Personal Finance

3 Social Security 'Gotchas' That Could Upend Your Retirement

Published:

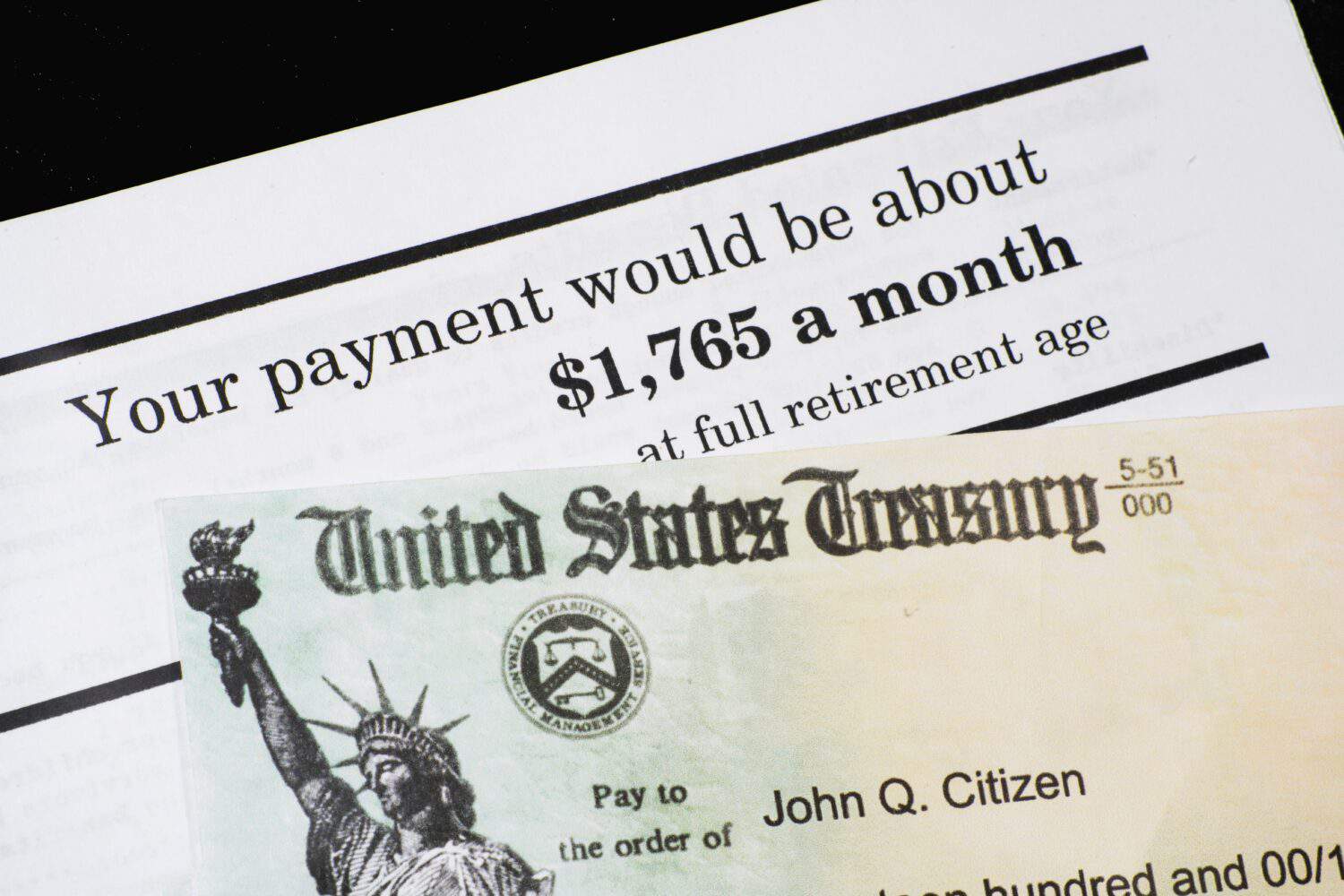

One of the most important decisions you might make as a retiree is filing for Social Security. You get what’s generally considered an eight-year window to sign up for benefits that begins when you turn 62 and ends when you turn 70 (though technically, you can file after age 70 — it’s just that it makes no financial sense to delay your claim beyond that point).

If you expect Social Security to be a big income source for you in retirement, then you’ll clearly put a lot of thought into your filing decision. But here are a few “gotchas” that may come back to bite you.

Key Points from 24/7 Wall St.

You’re eligible for your complete monthly Social Security benefit at full retirement age (FRA), which is 67 for folks born in 1960 or any year after. But as mentioned earlier, you can file as early as 62.

You may be inclined to move over to part-time work once you’re eligible for Social Security and supplement the missing portion of your paycheck by claiming benefits. But if you work while collecting Social Security before reaching FRA, you’ll be limited in what you can earn before you risk having some of your benefits withheld.

In 2024, the earnings-test limit for Social Security is $22,320, and it’s rising to $23,400 in 2025. Beyond that point, $1 in benefits is withheld per $2 of earnings.

If you haven’t reached FRA yet in 2024 but will by the end of the year, your earnings-test limit is $59,520, rising to $62,160. From there, $1 in benefits is withheld per $3 of earnings.

You may want to aim to keep your income at or below whichever threshold applies to you to avoid having some of your Social Security withheld — especially if you’ve already slashed your benefits for life by claiming them early.

Typically, claiming Social Security before FRA means reducing your monthly benefits for life. But there’s a workaround if you regret an early filing.

Social Security gives all recipients one lifetime do-over. So if you file for benefits before FRA and end up unhappy with your monthly paycheck, you could undo your claim and file again later on.

But there’s a catch. You only get one year to undo your Social Security filing, and you need to repay every dollar in benefits you received to be able to sign up again later on. If you’ve already spent that money, you be stuck with your early filing — and the reduced monthly benefit that comes with it.

There’s an upside to delaying Social Security past FRA. For each year you do, your benefits grow 8%, up until age 70.

You may be inclined to put off your claim as long as possible to snag the maximum monthly benefit you can. But in doing so, you might end up dipping into your savings too heavily and withdrawing too large a chunk of your balance.

It’s one thing to delay Social Security and work until you’re ready to take benefits. But be careful if you’ll be delaying Social Security but retiring a few years prior to signing up. If you’re forced to take too much money out of your savings, you could put yourself at risk of eventually running out.

Now the good news in that scenario is that you’ll have larger Social Security checks to compensate. But it’s still not a great thing to deplete your nest egg in your lifetime.

All told, it’s important to study Social Security’s rules carefully. The more you know, the less likely you are to have one of these “gotchas” hurt your retirement finances.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.