Personal Finance

Apple CEO Tim Cook says that owning Crypto is part of a diversified portfolio and I'm not sure I agree with him

Published:

Last Updated:

24/7 Wall St. Key Points:

There are a lot of arguments about what exactly a “diversified portfolio” means. I recently came across a Reddit post in the r/fatFIRE community that highlighted a thought-provoking statement by Apple CEO Tim Cook. In an interview with The New York Times, Cook revealed that he has personally invested in cryptocurrency for “a while” and considers it “reasonable to own crypto as part of a diversified portfolio.”

For a forum often focused on traditional investment approaches like index funds and bonds, this sparked an interesting debate: Should this shift perspectives on crypto investments?

Let’s explore some of my opinions on this topic, especially for those pursuing financial freedom.

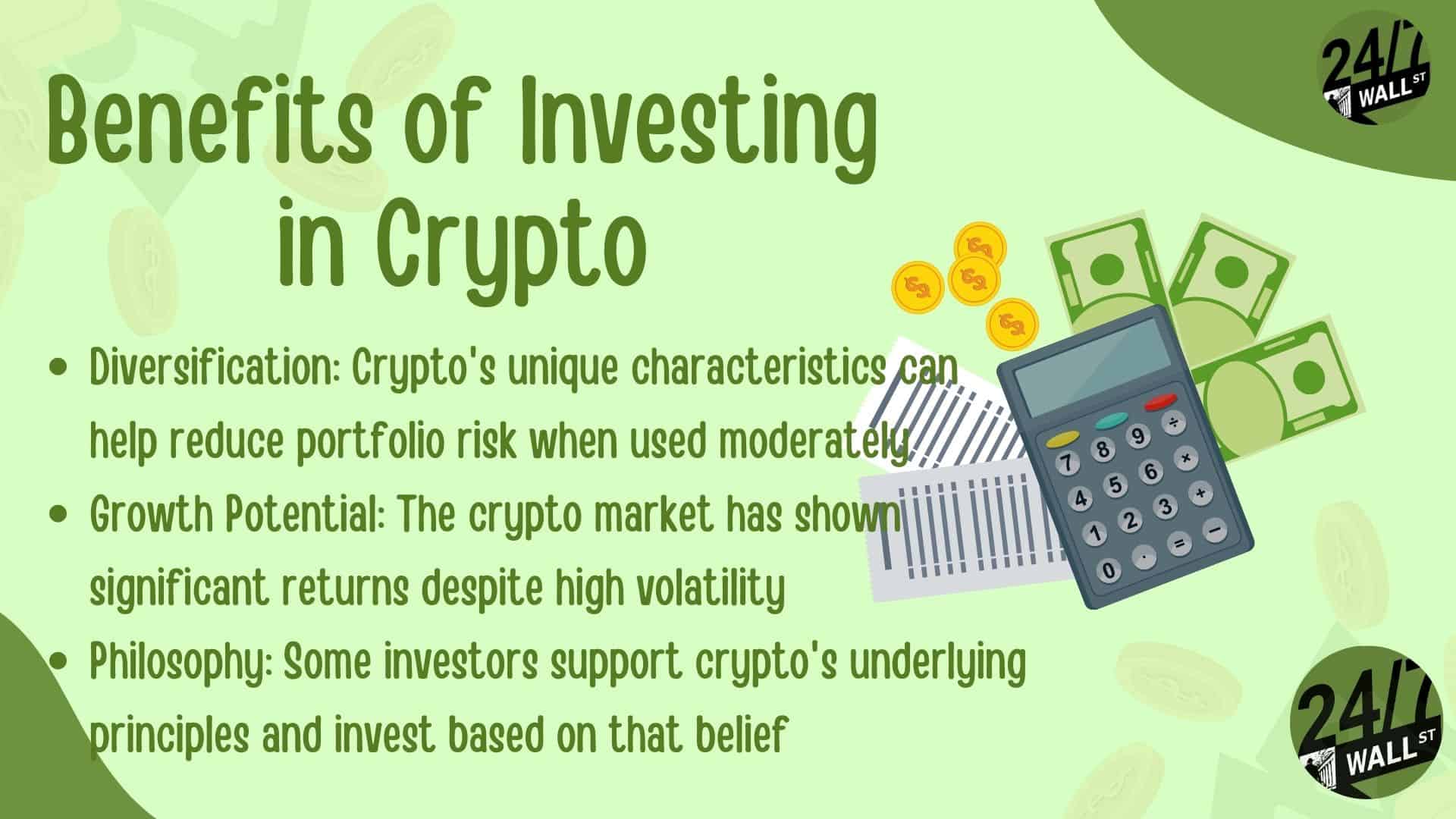

So, let’s look at what exactly crypto can bring to a portfolio. There are many reasons why investors recommend crypto, such as:

However, crypto is highly speculative. Its value can fluctuate dramatically, even though we expect it to rise. However, this assumes you’re using crypto as part of a balanced portfolio, not just investing in crypto. When used to diversify a portfolio, it is used very sparingly.

The Reddit post raises a key question: For those sticking to low-risk investments, does this news prompt a reconsideration of risk tolerance? The answer depends on your financial goals, timeline, and comfort with volatility.

Cypto is very high-risk, akin to high-growth stocks. Therefore, it should only comprise a small amount of your portfolio, around 1-5%. This approach allows you to use it for diversification while also keeping your portfolio from becoming too volatile.

Yes, you can use crypto as part of a diverse portfolio, but it shouldn’t be a huge portion.

That said, it’s best to work with a financial advisor if you’re worried about using crypto or don’t want to research your own investment options. While Tim Cook’s endorsement might be noteworthy, your financial plan should reflect you, not the portfolio of a billionaire!

Advisors can help assess whether crypto is a good option for you or not.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.