Personal Finance

Is it actually true that most Americans have less than $1,000 in their savings?

Published:

You have likely seen the shock headlines that most Americans don’t have any savings and would be financially ruined if an unexpected emergency costing $400 or more arose. Financial guru Dave Ramsey even mentioned it recently in arguing for people to have a $1,000 starter emergency fund. Heck, even I referenced it.

While that fact quickly took holding in the public consciousness and is now seen as fact, is it true? Not quite.

The statistic comes from a May 2021 Federal Reserve survey on the “Economic Well-Being of U.S. Households in 2020.” In it, the central bank noted that 64% of Americans would be able to pay for a $400 emergency expense by using cash or its equivalent. That implied 36% would not be able to cover such a relatively small expense.

From that, media ran with it and today, it has become ingrained that “most” Americans can’t afford to pay for minor crises out of savings.

While even a little over a third of U.S. households not being able to afford such unexpected costs is alarming, that’s not quite true either.

First, the survey was conducted during the Covid pandemic. When the government shut down the economy and millions of people were laid off, households had to make judgment calls. Many people had no income coming in. While the government did hand out stimulus checks checks to get people to spend, consumers still needed to decide where to direct their limited funds. It should be noted that the number of people who could pay for a $400 emergency out of cash shot to 70% during this time because of the free money being handed out.

Second, even though the Fed survey was conducted during the pandemic, its data showed more Americans than ever are saving. In 2019, 63% of Americans could pay for the theoretical emergency out of cash, 13 percentage points higher than could afford it back 2013 when only half of U.S. households could.

But if we dive even deeper into the finances of Americans, we discover a much brighter picture.

A different Fed survey called the “Survey of Consumer Finances” found Americans had plenty of savings to cover emergencies.

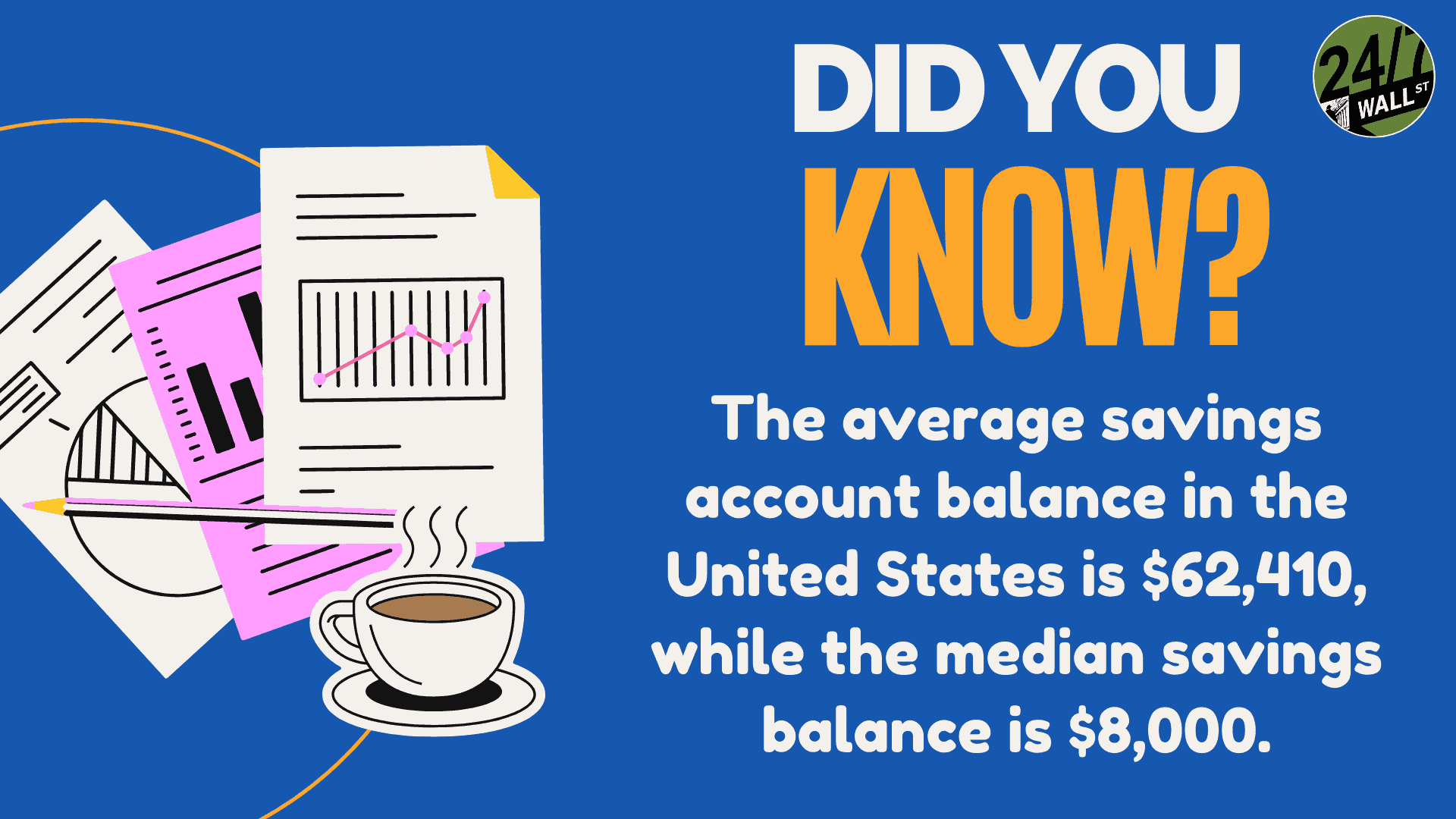

Over 98% of all U.S. households have transaction accounts, or checking, savings, or money market accounts. These liquid assets providing ready-access to cash had a mean balance of $65,000 in them.

Admittedly, that is skewed by higher income households whose balances are larger. Still, the median value of the accounts, or the number after removing the outliers from the results, was $8,000. That’s a much different picture than was given by the previous survey.

The numbers are also skewed by age. Younger folk typically have less money saved than middle-aged and older people. That makes sense because young people are typically at a lower wage-earning time in their life. As they age, they make more and can put more away.

Now don’t get me wrong. Americans aren’t saving nearly enough as they should. Bureau of Economic Analysis data shows the personal savings rate, or the amount of money people are squirreling away as a percentage of their personal income, is woefully inadequate.

As of August 2024, that rate was just 4.8% compared to 50 years ago when Americans were socking away 14% of their income. Now it does tend to spike during times of trouble. For example, the personal savings rate began rising during the financial and housing markets collapse of 2007 when it was at a low of 1.9% and peaked at 10.9% in December 2012.

Yet Americans do have money saved and have ready access to it in case of emergency. Maybe it’s not at the level it should be, but don’t be taken in by the headlines intended for clicks and eyeballs. We can handle minor emergencies and a bit more.

Even so, don’t get complacent. You should still save more and bulk up that emergency fund to cover three to six months of expenses.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.