Personal Finance

My 69 year old sister has a net worth of $10M and dementia. Her bank took advantage of her and tied up 90% of her money. What can I do?

Published:

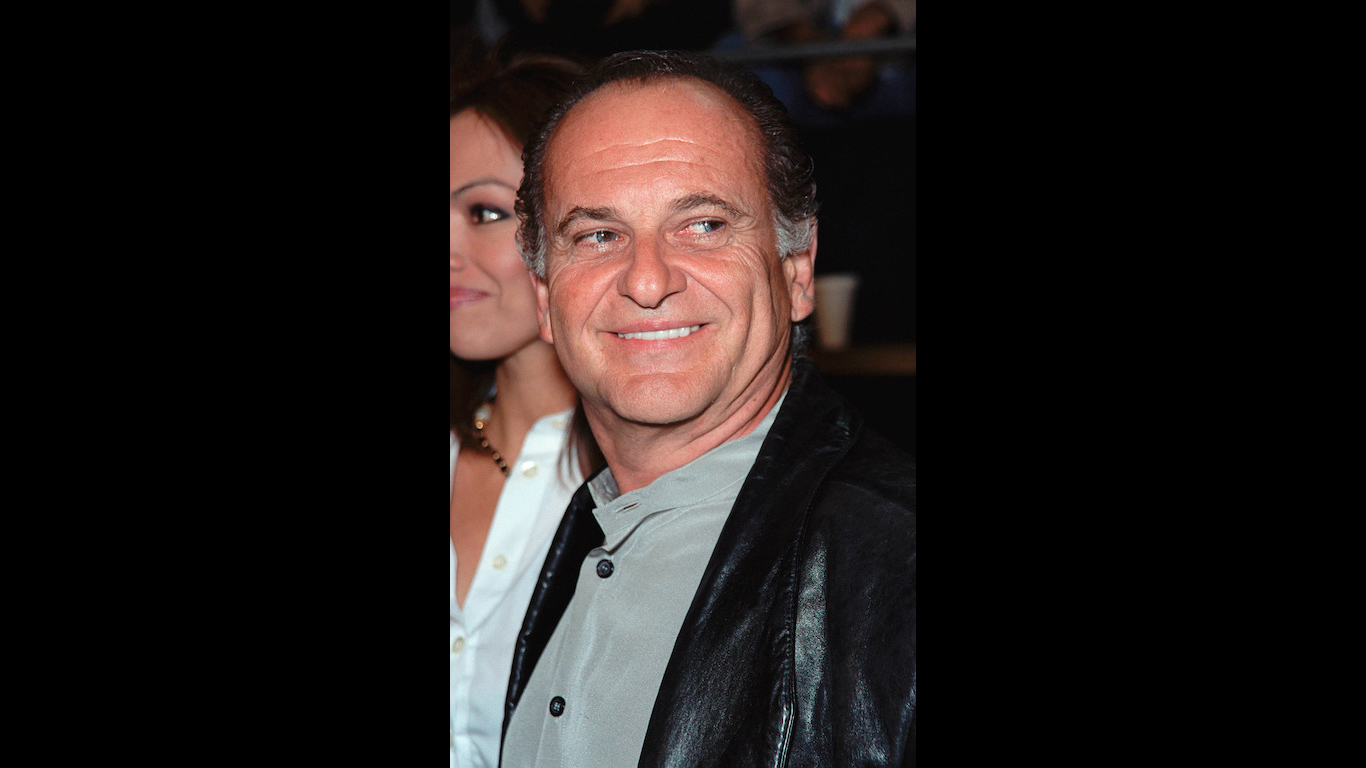

My Cousin Vinny (1992) is a comedy starring Joe Pesci as Vincent Gambini, a newly licensed lawyer from Brooklyn who has to go to Alabama to defend his cousin and friend in a robbery trial. There is circumstantial evidence that needs to be debunked if Vincent is to win the case, his first ever trial. Much of the humor comes from the fish-out-of-water Brooklyn wiseguy in a genteel Southern town. Marisa Tomei won a Best Supporting Actress Oscar for her role as Vinny’s fiancee, Mona Lisa Vito. The movie has often been cited by lawyers as one of the closer to real-life depictions of jurisprudence and evidentiary analysis.

Many financial situations also can contain what appears to be strong circumstantial evidence of institutional malfeasance. While the vast majority are civil disputes, some can enter the criminal arena. However, much of that circumstantial evidence can often be explained, and oftentimes the mistaken assumptions are due to incomplete information, a lack of knowledge on the part of the accuser, and a lack of research into the actual documents of the matter. The problems are compounded when the accuser is a newly arrived third party to the scenario.

A Reddit poster sought financial advice on a scenario that struck a number of respondents as being more demanding of legal, rather than financial advice. His 69-year California-based older sister has developed dementia, and has a projected life expectancy of 3-5 years. The brother has become the trustee over her finances, and he is troubled over the annuities his sister contracted with her bank. He believes she is a victim of the bank’s predatory practices on seniors and was soliciting amelioration advice. The information he discloses includes:

The poster has considered filing a complaint with the CA attorney general’s office. However, like the classic Akira Kurosawa film, Rashomon (1950), the same event can be viewed as drastically different from varying perspectives.

The majority of respondents advised getting a lawyer. Some thought of getting a California politician involved to publicize the case to highlight elder abuse issues. One reply came from an attorney, who advised checking on the contract dates for applicable back provisions under California statutes as “free look” provisions vary from state to state and might provide a legal escape clause.

Quite a few questioned the validity of the $50,000 monthly expenses, which seems unusually high, and some mused whether or not the brother himself was acting with ulterior motives.

However, most of the respondents who are familiar with annuities thought that the bank acted in accordance with the sister’s wishes and held no liability. The terms are standard for deferred annuities, given that her projected retirement would be at age 73. Surprisingly, there was a dearth of practical solution responses. One would think these proposals might be worth a look:

This article was written solely from an informational basis. If more comprehensive advice is sought, a financial professional should be consulted.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.