Personal Finance

My employer offers an incredibly generous 401(k) match but I don't want to wait until 60 to spend my money - is there another way?

Published:

Last Updated:

It’s not every day you get a 401(k) with a 100% employer match, but that’s exactly the situation I ran across in a recent Reddit post. While the 22-year-old poster was eager to take advantage of the match, they were very hesitant about locking thick money away until retirement.

Their dilemma? How to save for long-term goals like retirement while also keeping some money accessible for other big milestones, such as buying a house.

This is an issue I run into all the time with young professionals. They’re trying to balance retirement savings and shorter-term financial goals. Luckily, they can do both effectively.

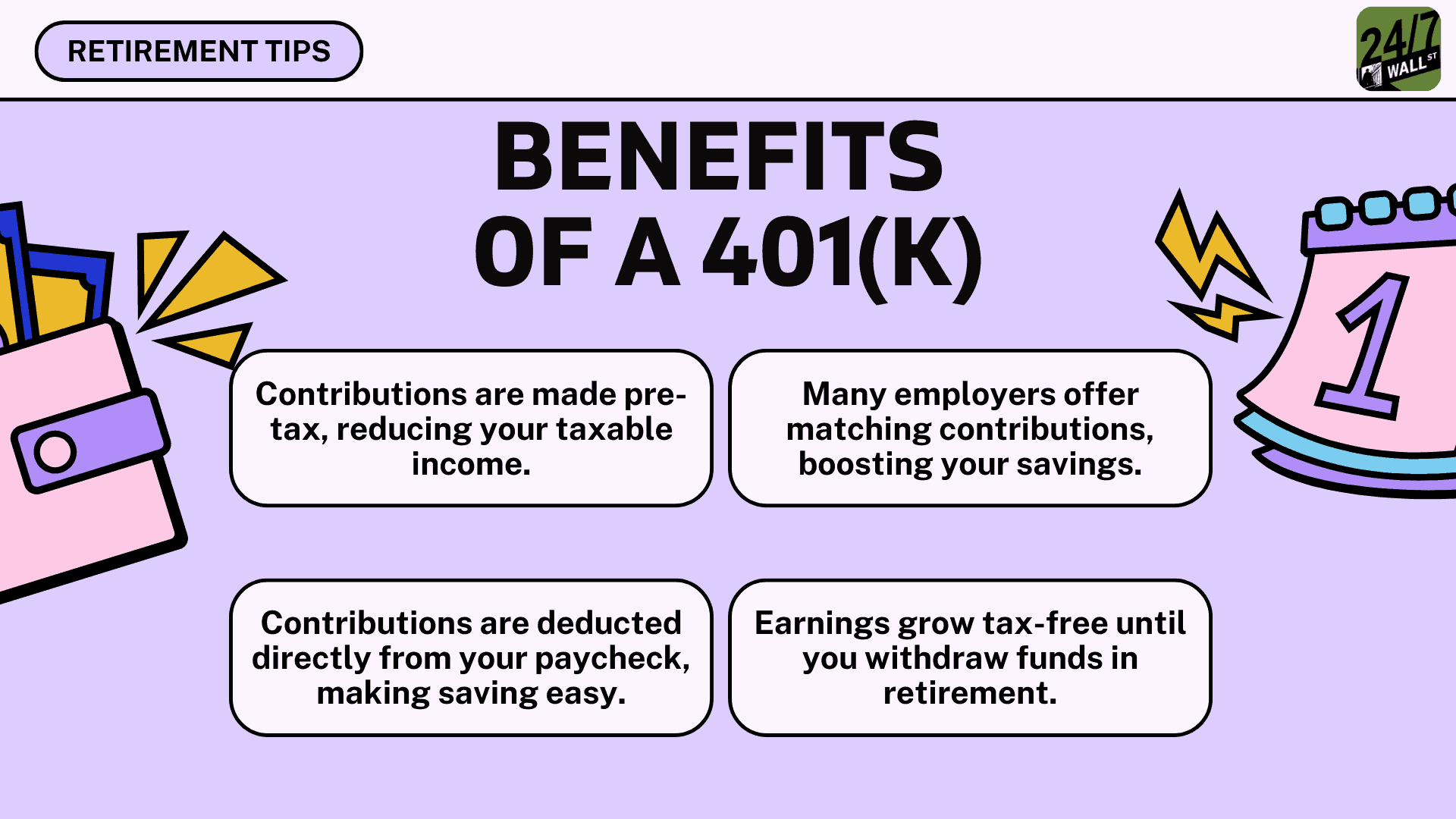

First, let’s examine why I absolutely recommend that this Redditor take full advantage of the 100% match. A 100% 401(k) match is essentially free money. For every dollar this user puts into their 401(k), their employer will contribute another dollar. This can dramatically grow their retirement savings over time, thanks to compound interest.

Yes, they cannot receive this money until they’re 60. However, it’s unwise to pass up what’s basically free money!

The Redditor reports that they prefer their Roth IRA because they can withdraw from it. Roth IRAs are fantastic for young savers because the money grows tax-free, and unlike traditional 401(k) accounts, you can withdraw your contributions (but not earnings) at any time without penalty.

This does allow some flexibility. However, I wouldn’t plan on withdrawing from a Roth IRA habit. It’s best to let retirement stay retirement.

So, how should they balance contributing to both a 401(k) and a Roth IRA while also hitting other financial milestones? Here’s what I’d recommend:

I’d recommend the Redditor go with their instinct to invest in their 401(k) and another account for other goals. Here’s why:

Remember, this is just my opinion, not financial advice!

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.