Personal Finance

If your household brings in $200k per year, this is how much you need saved for retirement by age 50

Published:

Last Updated:

At some point, you’ll want to retire and just take it easy.

Unfortunately, many of us may not be saving enough if at all.

In fact, according to the Federal Reserve’s Survey of Consumer Finances, the average retirement savings for all families is just $87,000. Worse, only 54.4% of all families have a retirement account, meaning 54.4% of Americans have nothing saved for retirement at all.

While there’s no magic number, Americans say they’ll need about $1.46 million to retire, according to a Northwestern Mutual study. That’s up 15% from $1.27 year over year. That’s also up about 53% from 2020 when the money needed was $951,000.

If you’re already retired, or even able to think about retiring comfortably, congratulations.

For those that aren’t there just yet, here’s where you compare with your age group. According to Edward Jones, if your household earns $200,000 and you plan on retiring by 65, here’s where you should be between your 20s and your 60s.

| Age Group | Current Savings Range |

|---|---|

| 20s | $0 to $445,000 |

| 30s | $345,000 to $945,000 |

| 40s | $810,000 to $1.615 million |

| 50s | $1.43 million to $2.5 million |

| 60s | $2.26 million to $3.17 million |

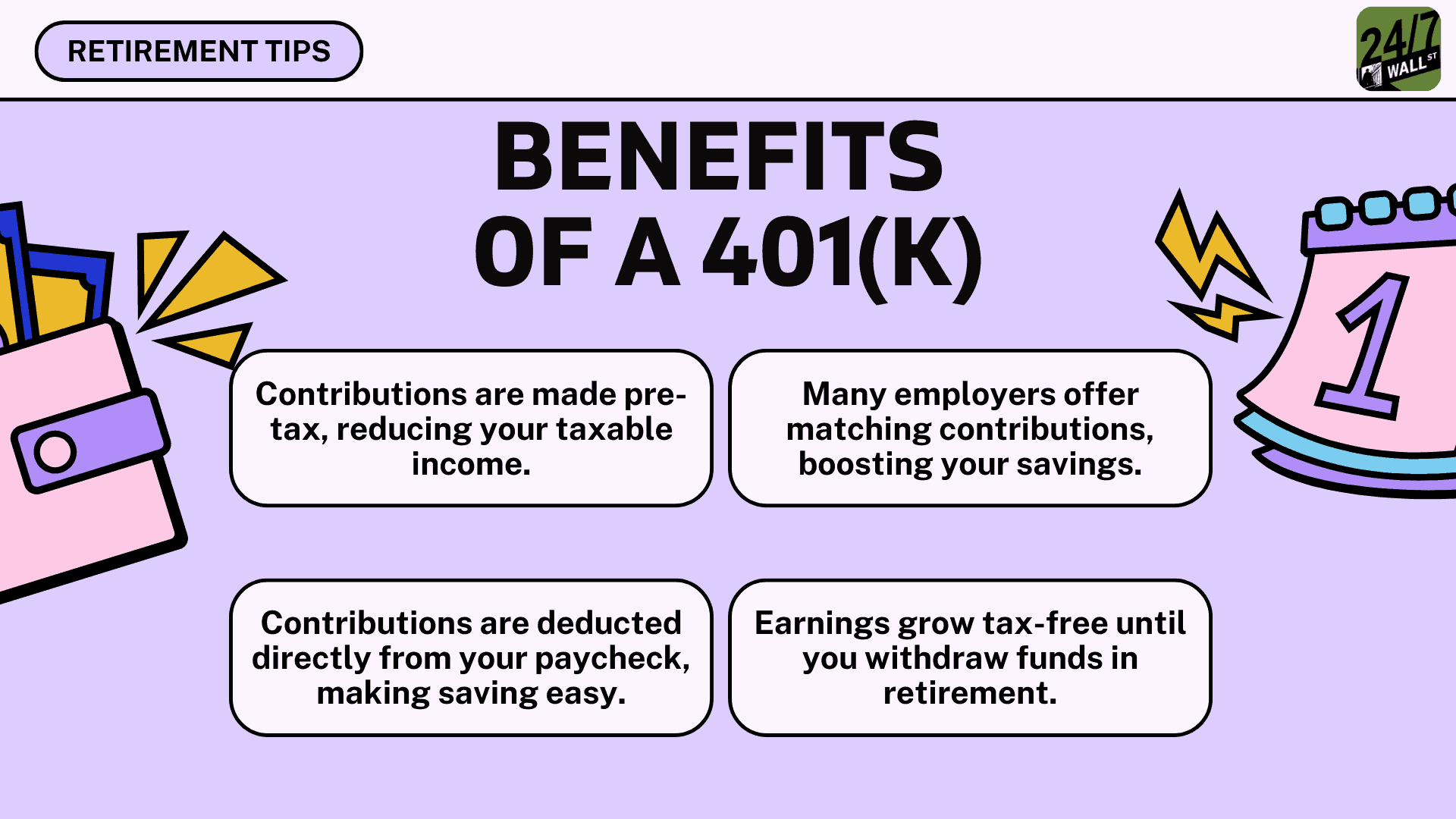

If you’re not within the range for your age group, don’t panic. There are several things you can do now to catch up. For one, you can maximize your 401(k), and if you don’t have one set up, or you work for yourself, talk to your company’s financial administrator or your advisor. In fact, if you do work for yourself, you can always set up a Solo 401(k).

First, if you have an employer that will match your 401(k), maximize your contributions up to the amount your employer will match. If your employer will match up to 6% of your salary, maximize that. If you earn $75,000 a year, and you contribute 1%, that’s $750 for retirement. If your employer matches that, you have $1,500 for retirement per year. If you contribute 6% and your employer matches that, that’s about $6,750 in retirement per year.

Second, you can invest in a traditional IRA, for example. While it’s best to check with your financial advisor, many times you can deduct contributions on your tax return.

Three, consider a Roth IRA, where you make contributions with money you’ve already paid taxes on. With a Roth IRA, your money can grow tax-free with tax-free withdrawals. But again, check in with your financial advisor before doing anything.

Also, if you are self-employed, you can set up a Solo 401(k), a variation of the 401(k) plan but set up for those who work for themselves. For 2024, the IRS says you can contribute up to $69,000 with an additional catch-up contribution of $7,500 if you’re 50 or older.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.