Personal Finance

My employer offers an incredibly generous 401(k) match but I don't want to wait until 60 to spend my money - is there another way?

Published:

Last Updated:

It’s not every day you get a 401(k) with a 100% employer match, but that’s exactly the situation I ran across in a recent Reddit post. While the 22-year-old poster was eager to take advantage of the match, they were very hesitant about locking thick money away until retirement.

Their dilemma? How to save for long-term goals like retirement while also keeping some money accessible for other big milestones, such as buying a house.

This is an issue I run into all the time with young professionals. They’re trying to balance retirement savings and shorter-term financial goals. Luckily, they can do both effectively.

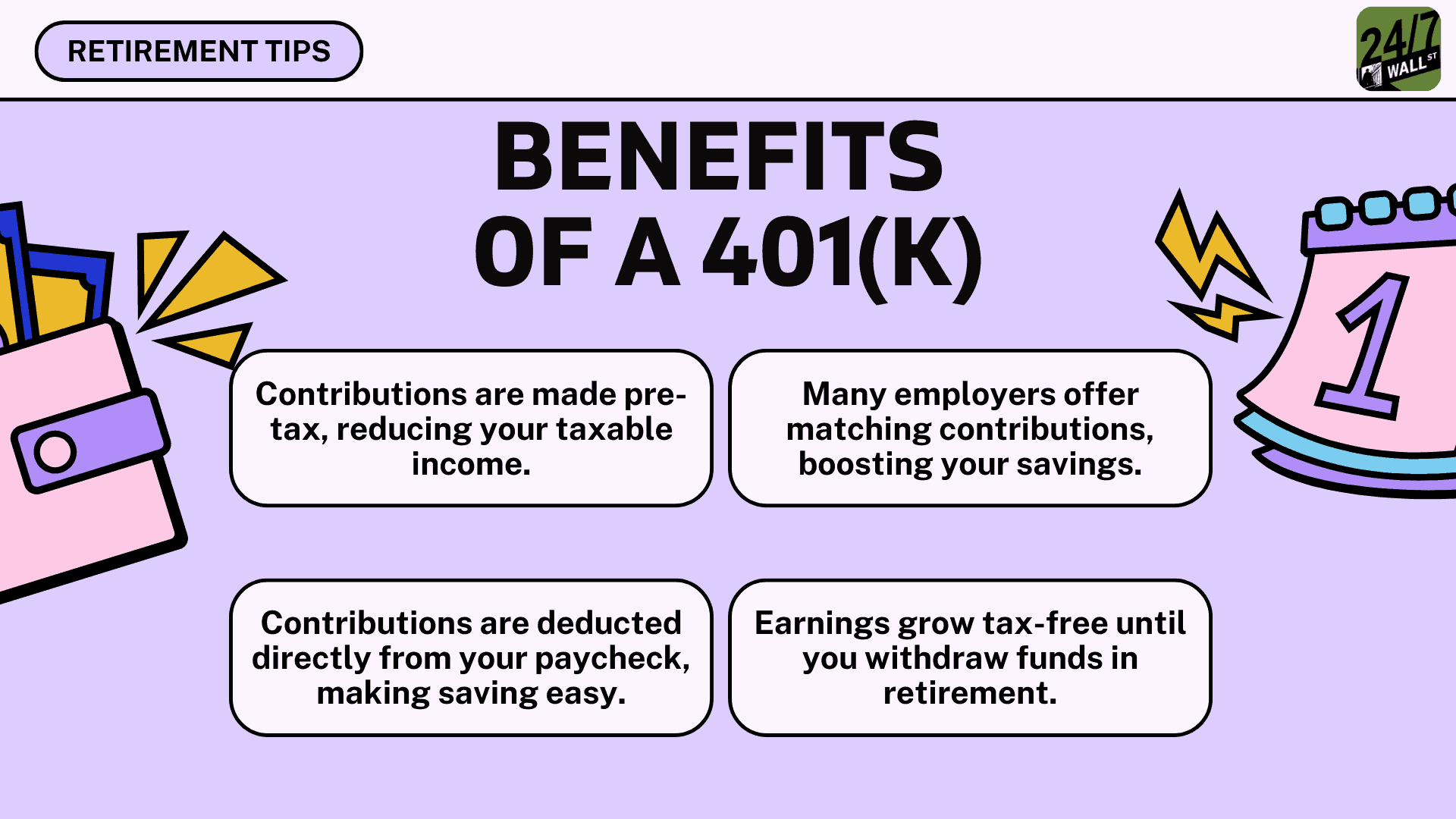

First, let’s examine why I absolutely recommend that this Redditor take full advantage of the 100% match. A 100% 401(k) match is essentially free money. For every dollar this user puts into their 401(k), their employer will contribute another dollar. This can dramatically grow their retirement savings over time, thanks to compound interest.

Yes, they cannot receive this money until they’re 60. However, it’s unwise to pass up what’s basically free money!

The Redditor reports that they prefer their Roth IRA because they can withdraw from it. Roth IRAs are fantastic for young savers because the money grows tax-free, and unlike traditional 401(k) accounts, you can withdraw your contributions (but not earnings) at any time without penalty.

This does allow some flexibility. However, I wouldn’t plan on withdrawing from a Roth IRA habit. It’s best to let retirement stay retirement.

So, how should they balance contributing to both a 401(k) and a Roth IRA while also hitting other financial milestones? Here’s what I’d recommend:

I’d recommend the Redditor go with their instinct to invest in their 401(k) and another account for other goals. Here’s why:

Remember, this is just my opinion, not financial advice!

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.