Personal Finance

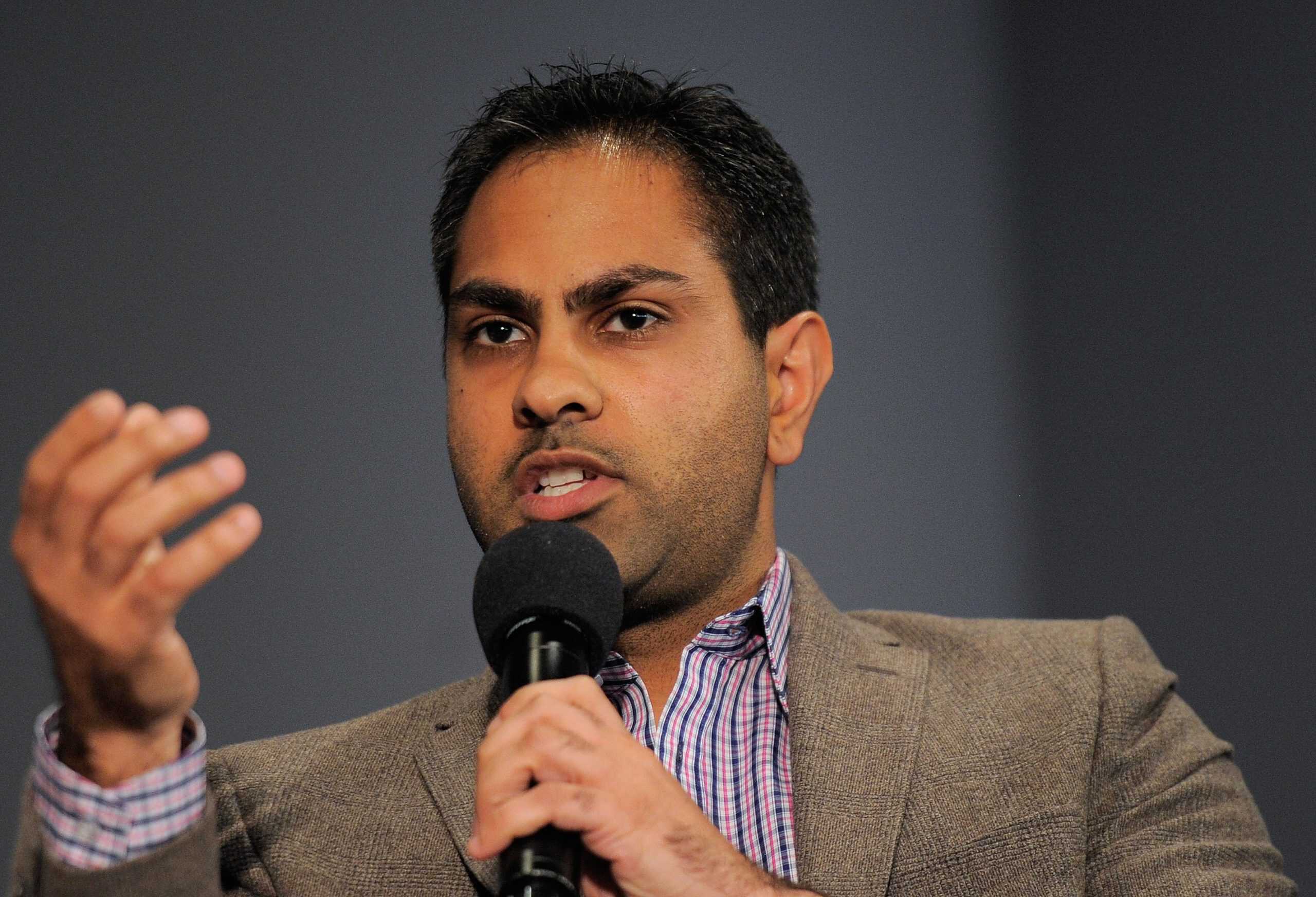

Ramit Sethi Says Doing This Every Year Could be Worth Thousands of Dollars

Published:

Every December, author Ramit Sethi does a “rich life review.”

He’ll look back at the year that passed and plan for the one ahead – something we should all strive to do, as well. All of which involves looking at how much money you brought in for the year, debt, investments, budgets, and goals you met and haven’t met just yet

If you invested 5% of your income in 2024, try to increase it to 6% for 2025. By doing so over the next decade or so, you could increase your investments by thousands of dollars thanks in part to compound interest.

“While 1% is a small percentage of your annual earnings today, after 20 or 30 years it can make a big difference in your account balance when you retire. That’s because the longer you give your money a chance to grow, the better. And it works no matter how old you are—or how far off retirement is,” notes Fidelity.com.

Sethi suggests setting aside a one-year emergency fund.

For many of us, saving a year’s worth of expenses is easier said than done.

If you can’t swing that, start small with an emergency savings goal of at least $1,000. Sure, it’s small but it’s a safety net, and it’s a start. In fact, if you can put away about $85 a month, you’ll reach that goal and have some wiggle room. However, be sure to store this in a separate “don’t touch” account, automatically depositing money every time you’re paid. Plus, if you ever receive another source of income, such as a bonus or a gift, put it directly into that “don’t touch” account instead of spending it immediately.

Know how much money they have coming in and going out, which you can also do by answering key questions. How much do you make? How much do you owe? What percentage of your income is being invested? How much are you saving? What are you spending your money on, and where can you spend less?

Consult with financial advisors. They also diversify their wealth across multiple financial avenues, including high-yield savings, money market accounts, diversified investment portfolios and even real estate in many cases.

Automate your money so it’s automatically shifted into other accounts without having to think about it. They do it with savings, investments and bills. You can do this with direct deposits, automatic credit card payments, expense tracking apps, and bill autopay.

As Sethi once noted on X, “I spend less than one hour/month on my own finances.”

He also suggests setting up a system where 85% of your salary goes into your checking account, while 10% goes into a retirement account. The other 5% can go to an emergency fund or a higher-yield savings account. Then, once you figure out where to put your money, automate it all. Set up auto transfers. Set up an automatic credit card, car, mortgage and tuition payments.

Also known as the Pareto Principle, the 80/20 rule is the idea that 80% of outcomes come from 20% of causes. With it, Sethi advises that you focus more on the most impactful parts of your finances rather than the minor details of your finances.

As he reported on Success.com, “Optimizing your spending can seem overwhelming, but it doesn’t have to be. You can do an 80/20 analysis, which often reveals that 80 percent of what you overspend is used toward only 20 percent of your expenditures. That’s why I prefer to focus on one or two big problem areas and solve those instead of trying to cut 5 percent out of a bunch of smaller areas. Here’s how I do this with my own spending. Over time, I’ve found that most of my expenses are predictable. I spend the same amount on rent every month, roughly the same on my subway pass, and even basically the same monthly amount on gifts.”

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.