Personal Finance

I'm 47 and make $140k a year - am I crazy to think I shouldn't be paying for my kids college and potentially get myself into debt trying to?

Published:

Last Updated:

The cost of a college education is absurd. The amount of debt students are saddled with is the result of overly abundant government grants and loans. It is the law of supply and demand and is known as the passthrough rate.

According to the Federal Reserve Bank of New York, for every $1 increase in the maximum amount of federally subsidized student loans, college tuition rises $0.60.

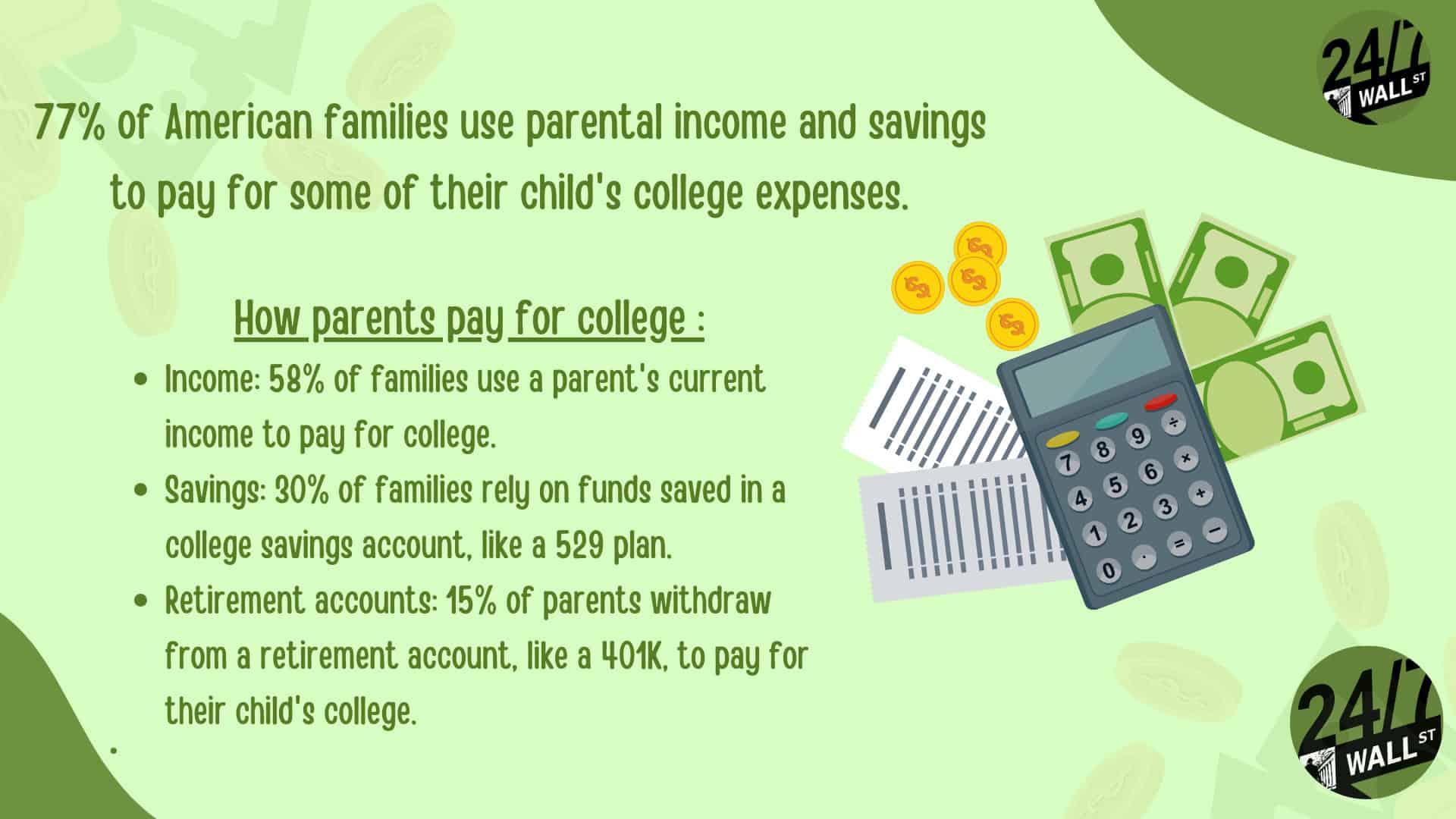

Today, Americans owe $1.7 trillion in federal and private student loan debt, a heavy load that saps the financial security of students and parents alike. Some parents now question whether they should, or can even afford to pay for a child’s college education.

The issue was of significant concern to a Redditor on r/DaveRamsey, a board devoted to the teachings of personal finance guru Dave Ramsey. While he didn’t want to undermine his child’s educational opportunities, he also didn’t want to derail his own admittedly difficult financial situation.

While I’m not a financial planner, so this is just my own opinion, the typical financial advice to begin saving for a child’s education when they are born through a 529 college savings plan or similar vehicle is misguided. At the very least it should not come before your own retirement savings account.

If you have not fully maximized every retirement option for yourself, your child’s education savings should be secondary. Parents can no longer afford the luxury of footing the bill for college because it is increasingly a financial burden and detrimental to the child.

The Redditor was divorced, paid alimony, is heavily in debt, and is still trying to gain control of his own finances. Although he wants to provide a bright future for his child, he should have been talking with his child all along about the cost of college. It is crucial to shift the focus from parental funding to individual responsibility and self-reliance.

While there was a lack of preparedness on his part, it does not mean he should be ruined financially because of it.

First, higher education’s astronomical cost places an incredible financial strain on families. Paying for tuition, fees, and living expenses leads to significant debt, impacting both parents’ retirement plans and the child’s future financial stability. This cycle of debt can be avoided by encouraging students to explore options like scholarships, grants, and part-time jobs.

It is also not necessary they attend a private, four-year university. For the vast majority of students, a quality education can be had by attending a local community college. Not only is tuition cheaper, but room and board expenses can be eliminated. The difference in cost offers the student the opportunity to save for their own retirement sooner, unburdened by years of grinding debt.

Second, relying upon parents can create a sense of entitlement in the child. They may not be as motivated to work hard academically or explore career options better aligned to their interests and skills. Poor choices in college, classes taken, and degrees pursued can result, along with a lack of appreciation for the value of hard work and financial responsibility.

Instead of simply relying on parental support, children should be encouraged to pursue paths that foster independence and self-sufficiency. This includes vocational training, apprenticeships, or even starting their own business. They offer proven, valuable skills and practical experience that prepare them for a successful career and financial security.

Ultimately, investing in a child’s future means allowing them to become responsible, self-sufficient individuals. They should take ownership of their education, explore diverse career paths, and develop the skills necessary to thrive in a competitive job market.

Parents should discuss early on the cost of college and avoiding crushing debt to create a sense of responsibility and independence. Their child can build a brighter future for themselves, while not being burdened by debt and end up being free from entitlement.

It’s not a popular opinion, but a child who learns a trade or skill will be better off financially later on. And parents should not feel guilt or allow themselves to be guilted into shouldering the cost.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.