Personal Finance

If your household brings in $200k per year, this is how much you need saved for retirement by age 40

Published:

Last Updated:

Today’s harsh reality is the cost of living continues to rise and your retirement savings are losing ground. The things you take for granted today — healthcare, housing, even groceries — are going to cost you significantly more in the future. Ignoring inflation is like trying to kick a field goal, but they keep moving the goalposts on you.

Just because you are 40 years old, and are a high-wage earner with a solid career, it doesn’t mean you can ignore your retirement. In fact, the clock is ticking and inflation is making it harder than ever to move the football over the goal line.

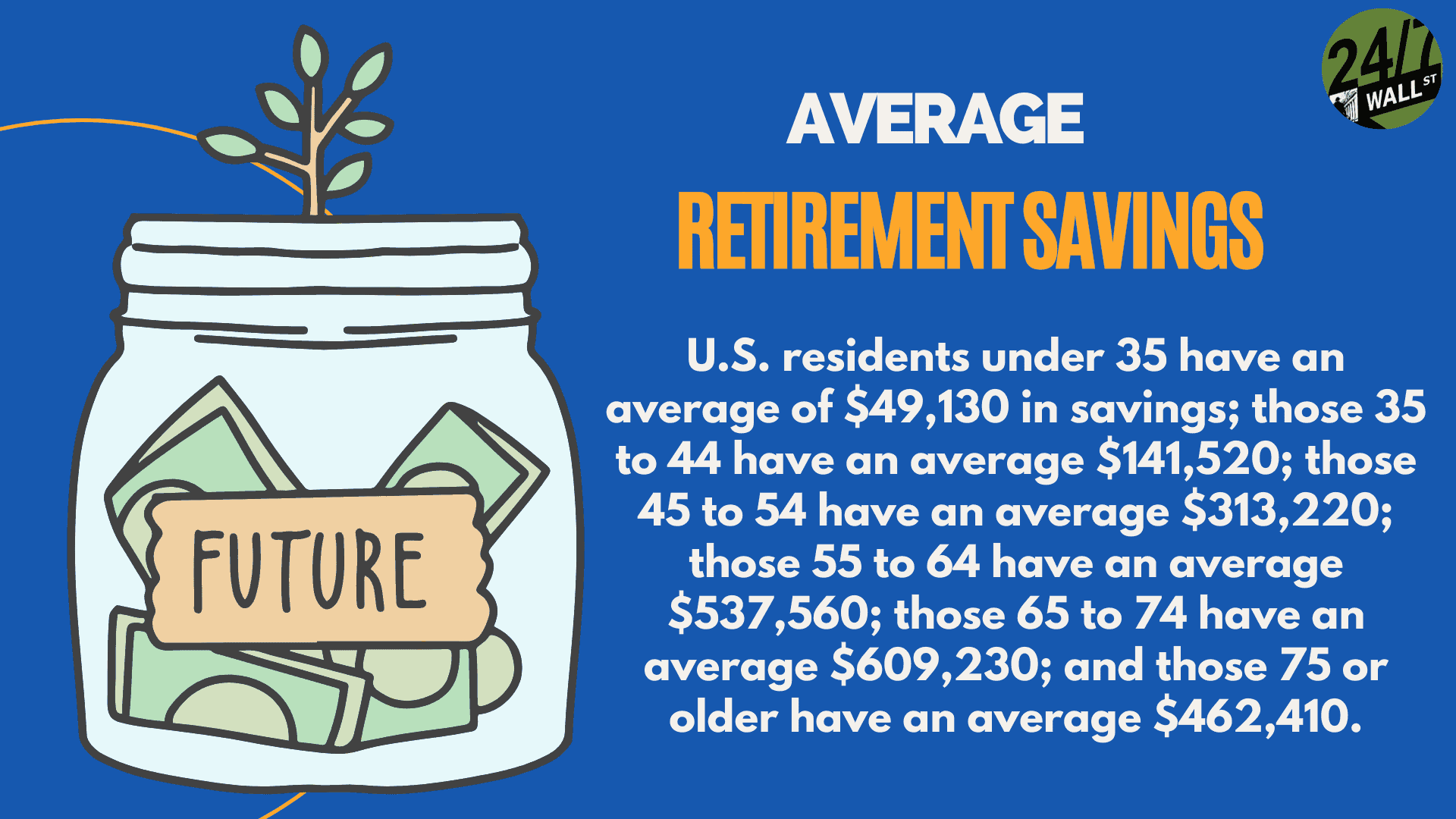

Recently, retail broker Edward Jones released a comparison of average retirement savings balances by age group. It found that for people 40 years old with incomes of $200,000, you should have between $810,000 and over $1 million already saved. That’s a big number, and it’s easy to feel overwhelmed. But ignoring it won’t make it go away.

To arrive at those figures, Edward Jones baked some assumptions into its calculations. It estimated you are contributing 15% of your pre-tax income to your retirement accounts, which is a good starting point as it is crucial to build a solid foundation.

It also assumes you’re going to achieve a 6% return on your investments before retirement and a 5% return afterward. This requires having a diversified portfolio and a willingness to ride out market fluctuations.

Next, Edward Jones figured you will begin receiving Social Security benefits at age 65 where you can expect an average benefit of $41,112. As we all understand, though, that’s not nearly enough to live comfortably.

So looking at our base case scenario and peeking into your retirement savings, how do you measure up?

If after looking at your balances and seeing that you are behind schedule, the first thing to do is not panic. There are steps you can take to get back on track:

Reassess your goals. Take a hard look at your spending habits and adjust your retirement goals accordingly. You are probably going to have to make some tough choices and sacrifices now to secure a comfortable future. It may require cutting items out of your budget and assessing whether the things you are buying are needs or wants.

Boost your savings. Increasing your contributions to your retirement accounts could go a long way toward narrowing the gap. Raising your contributions to 20% or 25% may be necessary, but even a small increase can make a big difference over time.

Maximize your investments. I’m not a financial planner, so talking to a financial advisor and a tax professional about investment options can help you achieve higher returns that are best suited for your personal situation.

Take advantage of tax breaks. Utilize tax-advantaged retirement accounts like 401(k)s and Roth IRAs to their fullest to maximize your savings.

There are those fortunate people who find they have been so diligent about saving that they are doing better than expected. If that’s you, good for you! Now is not the time to stop. Here are a few steps you can take to accelerate your results.

Max out retirement contributions. If you are already fully funding your 401(k) and IRA accounts, then consider opening a taxable brokerage account to save even more.

Diversify your portfolio. With a healthy mix of stocks and bonds in your retirement accounts, you may want to juice your returns a bit by considering alternative investments such as real estate, rental properties, or commodities. By diversifying into different asset classes, you add stability and growth potential to your savings.

Plan for the long-term. Healthcare is likely going to be one of your biggest expenses in retirement so think about about long-term care, estate planning, and other financial considerations you will face as you age.

Remember, retirement planning is a long-term process, not not something to be achieved overnight. By taking proactive steps now and making smart choices, you can be assured you have a comfortable and fulfilling retirement.

Don’t let the $800,000 question become a source of stress. By taking control of your financial future, you’ll be well on your way to enjoying your Golden Years.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.