Personal Finance

I'm trying to plan for retirement even though we have 3 kids - I'm unsure if $5 or $10 million is enough to comfortably live our lives

Published:

Last Updated:

The old real estate mantra “location, location, location” very much applies to retirement planning. Being a millionaire in a low cost of living market means you can stretch your dollars much further than someone living in a high cost of living area. You’re going to need a heckuva lot more money to retire on if you choose that route.

That’s why a Redditor’s question on r/ChubbyFIRE about whether he needs a net worth of $5 million or $10 million is not as far afield as it initially sounds. Most would consider the lower number sufficient for living an affluent, upper middle-class lifestyle while being financially independent. However, because the Redditor lives in the super-high-cost San Francisco Bay area and wants to stay there, that might not be enough. He is not ready to retire just yet, but he also is drained by his current job and ultimately wants to raise three kids in the area long term. Closer to the upper-end figure just might be required.

It is important to understand the ChubbyFIRE lifestyle the Redditor pursues represents financial independence with a more luxurious approach compared to traditional FIRE (Financial Independence, Retire Early).

Where the latter focuses on frugality to achieve financial independence, ChubbyFIRE emphasizes maintaining a higher standard of living, including frequent travel, often overseas; upscale dining; and a comfortable home in desirable areas. Achieving this in a city like the San Francisco Bay Area requires significant financial resources.

The Bay Area’s housing market is among the most expensive in the U.S. According to California’s Vital Signs, the percentage of households spending over 35% of their income on housing has risen from 22% in 1980 to 30% in 2021. The median sale price of a home in 2021 was $1.2 million with prices rising 70% over the last two decades.

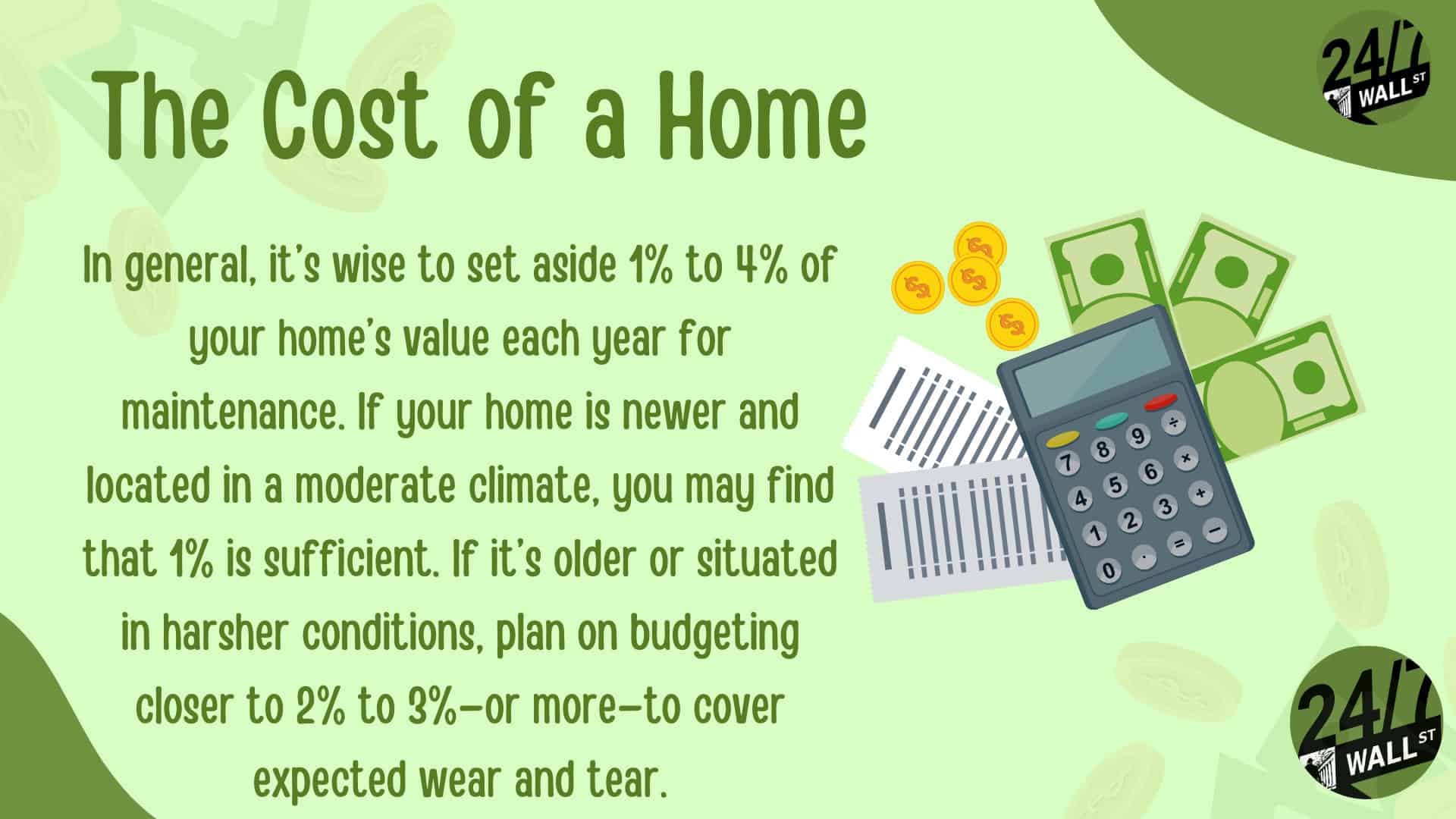

Property taxes, maintenance, and insurance can add tens of thousands annually to housing expenses, and then you have to add in the cost of utilities and transportation. Add in the expense of dining out, perhaps memberships at private clubs, and other leisure time activities, and annual spending could see an extra $100,000 added to the bill.

You’re also going to have higher healthcare costs in the Bay Area, including for insurance and medical expenses. And with three kids, the Redditor will be facing significantly elevated childcare costs as well, not to mention eventual college costs. Living in the Bay Area is not for the faint of heart when it comes to coats.

For a sustainable ChubbyFIRE lifestyle in that market, it is not unreasonable to expect that a portfolio generating anywhere from $250,000 to $400,000 a year in passive income will be required. Assuming a conservative 4% safe withdrawal rate to maintain the principal, an investment portfolio of $6.25 million to $10 million will be essential.

So for the Redditor, he might be able to make do with a $5 million net worth, but it will require careful spending and supplemental income sources. Since he is thinking of taking a less stressful job that affords him more time with his children, he will need a net worth closer to $10 million to maintain true financial independence.

ChubbyFIRE in the Bay Area demands substantial wealth due to the region’s high cost of living. While it’s possible to achieve a $5 million net worth, the Redditor’s long-term goals suggest having a cushion closer to $10 million will be necessary to sustain a luxurious lifestyle.

Now I’m not a financial planner or tax professional, so these are just my opinions. It is critical for anyone pursuing this lifestyle in such an expensive area to consult with financial experts first to map out a course of action that will meet their needs.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.