Personal Finance

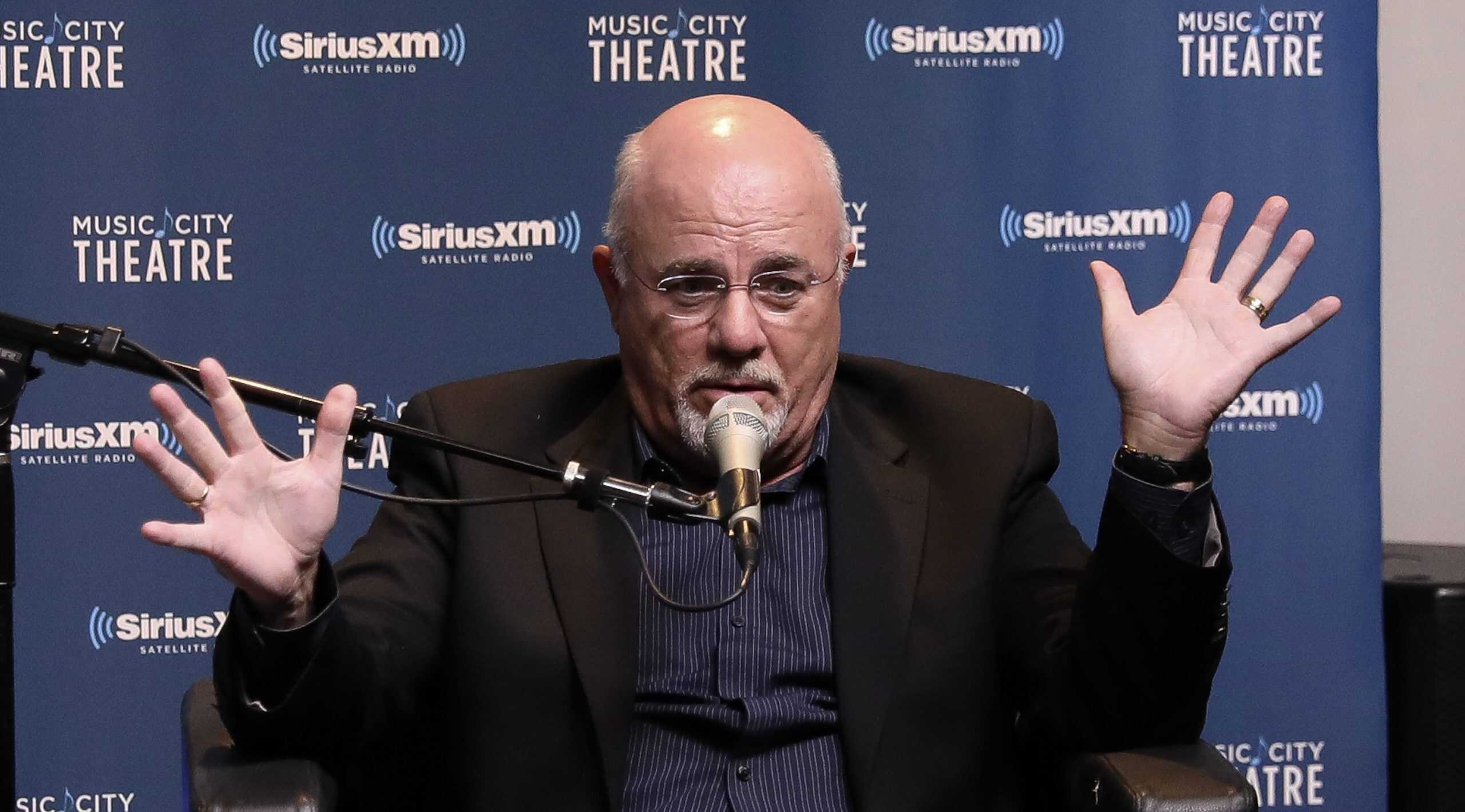

If you've got over a million dollars and not sure what to do with it - Dave Ramsey says do these 8 things

Published:

The dream of joining the Millionaires Club has become a reality for many Americans.

In fact, as of 2024, about 18% of U.S. households have achieved that status, which comes out to about 23.7 million households. If you’re in that group or working hard to join the club, finance coach Dave Ramsey suggests you make eight key moves with your money.

According to Ramsey, combining your money with your spouse is key in creating long-term wealth. Many millionaires say that a strong financial relationship with their spouse has been key in building wealth and success. A strong relationship with a spouse can grow even stronger if both have aligned financial goals regarding spending, saving and investing.

If you want to reach a goal, plan for it. Financially, that includes creating a budget. It’ll help you figure out what you have coming in and going out. It’ll help you figure out where you may need to cut back on spending, or even where you may be coming up short.

As Ramsey has said, “If you aim at nothing, you will hit it every time.”

According to Pew Research, one in four adults under 40 have student loan debt. That drops to 14% ages 40 to 49, and to 4% over the age of 50.

“Among borrowers who attended some college but don’t have a bachelor’s degree, the median owed was between $10,000 and $14,999 in 2023. The typical bachelor’s degree holder who borrowed owed between $20,000 and $24,999. Among borrowers with a postgraduate degree the median owed was between $40,000 and $49,999,” added Pew Research.

If you can, eliminate the debt, or try to knock it down considerably.

Ramsey says that if you don’t have a real emergency, do not touch this money. Remember, a true emergency is an accident, hospital visit, etc.

Start small with an emergency savings goal of at least $1,000. Sure, it’s small but it’s a safety net, and it’s a start. In fact, if you can put away about $85 a month, you’ll reach that goal and have some wiggle room. However, be sure to store this in a separate “don’t touch” account, automatically depositing money every time you’re paid. Plus, if you ever receive another source of income, such as a bonus or a gift, put it directly into that “don’t touch” account instead of spending it immediately.

If you have extra time, see if you can pick up a side hustle, such as tutoring at night. Other ideas include driving for Uber or Lyft, delivering food, renting a spare room on Airbnb, babysit, or maybe even dog walk or pet sit. All are great ways to bring in extra income, says Ramsey.

If you don’t “have to have it,” you can cut out all unnecessary spending, and you can use that freed-up money to get out of debt and invest. But if all you do is consume, Ramsey says you can’t ever climb your way out of a financial hole, as noted by GoBankingRates.com.

There’s a tendency to spend more money as income increases. Instead, consider living below your means, and be more aware of what you’re spending as compared to what you’re bringing in – which brings us back to the importance of a budget.

“Before you even think about buying a house, Ramsey strongly recommends making sure you have an emergency fund and are completely out of debt. When you’re ready, don’t spend more than 25% of your take-home pay on housing, and use a 15-year mortgage if possible,” added GoBankingRates.com.

“As Ramsey explains it, data shows that homeownership is a key part of becoming wealthy — but only over the long run. When you first buy a house, your wealth-building actually slows down temporarily. If you’re not financially prepared for buying a home, Ramsey says it can clobber you. So, don’t turn a potentially wealth-building investment into a curse,” they added.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.