Personal Finance

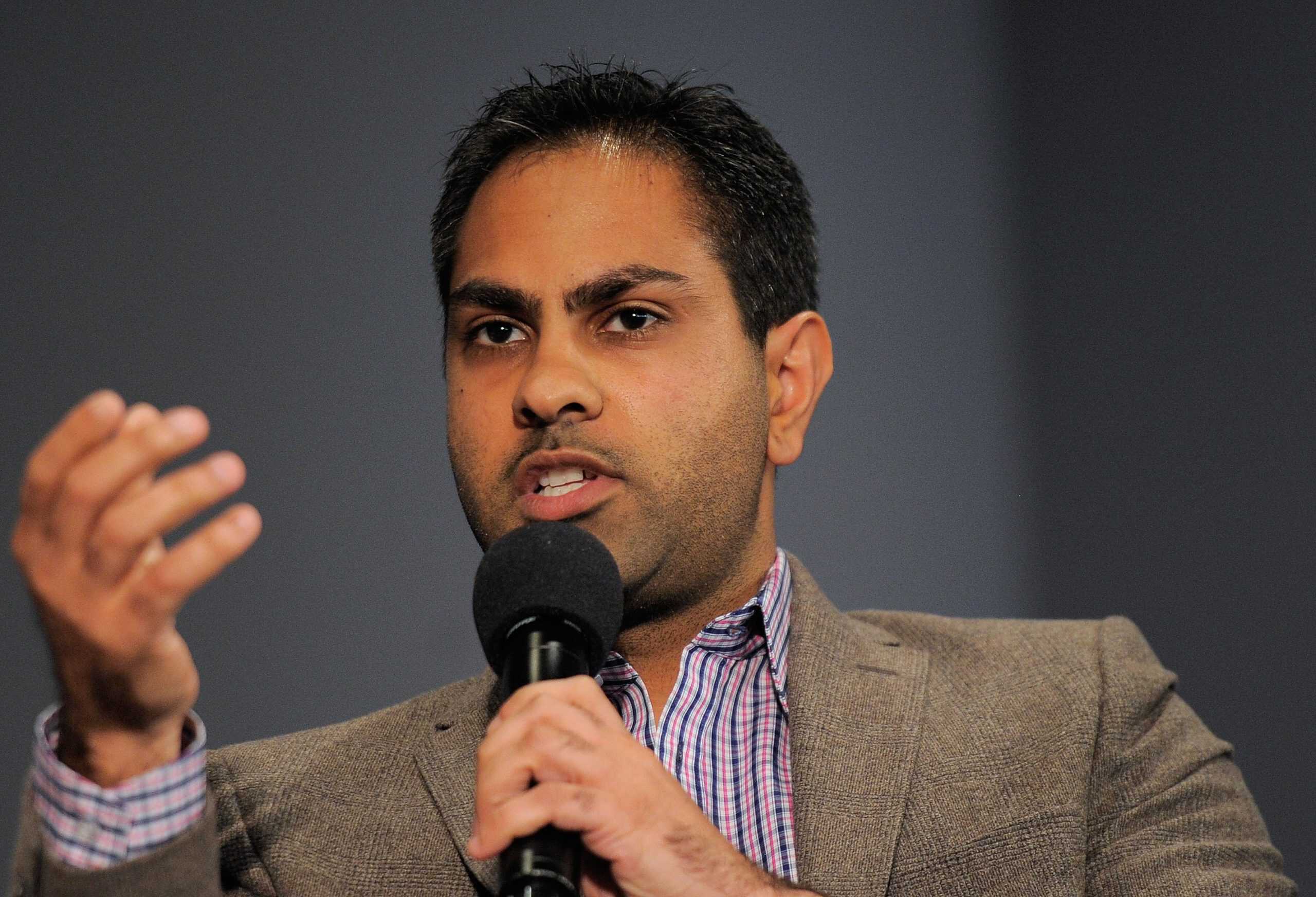

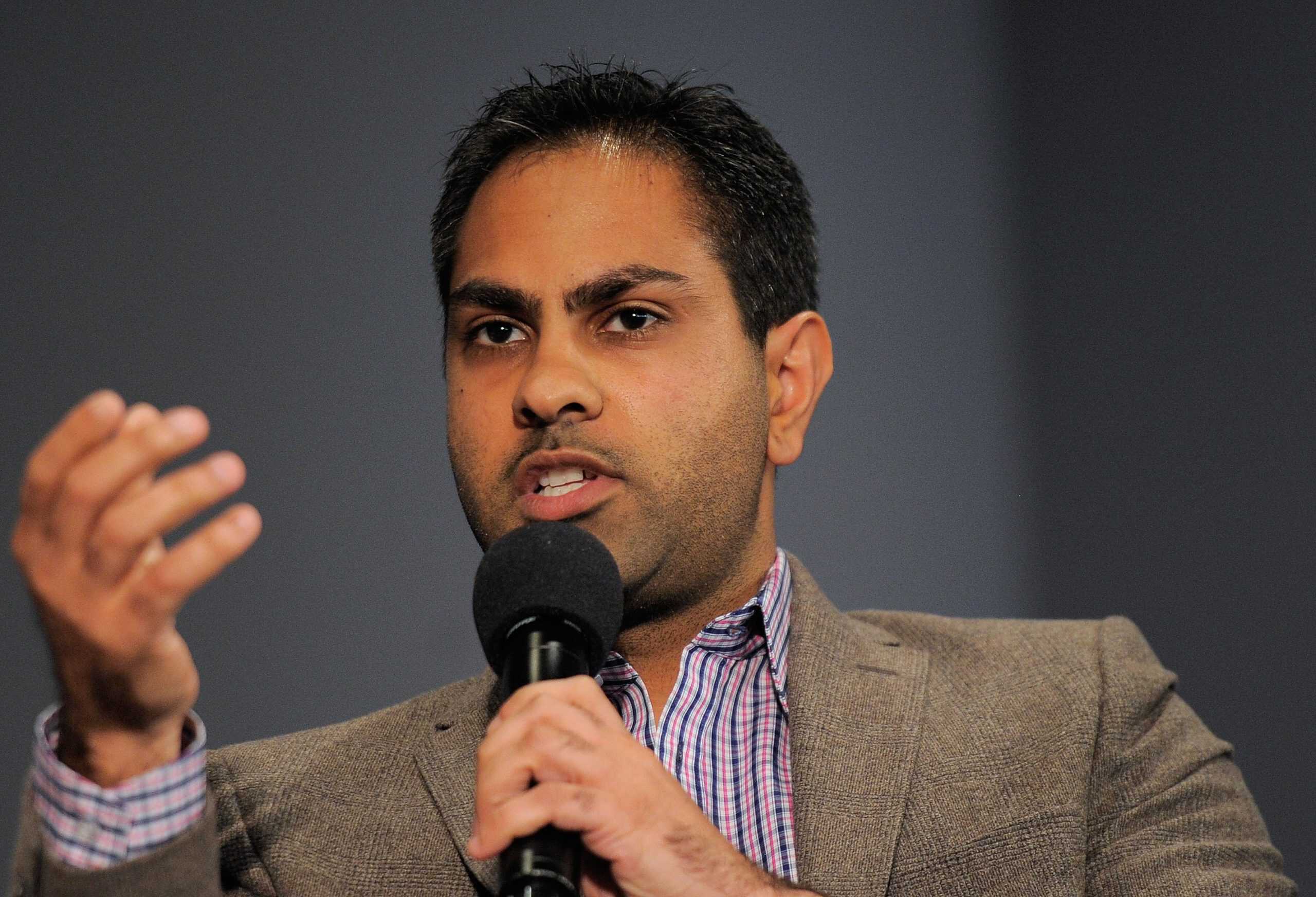

Ramit Sethi says these old tips from your parents don't work anymore and they can end up costing you millions

Published:

24/7 Wall St. Key Takeaways:

Most of us learned what we know about money from our parents, at least at first. Generally, this involves saving every penny, avoiding credit cards, and buying a house as soon as possible. These tips did work well for the previous generation, but they can be outdated in today’s fast-changing economy.

Ramit Sethi claims that sticking to the “old” advice can potentially cost you millions. He recently explained in a YouTube video why many of these older habits simply don’t work in the new world.

Here are some key takeaways from Sethi’s videos, as well as some suggestions on what to do instead:

Our parents often preach that you should save, save, save. Often, the recommendation is to avoid even small expenses so that you can save more. Saving is important. However, simply hoarding cash will not help you build wealth. Because of inflation, you have to keep growing your wealth, not just keep it tucked into a savings account.

Instead, you need to invest your savings, preferably into diversified assets. Sethi emphasizes that compounding returns over time are the true secret to building wealth and keeping it (and Dave Ramsey agrees with him).

Parents often see credit cards as dangerous tools that can lead to debt and financial ruin. However, Sethi explains that credit cards have their place when used responsibly. Many modern credit cards offer benefits like cashback and fraud protection.

What does Sethi recommend? You can use credit cards, but be sure to pay your full balance every month to avoid interest. Use credit cards strategically to boost your financial flexibility when you need to.

For previous generations, buying a home symbolized stability and financial success. But Sethi says this advice no longer applies universally.

Housing prices are very inflated, and home ownership comes with a lot of hidden costs, like maintenance, taxes, and insurance. Renting can be a better option for many individuals today. It’s important to look at the numbers carefully and make decisions based on your financial goals.

Parents often stressed the importance of hard work as the key to financial success. While effort is important, Sethi highlights that working smarter—by negotiating salaries, developing in-demand skills, and investing—is far more effective than grinding away endlessly.

It’s much better to work smart and hard rather than believe that working hard is enough in itself. Many people work hard all their lives and never grow wealth. Working hard isn’t the only thing you need to do to build wealth.

Money is often treated as a taboo subject that’s never brought up. However, this can be a huge financial mistake. Talking about finances is how you learn about finances. You can miss out on tons of advice if you constantly avoid conversations about money.

Instead, you should discuss money openly with anyone you trust. This should include your partner, of course, but it can also include your children, friends, and family.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.