Personal Finance

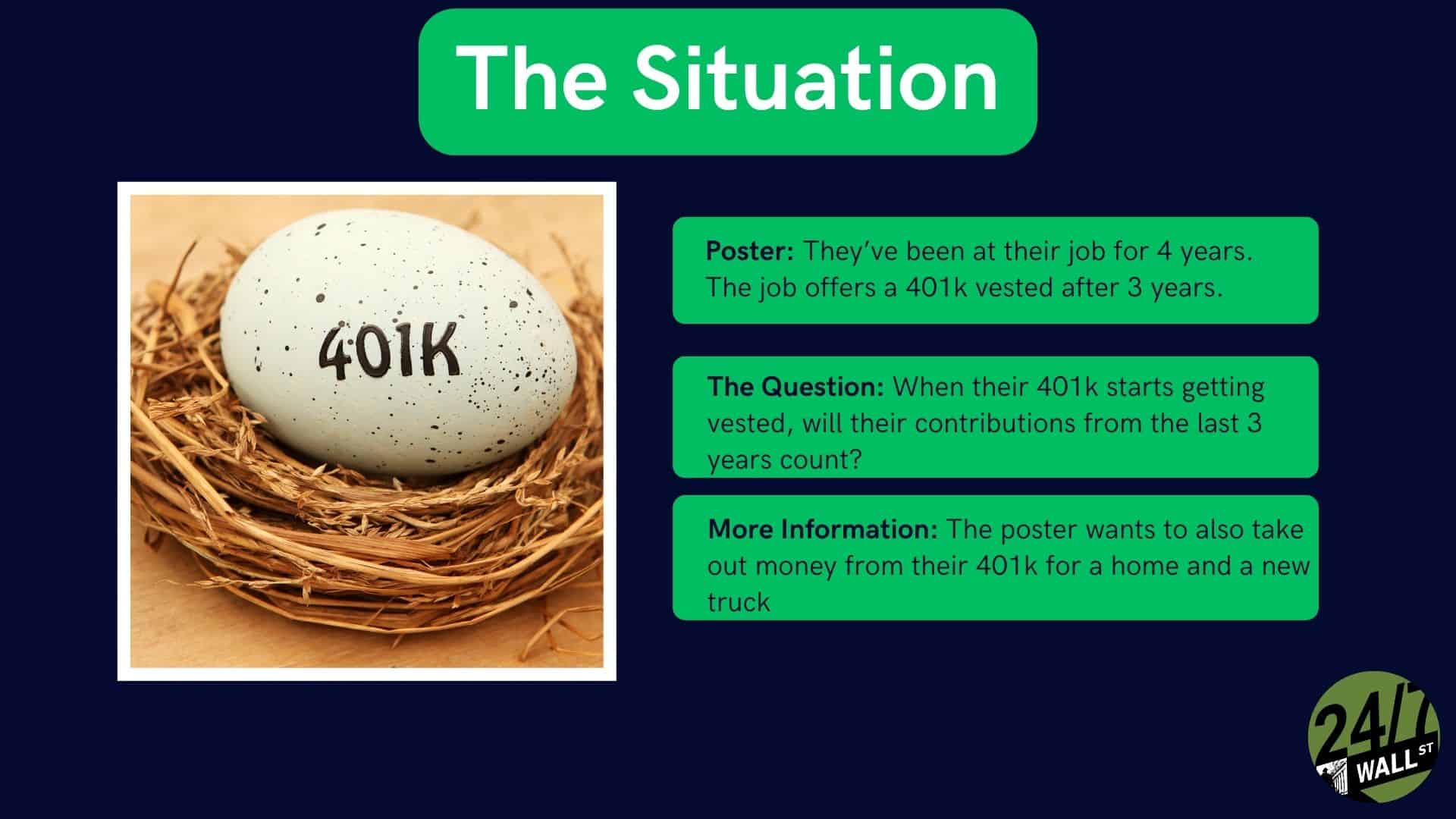

I've been at my job for 4 years and my 401(k) is finally vested — how can I take full advantage?

Published:

Reaching fully vesting in a 401(k) account is a huge milestone when it comes to retirement planning. However, just because you’re fully vested doesn’t mean you can sit back and relax! You may be wondering exactly what this means for your savings, especially if you have other financial goals in mind.

A recent Reddit post I read brought a lot of this to the full front. Even though 401(k) vesting is extremely important, it isn’t something that’s widely understood!

Vesting refers to the amount of time you need to work at a company before you gain full ownership of the employer’s contributions to your 401(k). When you reach fully vested status, you own both your contributions and your employer’s match whenever you leave the company.

Employers usually have a vesting schedule, which could range from right away to several years. In this poster’s case, it was four years. At this point, everything in their 401(k) belongs to them.

When you become fully vested, there are a few things to keep in mind. The employer’s contributions are typically matched on a per-paycheck basis. So, while you now fully own the match from past contributions, each paycheck’s match will continue to be contributed to your 401(k), and you’ll own them immediately moving forward.

You don’t have to wait for each contribution to become “fully vested.” It’s a one-time event. You also don’t get a sudden influx of cash into your account. Past matches would have already been added; you just now fully “own” them.

Whenever you become fully vested, it won’t change much in regard to your retirement strategy. You may be able to relax a bit knowing that those contributions are there to stay, though. We still recommend contributing to take advantage of employer matches.

Now that you’re fully vested, it’s important to take full advantage of your 401(k). We recommend:

Once those funds are fully vested, you may be tempted to pull money from your 401(k) to pay for other expenses. However, this isn’t recommended. Pulling from your 401(k) early results in penalties and taxes. However, there are exceptions, such as first-time homebuyer withdrawals (up to $10,000) or a loan from your 401(k) if your plan allows it.

We still don’t recommend 401(k) loans. There are tons of downsides to these loans. For instance, if you leave your job (even to no fault of your own), you’ll typically be required to pay back the full loan quickly.

Withdrawing money from your 401(k) also impacts your ability to retire, as that money will no longer be gaining interest.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.