Personal Finance

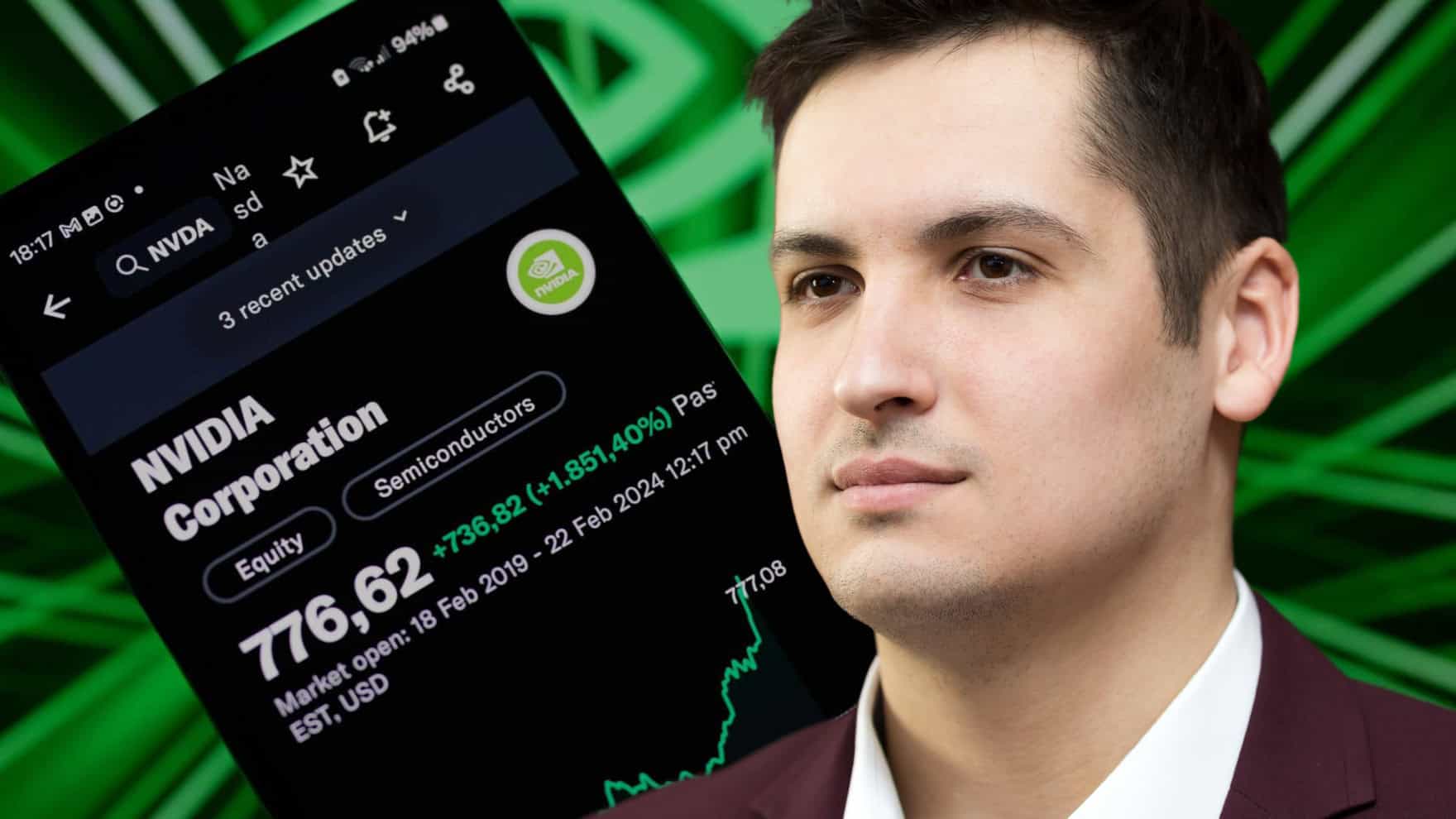

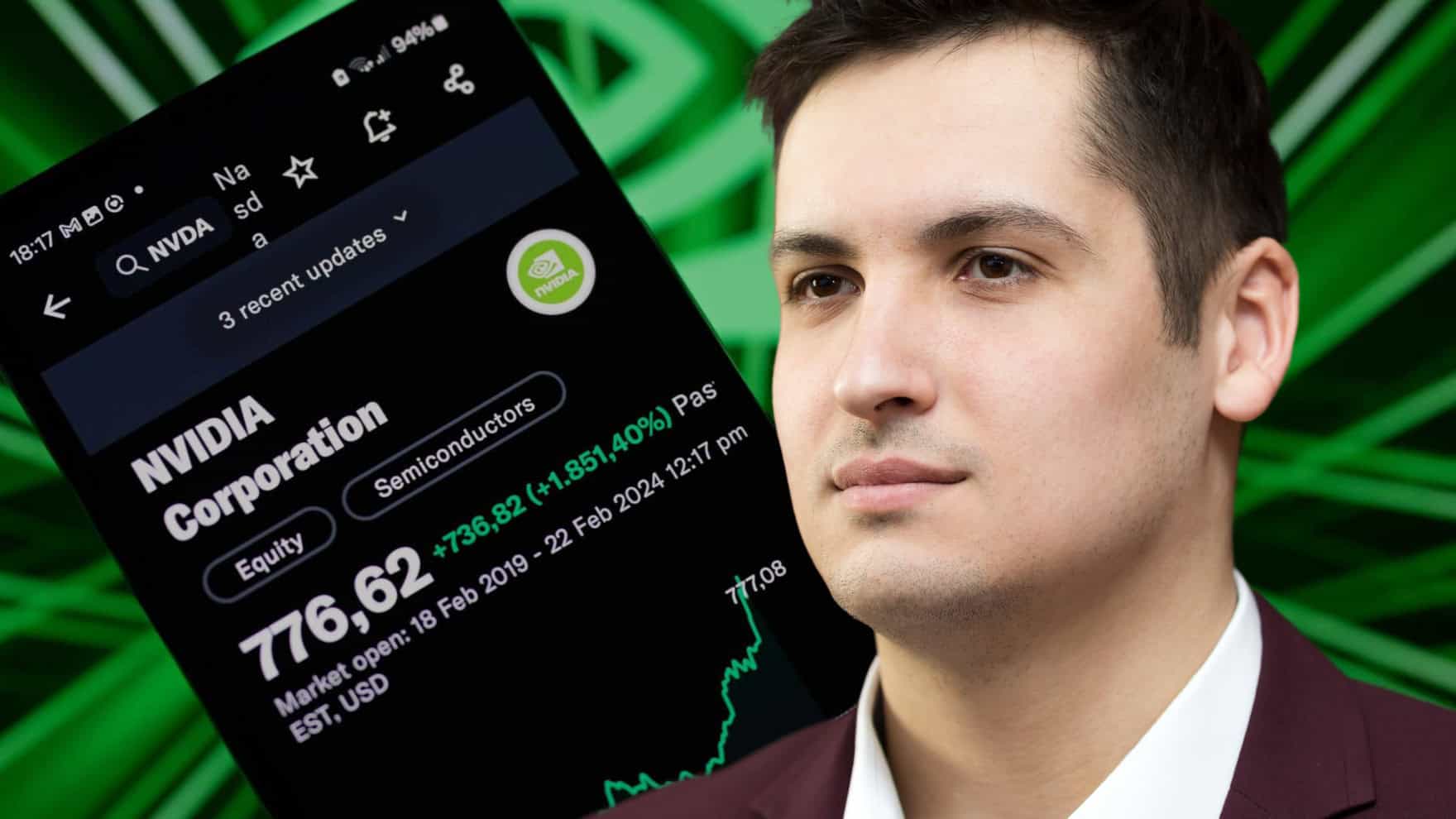

I'm 34 and bought NVIDIA options in my Roth IRA and now it's worth millions - should I take the money out so I can actually retire?

Published:

The Financial Independence Retire Early (F.I.R.E.) strategy embraced by Millennials and some Gen-Xers can be rewarding in unexpected ways. Founded on principles of thrift and aggressive growth-oriented investment, FIRE is designed so that average market growth metrics will allow for retirement nest eggs to appreciate to a 7-figure target (about 25x annual expenses) that can support retirement at a 4% withdrawal rate while one is still in their 50s, or on rare occasions, in their 40s.

Anomalous market conditions can sometimes accelerate the process. Disruptive technologies such as Artificial Intelligence have functioned like rocket fuel for Nvidia (NASDAQ: NVDA) and the other “Magnificent 7” stocks.

One 34-year-old who had been actively self-managing his retirement account bought synthetic long LEAPS (Long Term Equity Appreciation Securities) calls (long-term options with up to 3 years before expiration) on NVDA for his Roth IRA that has grown into multiple 7 figures in a short period. Given that the options have appreciated to such a high level but will eventually expire, he plans to cash them out and convert them to index funds until making his next move. As the index funds will grow to reach his F.I.R.E. target in the next 5-7 years at current rates, he is considering early retirement, but the high tax burden is a concern.

Other than mortgage at 2.97% interest, he and his wife also have maxed IRAs, 401-Ks, HSAs, and a 529 for their son, along with emergency funds in a brokerage account. Annual income is $200,000+, and the couple would like to spend more time as a family and travel.

He posted three scenarios that came to mind on Reddit and solicited other strategies for consideration.

The poster discloses in later comments that the Roth IRA with NVDA LEAPS calls is at nearly $5 million and his F.I.R.E. target was $10 million. My own advice would be to let all of the tax-deferred accounts and the emergency fund account continue to appreciate. I would restrict a small amount to day trade (if that is a personally important hobby activity) but refrain from risking any of the other funds. I would also explore the following:

This article is intended to be construed solely as informational. If greater in-depth tax or retirement finance advice is warranted, a financial tax professional should be consulted.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.