Personal Finance

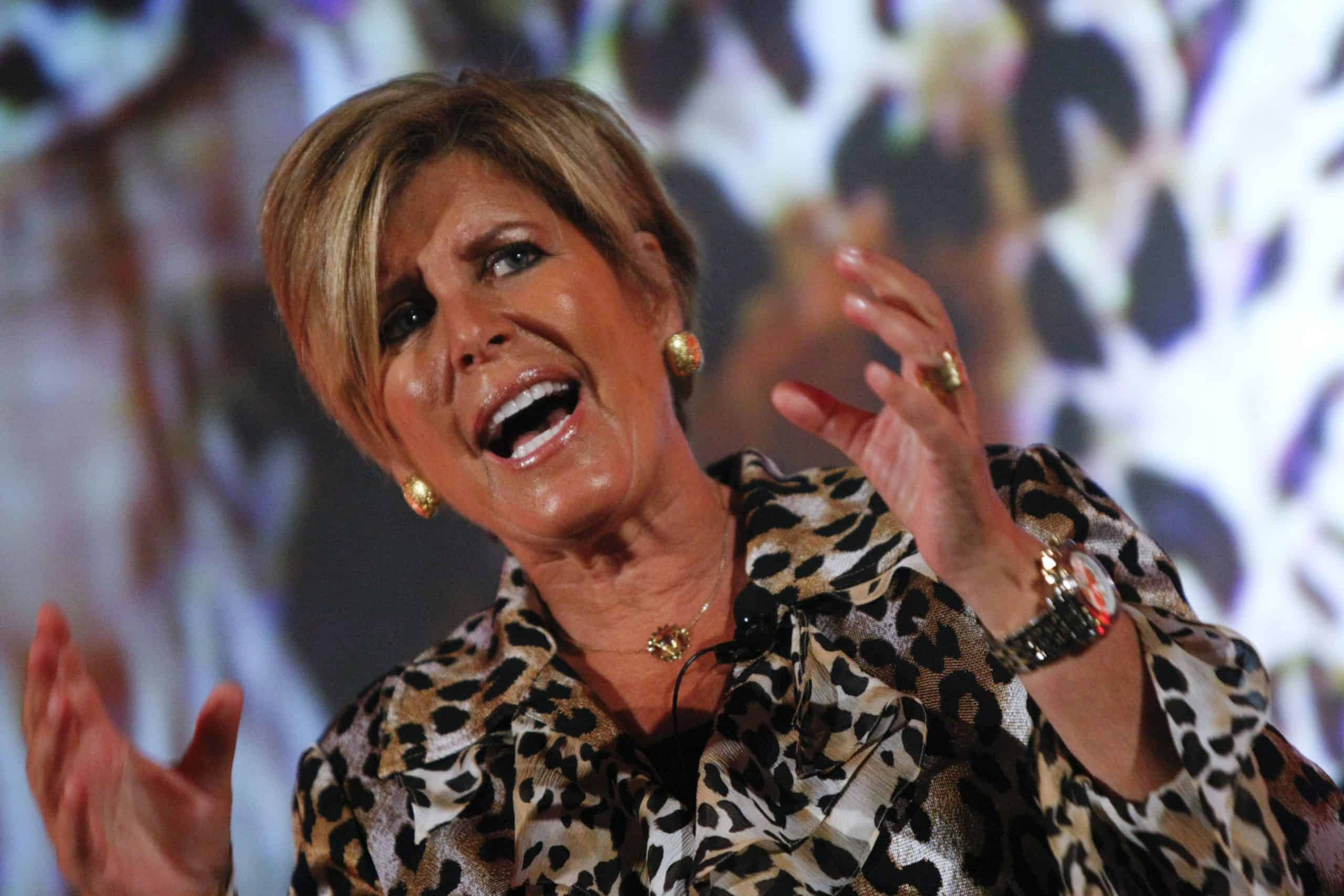

Suze Orman says this is the one expense you must cut in retirement

Published:

For many Americans, retirement often means living on a fixed income.

In fact, according to The National Council on Aging, at the moment, about 40% of retired Americans rely solely on Social Security income to get by. That, they say, averages about $1,913 a month. But in times of economic instability, including sky-high inflation – living on that fixed income can be challenging.

We also have to consider that 20% of Americans have no retirement savings at all.

“Obviously you’re not going to have the kind of retirement that you might have dreamed of, but having any retirement savings is better than having no retirement savings. So, if you reach 50 and you don’t have anything to save, it’s definitely not too late to start and to save whatever you can,” said David John, senior policy adviser at AARP, as quoted by CBS Austin.

For those in an unpleasant situation, one of the expenses you need to cut immediately is going out to eat, says Suze Orman.

“For you to have money, you have to learn to live below your means but within your needs. How do you do that? You do that by simply purchasing needs versus wants. What is a need? Need is food that you buy at a grocery store. What is a want? A want is going out to eat at a restaurant and doing it over and over again.”

Going out to eat contributes to massive credit card debt, too, which can weigh on you in retirement. Most people don’t realize how much money they spend by heading to the drive-through or going out to a fancy restaurant once in a while. Some of us, including me, stop by Dunkin every morning and spend about $20 on coffee and a hot bagel, which comes out to about $600 a month. People are literally eating themselves into debt.

According to Bankrate.com, “Americans say they’re willing to go into debt for the sake of experiences this year. Nearly 2 in 5 (38 percent) U.S. adults are willing to go into debt to travel, dine out, or see live entertainment, according to our Discretionary Spending Survey. The highest percentage of people would be willing to take on debt to travel, at 27 percent, followed by dining out (14 percent) and live entertainment (13 percent).”

Again, though, if you’re retiring, thinking about retiring, or are already retired and living on a tight budget, stop going out to eat so much.

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.