Personal Finance

3 Pieces of Dave Ramsey Advice That Are Worth Living By

Published:

Last Updated:

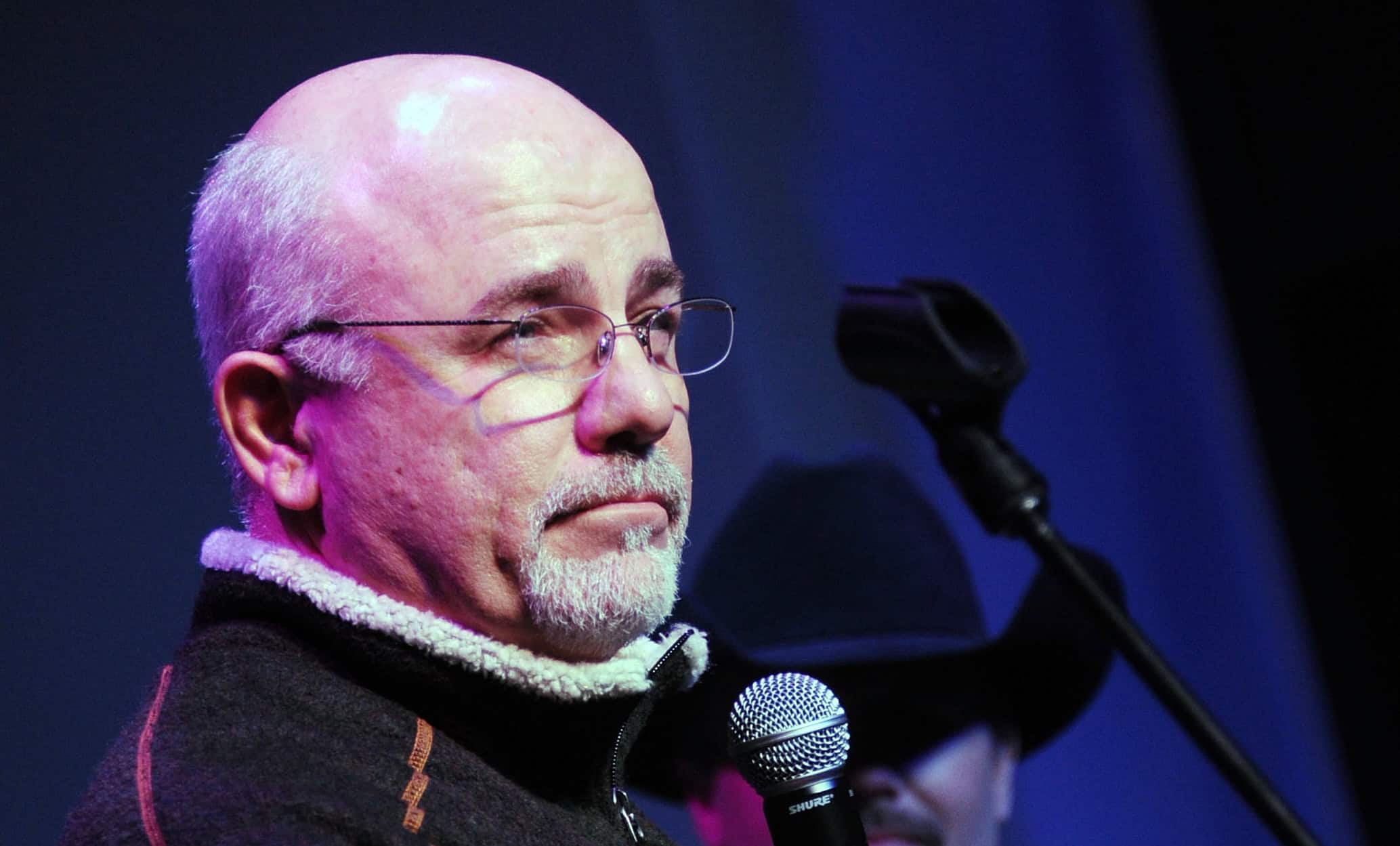

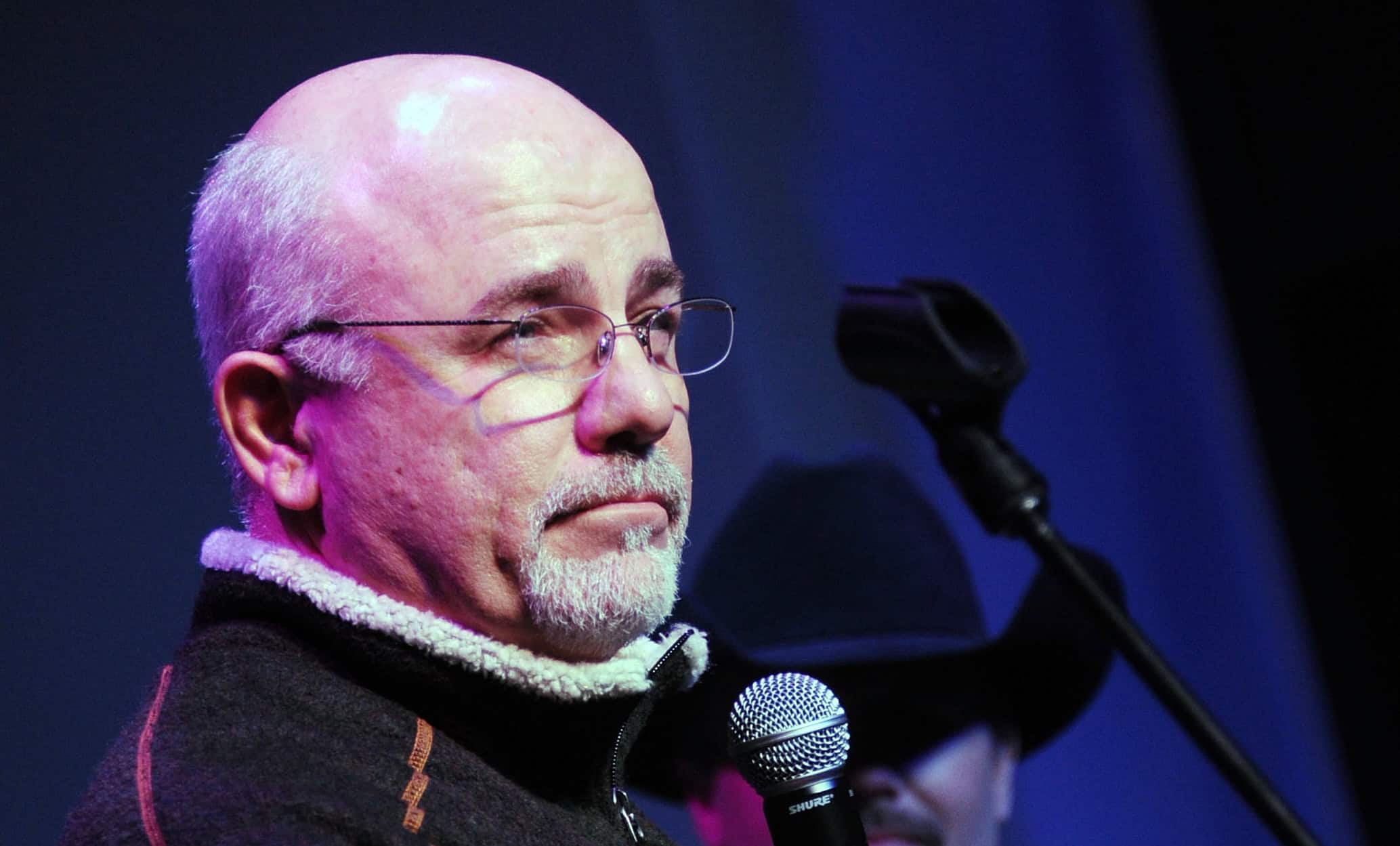

Dave Ramsey is a renowned personal finance expert and is certainly a divisive name in the world of personal finance. There are plenty of other experts on the subject matter who wholeheartedly disagree with many of Ramsey’s talking points, which are typically aimed at those who are in pretty dire financial straits.

I will say one thing – I have to agree on Dave Ramsey on one important tenet – investing and debt is as much a psychological game as it is a mathematical or logical one. Those who may have gotten themselves into some hot water with loans they likely shouldn’t have taken on or bankruptcy situations, etc. may have more of a thought process problem as a money problem. Much of his advice appears to be tailored to such individuals, and does seem to be worth considering for those looking for a way out of their debt problems.

Ramsey founded Ramsey Solutions in 1992 and has been a leading voice in the personal finance industry, focusing on providing practical financial advice to his readers and listeners of his podcast and radio show. Like him or not, I do think Ramsey has some useful nuggets of wisdom worth considering. Let’s dive into three of his top pieces of advice I think readers should consider living by.

Dave Ramsey’s debt snowball method stands out for its unique focus on behavioral motivation rather than just mathematical efficiency. Unlike the more traditional “debt avalanche” method, which involves paying down one’s highest-interest debt first (and is the method most personal finance experts and financial planners suggest), this method focuses on creating big wins. Essentially, using the debt snowball method, one pays off the smallest balances first, allowing for more cash flow to be put to work toward the next highest balance, and so on. By doing so, individuals can experience the positive psychological effects of having debts be paid off rather rapidly, increasing the likelihood that those on this process will continue to the very end.

Now, I’d have to say that in the case of an individual with two debts which are very similar in size (one is slightly larger but with a much higher interest rate), I’d have to disagree with Dave Ramsey here. But his logic – using the excess cash flow to make larger payments each month moving forward – makes sense, for those who are willing to continue with the process. We all need little wins here and there, and this method helps indebted individuals achieve that. I don’t think there’s anything wrong with fueling one’s motivation with a vision of a debt-free tomorrow, and that’s what Ramsey appears to be after with his ardent support for this debt pay down methodology.

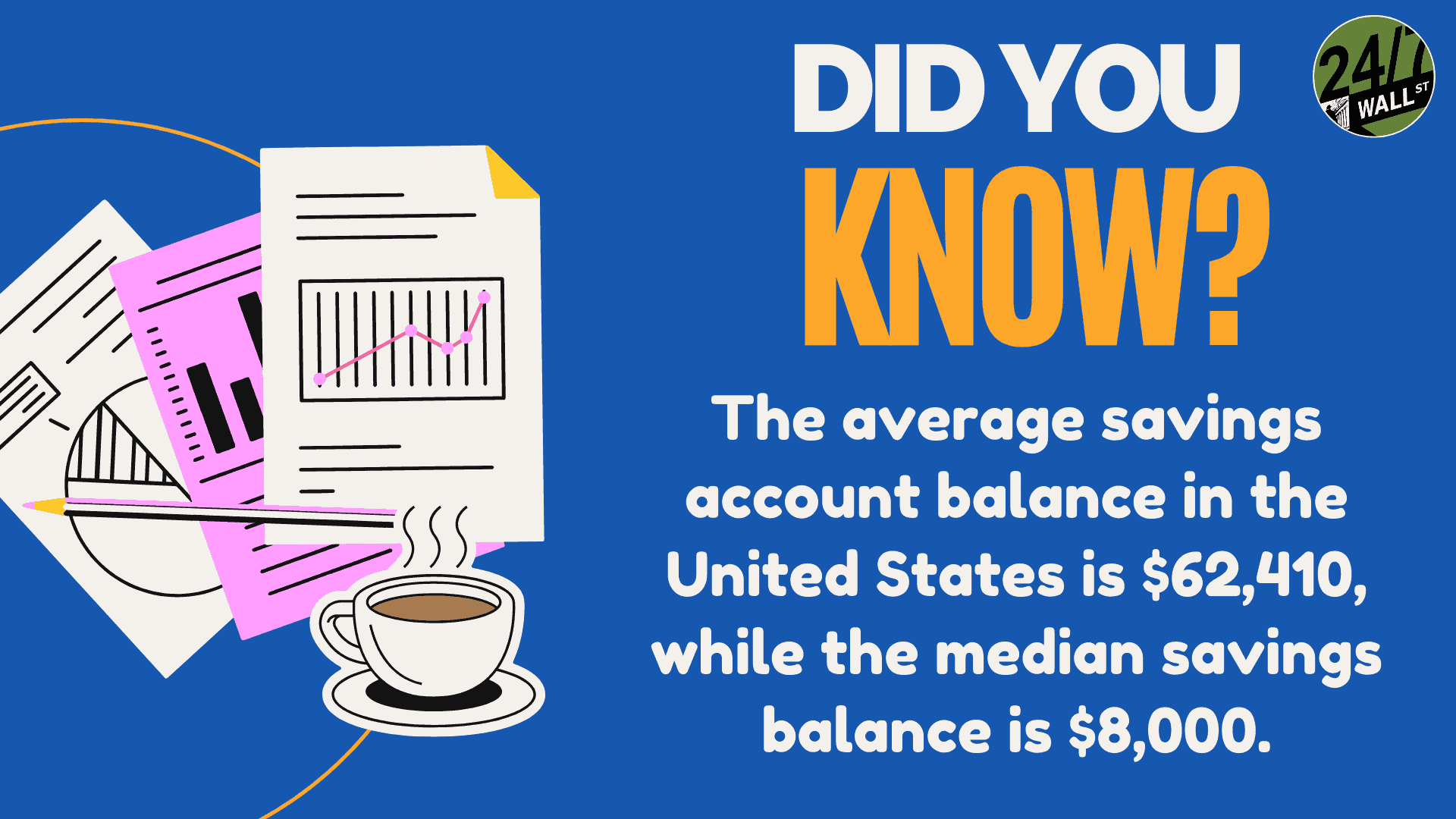

Even before beginning to pay down debt (and I probably should have led with this, but I do think the debt snowball method is his most prominent piece of advice so it went first), Dave Ramsey has continually harped on the idea that those looking to pay down their debts should have at least $1,000 set aside specifically for unexpected expenses. By setting up an emergency fund, those looking to start the debt repayment process won’t likely be forced back into debt to pay some sort of unexpected charge (say, a tire blows out, or a plumber needs to be called).

This small amount of money that’s set aside can handle most minor expenses, acting as a buffer that can protect individuals from financial derailment when life (inevitably) throws us curveballs. Also, having $1,000 set aside builds the savings muscle from the start, allowing those paying down debt to realize that they have the potential to set something aside for a rainy day (even when it seem impossible).

I think this is important for any individual or couple, and would wholeheartedly agree that this is a great piece of advice. One has to start building a foundation somewhere, and this is a solid place to start in my books.

Finally, we get to the big piece of advice that’s probably the hardest to live by. It’s one of those “do as I say, not as I do” type of ordeals, because so many of us have trouble with putting this piece of wisdom into practice on a consistent basis.

The idea that one should live within their means is really foundational to personal finance, but it’s underscored again and again by Dave Ramsey in his talks and in his various media appearances. His view is that too many people simply have a “keep up with the Joneses” mentality which leads to the problems in their life. Simply avoiding this common pitfall can stop many from ending up in piles of debt to begin with, but we’re in a consumer-driven economy, and the reality is clearly different than the ideal. That’s why Ramsey has the audience he does.

Comparison is the thief of joy, as they say, but it’s also the thief of one’s financial future according to Dave Ramsey. In order to stick with his debt reduction plan and create wealth that can be used for any purpose (generosity encouraged) in one’s old age, getting this piece of advice right as young as possible is key. I agree.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.