Personal Finance

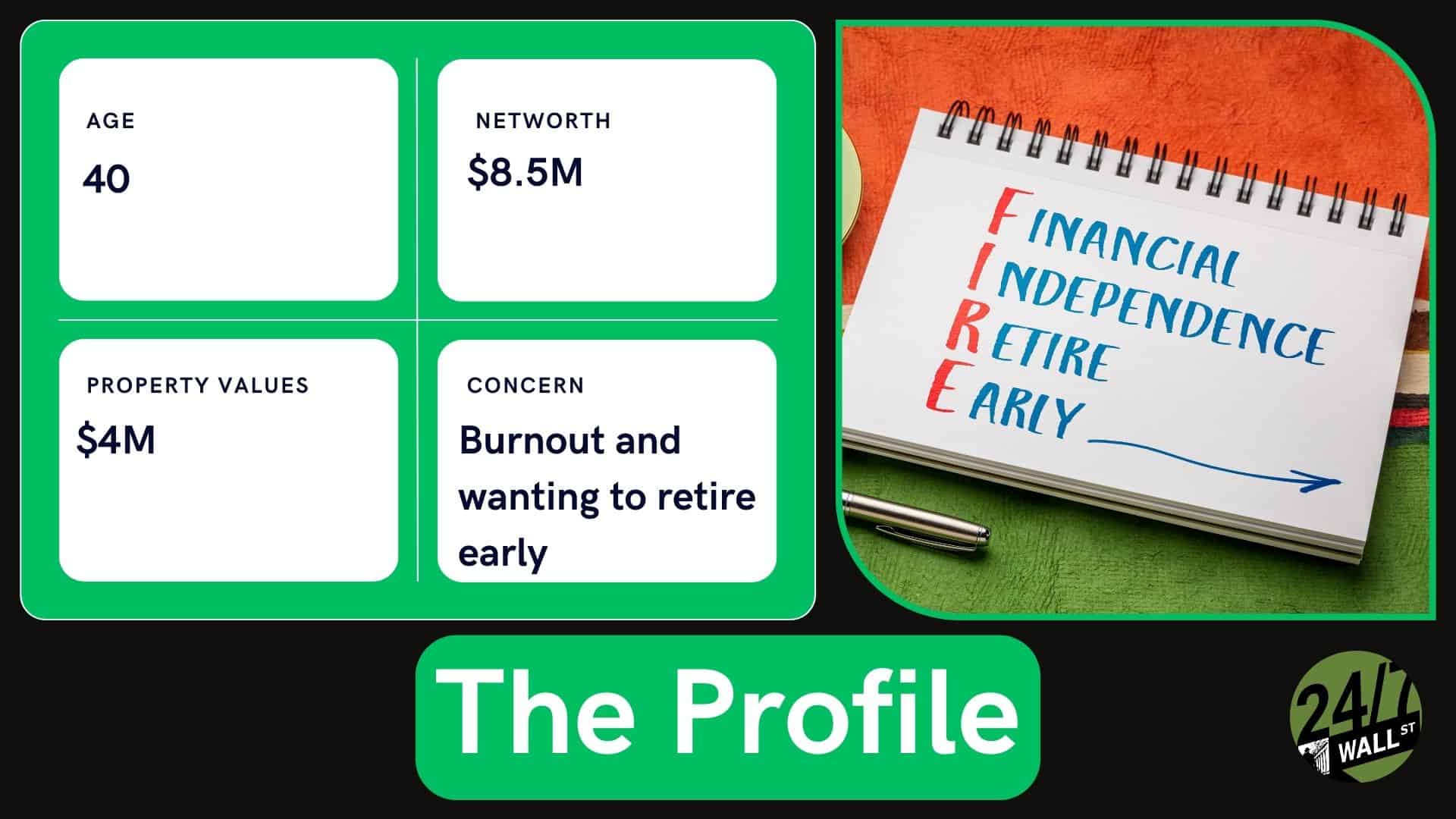

I'm 40 with a net worth of $8.5 million - I feel completely burnt out but family thinks I'm just being lazy

Published:

The modern development of “hustle culture” and working at the expense of every other aspect of our lives is a very modern development and has negatively impacted our society and well-being in ways we are only just beginning to understand.

What do we do when we finally earn “enough” money? Can we ever stop working? Is it immoral to enjoy what you worked for? The perpetual focus on money and work has warped many peoples’ perception of the value and utility of either.

One person, in particular, got extremely lucky with their dedication and has earned millions of dollars and now wants to take time to enjoy it, but those around him disapprove of this decision. They went to the community r/ChubbyFIRE, a group of people dedicated to financial independence and early retirement, to get their advice.

Keep in mind, the information provided here is not legal financial advice, and you should always consult an expert before making any financial decision.

The author of the post in question says they are doing “decently” with a net worth of $8.5 million. This doesn’t include their home.

They have around $7.5 million invested, around half of which is tax-advantaged, $4 million in property, all of which is nearly paid off, and they have a combined income of around $1 million per year. They say they want to retire and stop working altogether once they reach a net worth of $10 million.

The problem, the author says, is his spouse and her family. They all have the mentality that they should always be working as hard as they can and eventually “die at their desks”. His wife is too apprehensive about any inheritance and worried about telling her parents that she doesn’t want to work forever. The author says he would retire immediately if not for her opinions on work that force him to “continue to suffer”.

Eventually, the author asked the community if anyone else had been in a similar situation and what they did about it.

Thankfully, and refreshingly, the overwhelming response to the author’s question was one of confusion and support. Why work so hard for so much money if you’re never going to be able to enjoy it?

Most of the responses included some version of “tell your in-laws to live their own lives, and don’t worry about what they think about you.”

There were many reassuring comments that offered helpful advice to the author who obviously wanted to break free of the rat race but lacked the courage to do so. References to such works as “Die With Zero” and similar life-over-money books, videos, and guides abounded.

Other responses included some more helpful advice. They included some insight into the fact that both people in the relationship obviously really care about money, but for entirely different reasons. The author cares about it as a vehicle for retirement and life fulfillment, while the spouse sees it as validation and a social tool. This is a difference that probably isn’t easily resolved alone, so many commenters recommended getting a family therapist involved. Whatever the underlying issue is, however, it was clear that the author (or the spouse) did not have a plan they were working toward. In order to resolve their differences, they should sit down together and see if they can agree on a retirement plan, first.

In the end, the author has managed to save more money for retirement than most people on the planet will ever see in their lifetime, let alone be able to save for retirement. They would be able to retire for multiple lifetimes, so the issue isn’t the amount of money, but the social status they might lose if they retire early. Unfortunately, the social pressure to work, work, work until you die won’t go away, and it’s up to us to push back and secure some time, life, and joy for ourselves that our bosses and companies can’t take from us.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.