Personal Finance

My wife just lost her six-figure-paying job - will my salary and our $2 million in savings be enough for us to get by?

Published:

Last Updated:

Navigating a sudden layoff is never easy, even in a dual-income household! Recently, a Redditor on the r/ChubbyFIRE subreddit shared their concerns after their spouse lost her job following months of uncertainty.

With their income halved and significant expenses, they’re worried about childcare, housing, and their long-term financial goals. As they should be!

So, what should they do to mitigate the financial impact of the job loss? And what does this mean for their financial goals? I’ll take a look at all that below. But remember, this is an opinion piece and not financial advice. Working with a financial advisor is exceptionally helpful, especially in these uncertain circumstances.

Right now, the Redditor needs to focus on meeting essential expenses with reduced income. Their income dropped from $377k to $200k. Their monthly expenses are around $13k before tax. Luckily, their current income seems like enough to cover these expenses!

Furthermore, the poster can use their spouse’s severance package to bolster cash reserves. I’d also recommend cutting some discretionary spending, like their $675/month dining-out budget!

Now that their spouse is at home, they have the potential to cut back on some childcare expenses (especially if it doesn’t look like the spouse will find a new job anytime soon). That said, the poster wants to keep their nanny, as they very much love them.

Currently, the nanny costs $4,300/month, which is a significant portion of their income. However, they could still afford the nanny, especially if they reduce spending elsewhere. Alternatively, they could reduce the nanny’s hours or negotiate a temporary pay cut.

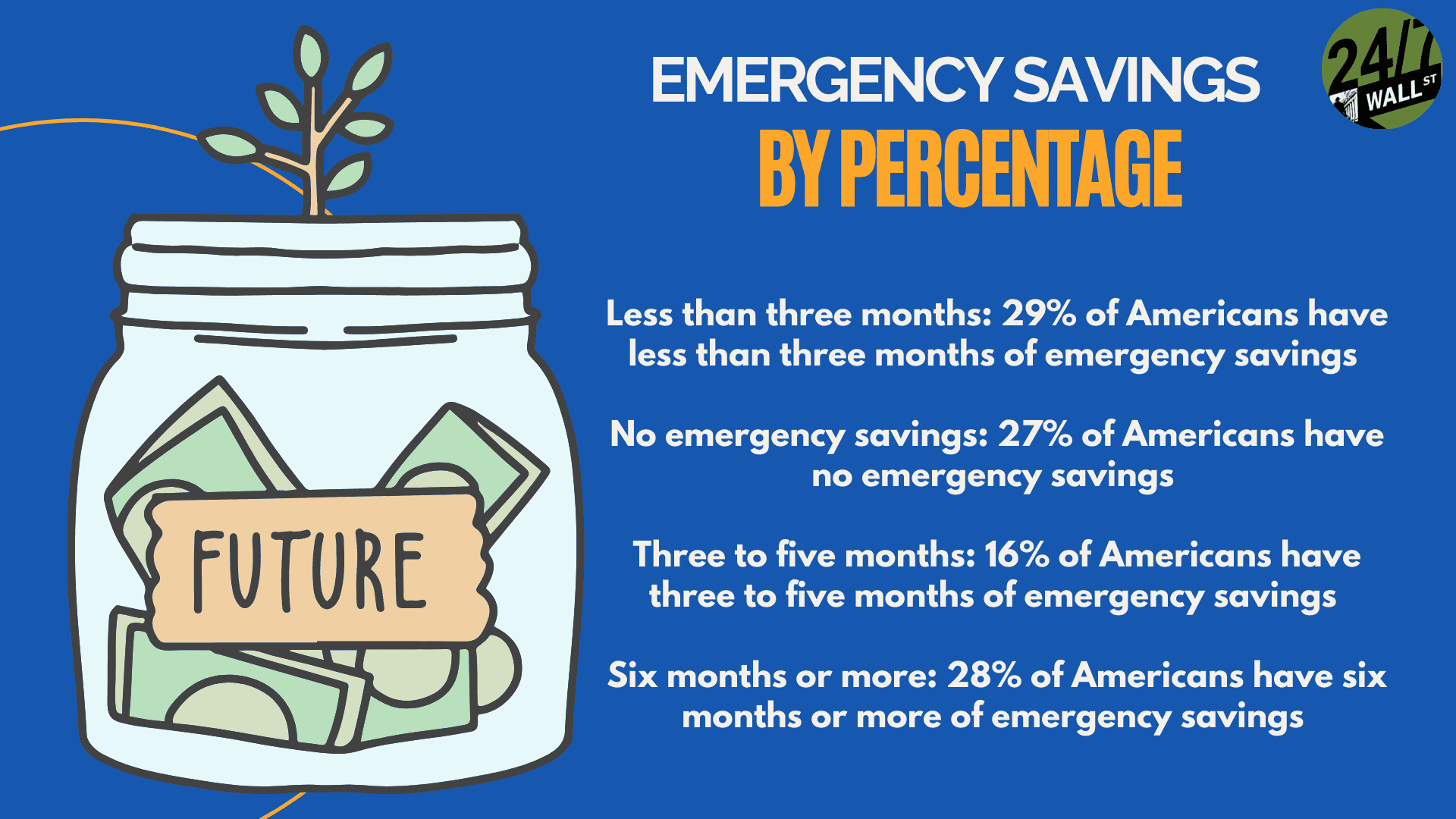

Currently, the poster’s emergency fund is depleted after $30k in unplanned expenses. It’s vital to rebuild this emergency fund right away in case other emergency funds pop up! Consider having as much as eight months of expenses saved.

Luckily, the spouse will likely get some severance pay and unemployment, which can help rebuild cash reserves. I’d also recommend reducing contributions to investment accounts (including retirement accounts) to free up funds.

The poster was aiming to retire within 10 years or so. However, it’s likely that these early retirement plans will be placed on hold temporarily. I’d recommend placing this goal on hold altogether for now and then reevaluating when the spouse is re-employed. This could be tomorrow or a couple of years from now.

I do recommend that they stay invested in all their current assets, though. Compound interest is a powerful thing, but it only works if the money stays invested.

Even if you can technically cover everything on one income, it’s still common to stress about a sudden job loss! It can be hard to stay focused on the positive, like having at least one spouse working. It’s very important to be proactive about managing stress and to keep communication lines open with your spouse.

If the stress becomes serious, consider seeking professional support.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.