Personal Finance

The Average American Can’t Answer These Simple Investing Questions

Published:

One of the most important things you can do in the new year is familiarize yourself with all the investment opportunities available. Whether it’s the stock market, ETFs, 401(k), annuities, or any other investments you can make toward your future, asking some simple questions can go a long way.

The average American likely doesn’t know the answer to these simple investment questions. Understanding the difference between stocks and bonds is important to a strong investment strategy. Use a qualified financial advisor to come up with a strong investment plan. Retiring early is possible, and may be easier than you think. Click here now to see if you’re ahead, or behind. (Sponsor)

Key Points

It’s okay if investing seems confusing and almost something that you need an advanced degree to understand. However, the reality is that investing is easier to follow than most people might think, and any industry jargon can be easily translated into simple language.

What’s the difference between saving and investing money?

The easy answer is that saving and investing can go hand-in-hand, but they are different. Saving is putting aside the money you have earned and plan to use. Saving might be for a car, home, vacation, or something else. Alternatively, an investment is using your money to try and make more money. In other words, investing is using your current earnings to generate more earnings.

When should you start investing?

The answer to this question is pretty nuanced, as it depends on whether you have disposable income that can be used for investing. However, the idea is that you should try to start investing as soon as possible to grow more wealth.

How much should you be investing?

How much you should invest will depend on how much you can afford. However, there is also a question about your goals and the timeline you hope to achieve them. The answer to this question will help you understand how much you need to invest. You also need to ensure you are only investing money after you have paid off your bills, established an emergency fund, and paid off any high-interest debt.

What is a stock?

When you purchase a stock, you buy a piece of a company that you hope will grow through a dividend or stock price increase. You buy stocks on exchanges like the New York Stock Exchange, and the stock’s worth can fluctuate based on the company’s performance.

What is the difference between a stock and a bond?

If you’re purchasing a stock or a piece of ownership in a company, you are generally looking for a higher potential return that also comes with more risk. On the other hand, a bond is a loan you give to a company or government in exchange for an interest payment. It is often considered less risky but has a lower return.

What does “risk” mean as far as the stock market goes?

Generally speaking, your “risk tolerance” equals the type of investments you make, as you don’t want to make any investments that could fluctuate too much. In other words, your “risk” is based on how much volatility you are willing to accept in the stock market. If you want a more conservative approach to the market, you will have a lower risk tolerance. However, riskier bets are often more likely to produce bigger returns if they perform.

What does it mean to “diversify” your portfolio?

The best way to invest is to diversify your portfolio so you don’t have all your money in one place. This might mean spreading your assets across the stock market, in bonds, real estate, 401(k) accounts, etc. If you have a downturn in one area, the other investment accounts will hopefully still perform well to balance any losses in one investment sector.

What is a mutual fund?

If you are investing in a mutual fund, you are looking at investing in a pool of investments established by a money manager or hedge fund. These mutual funds generally include accounts like investments, real estate mutual funds, or a mutual fund in technology, natural resources, or healthcare sectors. Mutual funds are generally open to the public. To simplify, instead of buying just one stock of Walmart, you will invest in a mutual fund that includes a portfolio of companies, including Walmart.

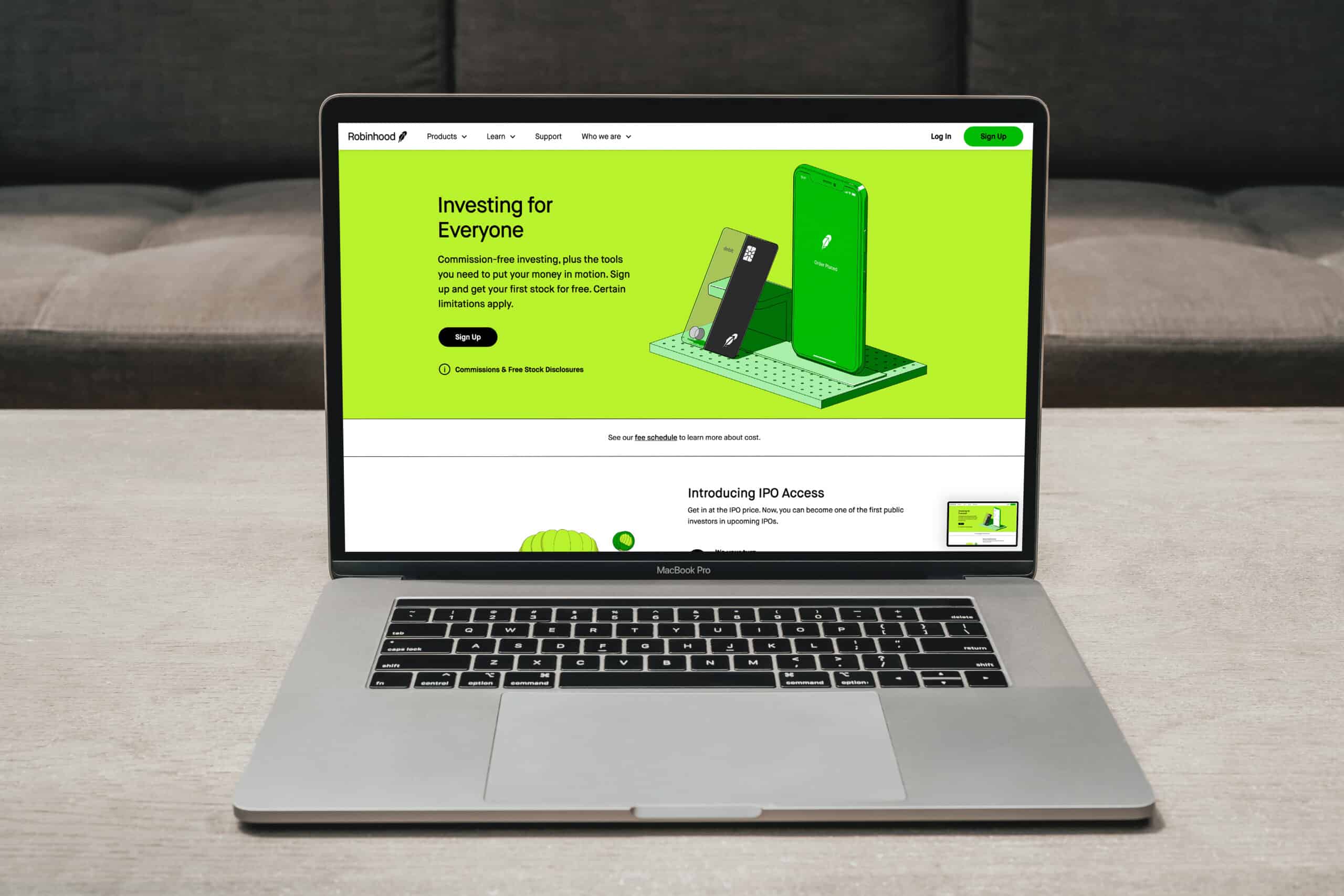

Do you need a minimum investment to get started?

In most cases, you don’t need any minimum investment to get started, as it’s up to you and your comfort level. Some brokerage accounts will have minimums to get started, but if you are self-investing with a company like Fidelity or Robinhood, you can start with as little or as much free cash as you have available.

How do dividends work?

One smart investment strategy is investing in companies that pay quarterly dividends. A dividend is when a company makes a small payment to shareholders out of its profits. Some companies pay dividends in cash, while others use the money to buy additional shares. However, it’s important to know that not every company pays dividends.

What is the difference between a bull and a bear market?

If we are in a bull market, it’s a moment when the stock market is on the rise, while a bear market means it is falling. The reality is that both bull and bear markets are standard parts of the stock market cycle, but they have different effects on investment strategy. It’s important to remember that market swings in both directions are not uncommon or a reason to panic.

What is the difference between a Roth IRA and a traditional IRA?

One of the biggest investment opportunities that can put money toward retirement is the IRA. Generally speaking, you have both a Roth IRA and a traditional IRA. A Roth IRA allows you to make after-tax contributions, while retirement withdrawals are tax-free. A traditional IRA uses pre-tax contributions, and withdrawals are taxed as income. You should work with a financial advisor to determine your right choice.

When is the right time to sell a stock?

One of the biggest questions anyone invested in the stock market has to answer is when to sell stock. The trouble is that there is no specific answer, and the answer depends on various factors, including a business’s fundamentals. Consider selling a stock if you have already made some big returns and want to spread these returns out of your investments into different or new opportunities.

How much does it cost to buy a stock?

The short answer to how much it costs to buy a stock depends on how you buy it. If you use an investment firm and have a financial advisor, you will pay a transaction fee, likely at the end of each quarter. However, if you use a self-directed investment strategy, there may be zero cost to buy a stock, which made the investing app Robinhood very popular with retail traders.

What is the difference between an ETF and a mutual fund?

If you choose to invest your money in an ETF, you are generally looking for an option that trades like a stock on an exchange and comes with lower fees. On the other hand, a mutual fund is more hands-off for investors. Professional financial advisors generally manage it as it is considered a safer long-term bet and has a low-risk tolerance.

Should you pay off debt before investing?

If you have the free cash to pay off your high-interest debt before investing, you should do so. However, this can be a little more nuanced, but only if the interest on your debt is lower than the percent you expect to make on the market. For example, paying off the debt first makes more sense if you have a credit card with 22% interest but only expect to make between 5-7% back on the market.

Is there a bad time to start investing?

Some brilliant and wealthy people believe they know how to time the market, but the reality is that timing the market is very challenging. In other words, there is no bad time to start investing as you want to make money as soon as possible. While the stock market has its bear and bull moments, the reality is that the market has gone up over time.

What kind of returns should I expect from stock market investments?

Most investors with a moderate risk profile often see an average return between 5-7% per year. Some years are higher, and some can be lower, but this is a consistent average rate of return. Knowing this number can help you work backward to determine how much you would want or need to invest to hit the number you feel comfortable having as part of any retirement portfolio.

Should you open up a brokerage account?

If you want to own diverse investments, opening a brokerage account, preferably with a qualified financial advisor, is smart. Once a brokerage account opens, you can purchase stocks, ETFs, mutual funds, bonds, and other investments to increase the yearly return rate.

How do I properly balance my portfolio?

One of the best things about working with a financial advisor is that they can help you create the right balance. For someone in their mid-40s, having a 60% stock and 40% bond portfolio might be the right move. However, for someone already retired, you might want to use a 70% bond and 30% stock split to reduce the risk due to market volatility.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.