compensation for actions taken through them.

24/7 Wall St. Key Takeaways:

- Financial freedom doesn’t happen by itself. You have to plan it, even when you have a high income.

- It’s easy to have a high income and also have debt. You have to lean into your financial plan.

- Also: Take this quiz to see if you’re on track to retire (Sponsored)

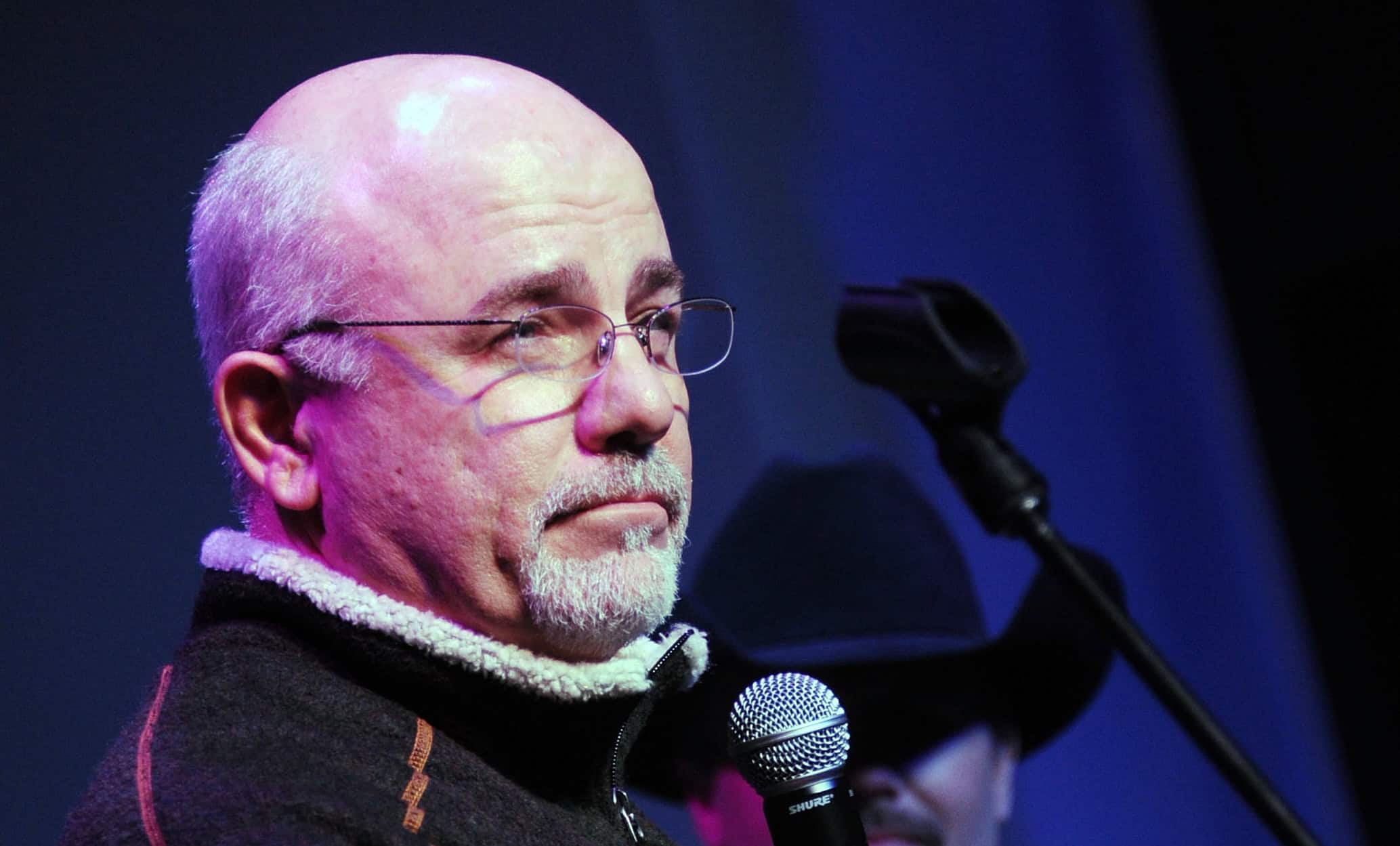

When Chris from Hendersonville, Tennessee, called into The Dave Ramsey Show, he had what he described as a “good problem.” Newly married with a young daughter, Chris found himself making over $400,000 annually in his self-owned concrete business.

Despite this, he was “rich poor.” Chris and his wife had nearly $500,000 in combined debts, including their car loans and mortgage.

Let’s take a quick look at Ramsey’s recommendations for Chris’s situation, as well as some of our suggestions:

1. Start with the Cars: Pay Off Consumer Debt Immediately

Chris admitted to being “redneck rich” in his first year of success, spending freely while accumulating two car loans totaling $98,000. Ramsey suggests that Chris uses his $60,000 in savings to pay off one of the car loans and then pay off the other within the month.

Eliminating consumer debt is foundational in Ramsey’s philosophy, freeing up cash flow and reducing financial stress.

2. Focus on the Mortgage but Prioritize Stability

Chris’s $405,000 home was financed with a 5/1 adjustable-rate mortgage (ARM) at 4.25%. Ramsey urged Chris to shift his mindset:

- Treat your income like a business: Ramsey suggested living off of $100,000 annually instead of spending all $400,000.

- Prepare for uncertainty: Chris expected his income to remain high. However, he acknowledged that a recession could halve it. It isn’t completely protected. Ramsey recommended that Chris pay down his mortgage as quickly as possible to keep some financial flexibility.

3. Build Long-Term Wealth Intentionally

Ramsey didn’t just focus on debt elimination; he also painted a bigger picture. By living below his means and investing wisely, Chris could accumulate significant wealth over time. Ramsey said that he could easily have millions by the end of the story.

However, that requires financial discipline and a clear financial plan.

4. Avoid Lifestyle Inflation

Lifestyle inflation is the end of the road for many with a high income. Chris admitted that he had spent money on just about everything. Ramsey highlighted this as a pivotal moment: instead of indulging in unnecessary purchases, Chris and his wife should redirect their income toward financial freedom.

You should live far below your means, especially when you have a high income and live in a low-cost area. Keeping your expenses low ensures stability and allows you to reduce debt quickly. Many of the most successful people aggressively avoid lifestyle inflation.

Things to Learn

Having a high income doesn’t guarantee financial income; Chris’s story reminds us of that. Ramsey’s advice boils down to a few principles:

- Attack debt with urgency, especially high-interest loans

- Live below your means, even during times of prosperity

- Build wealth on purpose

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.