Personal Finance

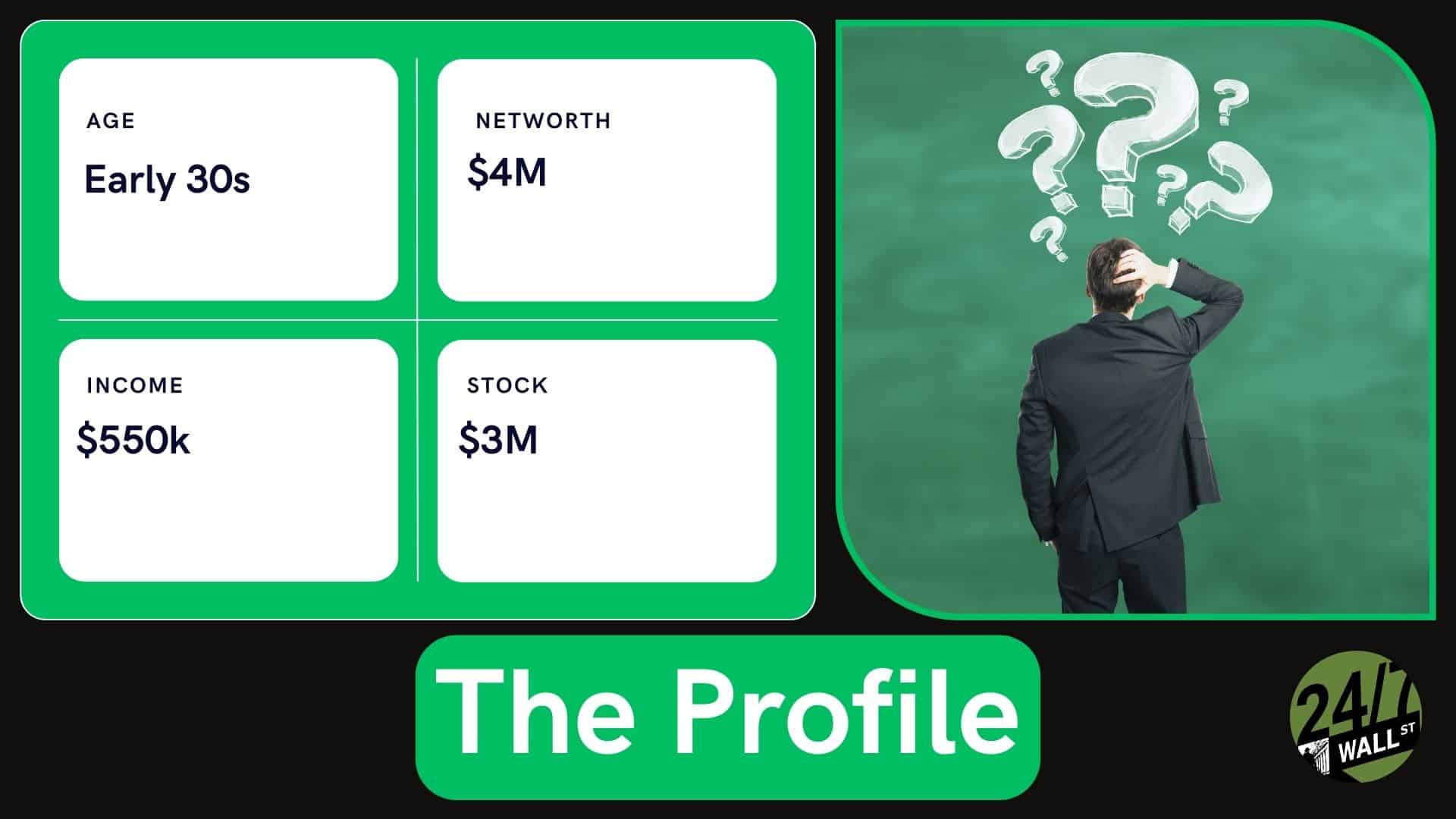

Early 30s with $4 million — should I invest more in stocks or real estate?

Published:

It’s a very impressive feat to have $2 million by the time you’re in your 60s, let alone having $4 million in your 30s. Undoubtedly, this fortunate financial situation is a reality for this individual posting on the r/fatFIRE subreddit who’s searching for investment advice from other like-minded overachievers who’ve embraced the movement known as FIRE (financial independence, retire early).

Notably, fat FIRE is the highest tier of all early retirements, allowing one enough financial flexibility to travel, spend more freely on discretionary (or even luxury) goods, spoil friends or family, or donate significant sums to their favorite causes. Getting your retirement savings in a place to achieve lean FIRE (one that entails a stricter monthly budget) is impressive. However, getting to fat FIRE is beyond impressive.

Indeed, spending a bit too much time on the r/fatFIRE subreddit is enough to make just about any lurker envious. In the case of this 30-something with $4 million banked, they’ve got extreme financial flexibility along with time on their side. And given they’re looking to put more money to work for them in the investment world, it sounds like they’re not about to blow the sum on any form of extravagance as some folks entering early retirement may be inclined to do.

The 30-something Redditor is wondering if they should invest in stocks or real estate. It’s an age-old dilemma for investors. Unless you get lucky in the real estate world, it’s tough to top the potential returns offered by equities. And given the maintenance costs, property taxes, mortgage interest, and all the sort property investing entails, I’d argue that becoming a lazy landlord in retirement isn’t all it’s made to be.

Further, given the age of the individual, they have a pretty long-term investment horizon that would allow them to stay invested through the worst of economic conditions. That means being able to ride out those market crashes without having to panic sell at the worst possible moments. If the Reddit poster is comfortable with buying more shares of wonderful companies (at sound valuations), I would skew towards stocks over real estate, especially since they noted they already have $1 million tied up in real estate.

Of course, the person already has a considerable stock portfolio that’s worth close to $3 million. While I do like stocks over most real estate, I do believe that having some cash on hand isn’t all too bad of an idea. If a crash does finally hit this market, you’re going to need some capital to go shopping for any potential bargains.

There’s a high opportunity cost of holding risk-free assets (think U.S. T-Bills). However, I do think having some financial flexibility can pay off should the S&P 500 not have another year of 20%+ returns up its sleeves (highly unlikely in my view). Also, allocating a small portion of one’s net worth to precious metals (think gold) can also make sense as a hedge against any macro headwinds that come rolling in or the potential return of high inflation.

In any case, one is best to consult the advice of a financial adviser before putting such a massive hoard of cash to work. Maintaining a diversified portfolio with enough liquidity is vital. That way, you won’t need to sell assets to shore up capital should a big expense come your way in the coming years.

Though I’m not completely against investing in rental properties, I do think it could take away from someone’s hands-off lifestyle in retirement. If that’s fine, betting on a rental property can be an option worth bringing up with the adviser!

Personally, I’d rather keep things simple with more liquid assets, like stocks, T-Bills, gold, and, if one is keen on real estate, REITs (real estate investment trusts), which strike me as a better, more flexible option for investors seeking income and appreciation.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.