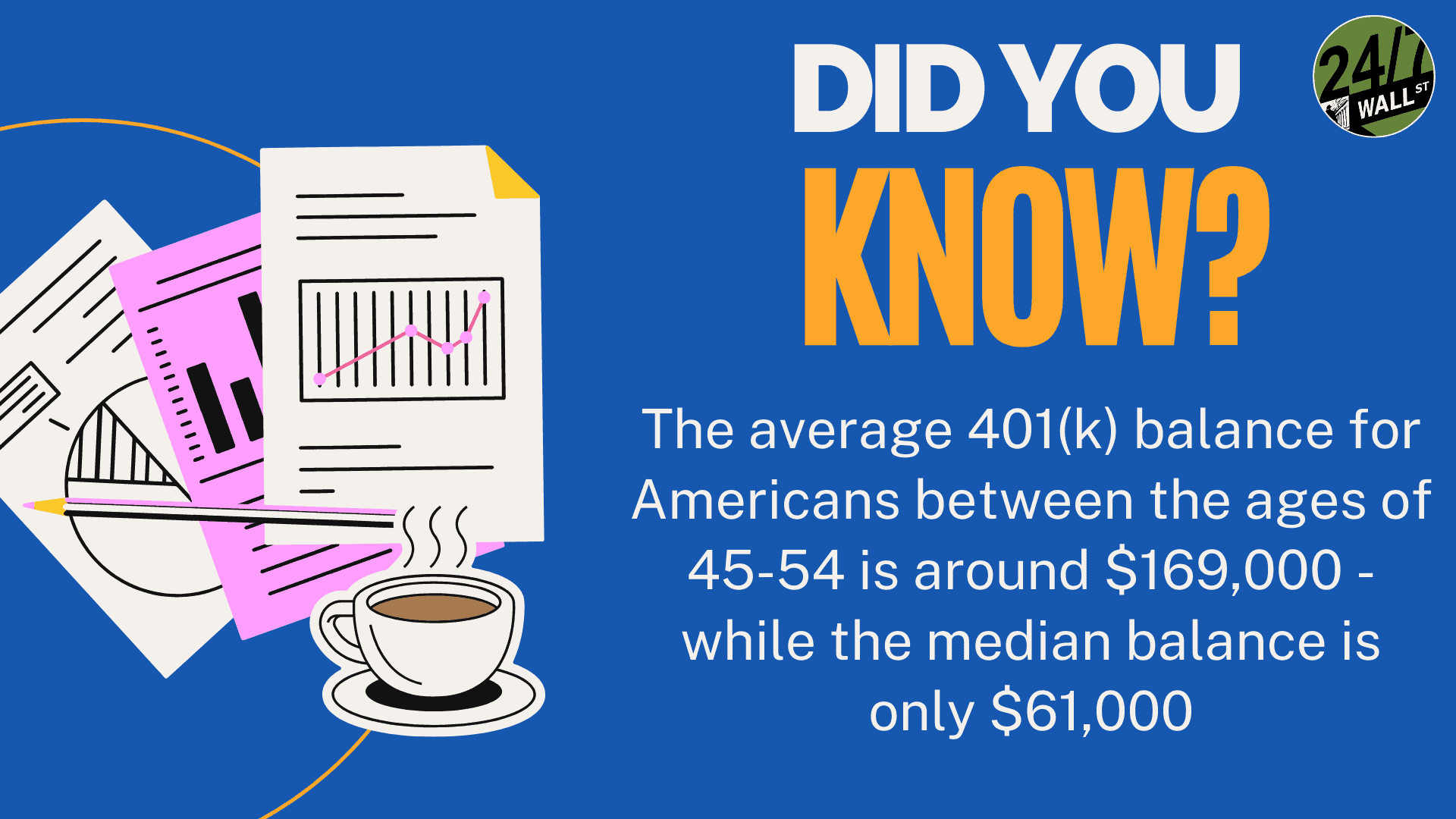

The post author is a 38-year-old male who is married to a 37-year-old woman. The couple have three kids under the age of three years old, with their youngest being one month old. He has a net worth of $1.1 million. He already has $960,000 spread over three retirement savings accounts (a 401k, 403b, and an IRA) $22,000 spread between three 529s, $12,000 in a taxable brokerage account, and $120,000 in a high-yield savings account (HYSA).

The author’s spouse is currently on maternity leave, but will soon be working one day per week to earn $45,000/year. She is the primary caregiver to their children. They live in a VHCOL (very high cost of living) area, have family close by to assist with childcare if needed and have a $1.7 million home with a $1.2 million mortgage at 5%.

The author maxes his 401(k) in February each year. He is questioning what they should do about his wife’s retirement savings. Her employer does not have a 401k match program. So, he is trying to decide if they should put 50% of her income into her own 403b.

It seems that the author is feeling the weight of having three kids. His post seems a little frantic, and anxious to me. Having a new baby can really get that adrenaline going and can really redirect anxiety to an unrelated issue. In the comments, he seems to mention frequently that his wife can easily go back to full-time work to increase their income.

Even with all of the different accounts combined, he is only putting away about 10% of his income. Usually, the rule of thumb is 15%. He isn’t maxing out his other retirement accounts, only his employer-related 401(k).

Many people in the comments are warning him against RMDs (Required Minimum Distributions) which is how the federal government collects taxes from accounts that are in tax-deferred retirement plans (like he has). Once you turn 72, you have to start paying RMDs on traditional IRAs, SEP IRAs, and SIMPLE IRAs. Most comments seem to be warning him to diversify more on his retirement accounts or else he might get pushed into a higher tax bracket and have to pay more taxes. Essentially, people are advising him on how to avoid paying his honest share of taxes in the future.

The general consensus on one point in the author’s situation is that no matter how much money you earn, maxing out your retirement savings accounts (however many you have) is always the best idea. The author never mentions how much his retirement goal is. When planning for retirement, it’s hard to know what exactly to do unless you understand how much you want to save, and what lifestyle you will be able to maintain off of that money.

The author may need to take another look at his To-do list and reprioritize it. With having three kids, one being a newborn, and his spouse being the main caregiver, it seems like he really needs to focus more on helping out in that area of his life. Maybe he should be worrying about his retirement which will happen 30+ years in the future, and focus on his life right now. As I previously mentioned, it’s interesting to me that he is worrying about this issue in such a high-stress stage of his life. Therapy is always a good idea, and talking to a therapist to figure out why he may be feeling this much anxiety about money would benefit him greatly in my honest opinion.

Talking to a financial planner (which I assume he hasn’t since he is turning to randoms on the internet for advice) would probably be a better idea than taking advice from strangers about something so important to him. It feels like if he consulted with a financial planner, who is an expert in all the information he is seeking, he might not even feel that anxious about it at all. He would probably spend much less time figuring this issue out, so he can spend more time supporting his spouse.

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.