Personal Finance

If your family brings in $100k per year, this is how much you need saved for retirement by age 50

Published:

Last Updated:

Retirement planning is like going on a long trip: you need a roadmap to know where you’re headed and regular checkpoints to ensure you’re on track. But it could be a daunting journey for folks in their 50s.

At this stage of your life you are in your prime earnings years when the hard work of your youth has transformed into a period of career achievement. But, just the past four years could have upended your routine.

The volatility of the stock market and rising inflation could have erased any progress you made. Now is the time to pull into a rest area and recalibrate.

Between 2020 and today, the cumulative rise of inflation has resulted in the price of a basic food basket rising 33%, according to Statista. With inflation creeping higher again, the central bank is no longer in the mood to cut interest rates further.

You need to check your roadmap again to be certain you are still on the right path. Data from the U.S. Census Bureau says the real median household income in the U.S. is $80,610. So if your income is slightly above this level, you need to have already saved up a sizable nest egg if you want to enjoy a comfortable retirement.

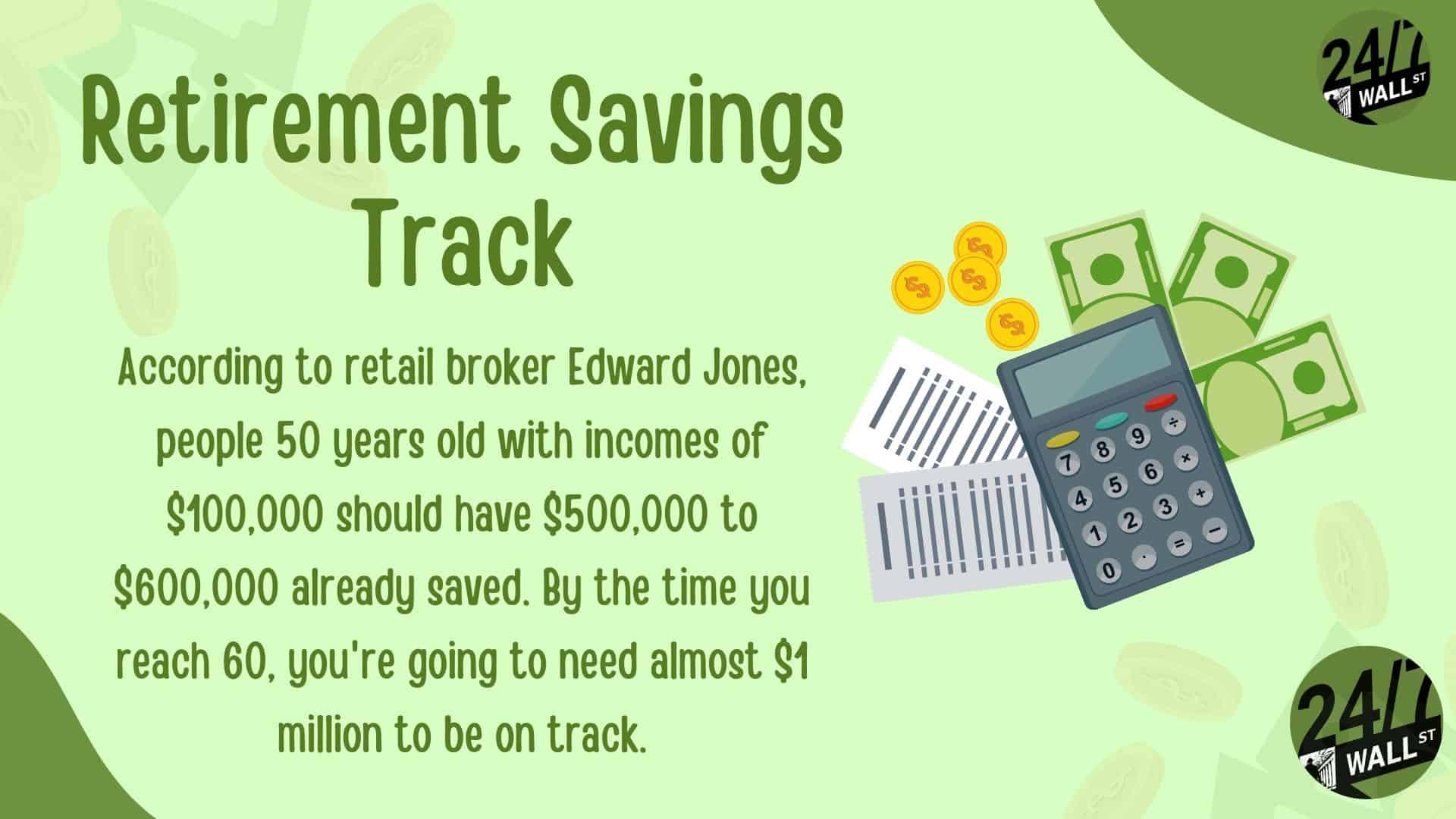

Retail broker Edward Jones recently released a comparison of average retirement savings balances by age group. It showed that for people 50 years old with incomes of $100,000, you should have $500,000 to $600,000 already saved. By the time you reach 60, you’re going to need almost $1 million to be on track.

Naturally, your mileage may vary. It is not a cut-and-paste plan, but one that provides some guardrails to get a sense of where you should be.

So if your savings fall short of this benchmark, don’t panic. There are actionable steps you can take to get back on track.

If your current savings are below target, here’s what you can do to close the gap:

1. Live Below Your Means. To accelerate savings, spend less than you earn. Create a detailed budget to identify where you can cut expenses. Eating out less, downsizing your home, or trimming discretionary spending means every dollar you save can go toward retirement.

2. Increase Your Savings Rate. If you’ve been saving less than 15% of your income, now is the time to boost that number. Max out your 401(k) contributions and take full advantage of any employer match. Also contribute to an IRA if eligible.

3. Eliminate High-Interest Debt. Pay off high-interest debt, like credit cards or personal loans. It is one of the best financial moves you can make as it gives you more flexibility to save for retirement.

4. Consult a Financial Advisor. A financial planner can help you customize a strategy to catch up on savings, optimize your investments, and plan for contingencies like healthcare costs in retirement.

If you already hit your $500,000 savings goal, congratulations! But don’t stop now. Step on the accelerator.

1. Max Out Retirement Contributions. Fully fund your 401(k) and IRA accounts, then consider opening a taxable brokerage account to save even more.

2. Diversify Your Portfolio. You may already have a healthy mix of stocks and bonds so consider alternative investments such as real estate, rental properties, or commodities. These can add stability and growth potential to your savings.

3. Plan for the Long-Term. Think about long-term care, estate planning, and other financial considerations that will arise as you age. Addressing these now can save money and stress in the future.

Reaching $500,000 to $600,000 in savings is a realistic goal for a 50-year-old earning $100,000, but requires focus, discipline, and regular adjustments. Inflation has moved the financial goalposts, but staying proactive can help you cross the finish line.

Remember, retirement planning is not just about hitting a number. It’s about living the life you imagine, free from financial stress. Whether you’re catching up or forging ahead, every step you take now brings you one mile closer to a comfortable and secure retirement.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.