This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive

compensation for actions taken through them.

compensation for actions taken through them.

We’re not all great with money.

In fact, according to the Financial Health Pulse 2024 U.S. Trends Report from the Financial Health Network, 70% of American households are not financially healthy, “with day-to-day financial realities worsening for many.”

Key Points About This Article

- With 2025 just around the corner, it’s a good idea to check in on your financial health.

- If you want to win with money, save and get ahead financially, there are five key things you need to do with your money right now.

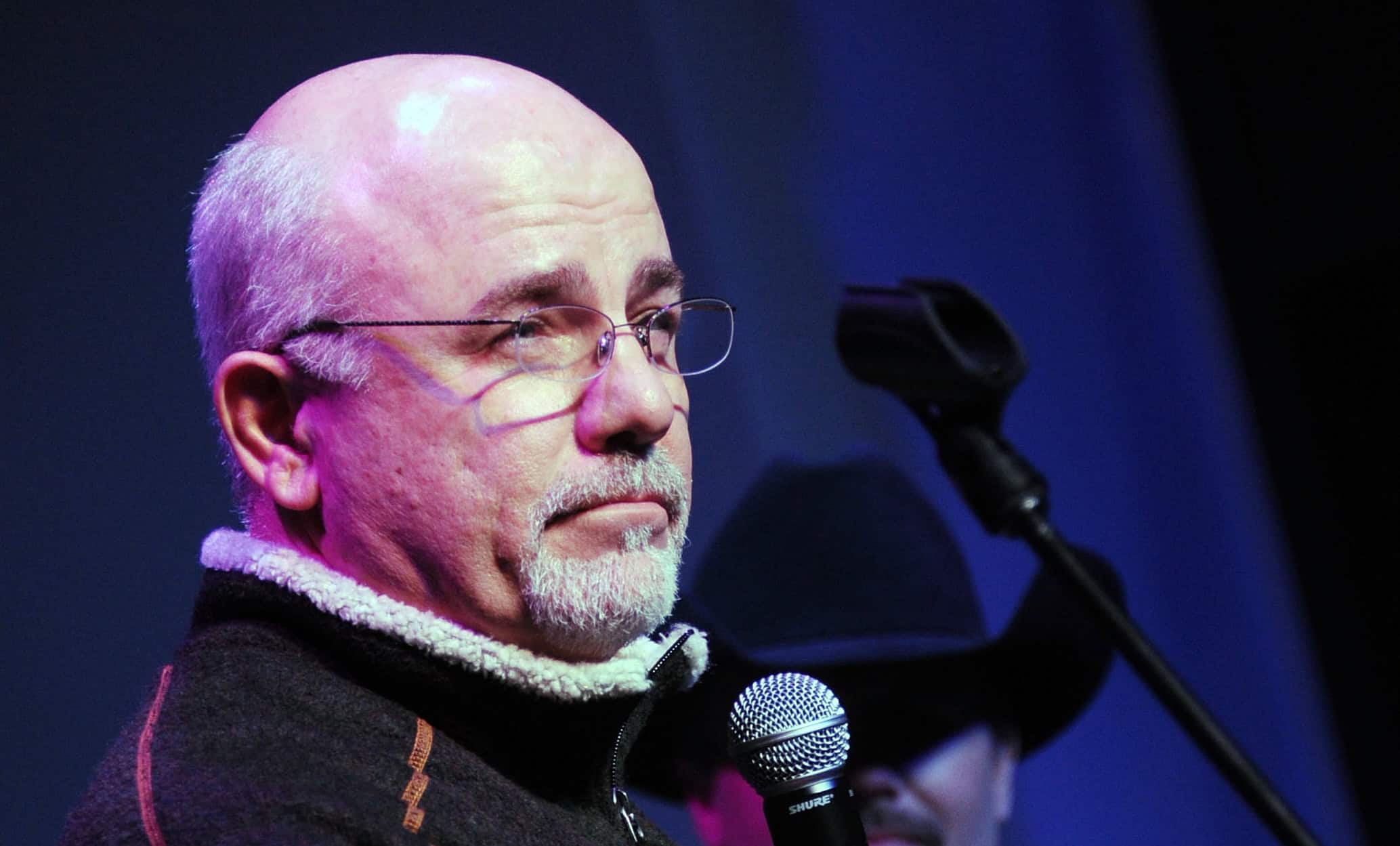

- Dave Ramsey suggests setting up an emergency fund, setting aside 15% of your income for retirement goals.

- Also: Take this quiz to see if you’re on track to retire (Sponsored)

“The data clearly show financial health in America – especially that of moderate and middle-income households – remains precarious and is influenced by a reliance on credit to stay afloat,” said Jennifer Tescher, president and CEO of the Financial Health Network.

But if you want to win with money, save and get ahead financially, there are a few key things you need to do with your money right now.

One, create a budget that lists your income and your expenses.

This is crucial. Without a budget, many of us lose account of what’s coming in financially and what’s going out. In fact, when others have asked me for financial advice, my top question is, what are you spending on? Unfortunately, I’m often met with the deer in the headlights stare and a response of “I don’t know.” Unfortunately, not knowing will destroy you financially.

Two, do your best to get out of debt.

Easier said, than done, sure. But there is a way out.

According to Dave Ramsey, use the debt snowball method – where you pay off your debts in order of smallest to largest. In doing so, list out all of your debt, including student loans, car payments, mortgages, credit cards, etc.

Then, as noted by Ramsey Solutions, “Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum payments on your other debts).”

Then, repeat that over and over again until you drive down your overall debt.

Three, live on less money than you earn.

As Suze Orman has said, live below your means to achieve financial freedom. Identify your needs and your wants, eliminating part of the expenses tied to wants. Automate your savings. Figure out your savings goal. Consult a financial advisor.

Four, Dave Ramsey suggests setting up an emergency fund.

He suggests setting aside 15% of your income for retirement goals.

Many things in life are unpredictable, especially medical issues. So, you must have emergency funds set aside just in case. Some analysts say you should have at least three to six months’ worth of living expenses set aside with it.

And, if you don’t have one set up, start small with an emergency savings goal of at least $1,000. Sure, it’s small but it’s a safety net, and it’s a start. If you can put away about $85 a month, you’ll reach that goal and have some wiggle room.

Five, max out your contributions to retirement accounts if you can.

Accounts with tax advantages – 401(k)s, IRAs, health savings accounts, etc. – are great ways to save and invest for the future. In many cases, contributions to these accounts can help cut your taxable income. For the 2024 tax season, you have until April 15, 2025, to contribute the maximum amount for it to apply to your 2024 taxes. Also, if your employer offers a match program, contribute enough to receive the highest employer match possible.

You can also max out your health savings account if you have one. With it, you can save and pay for certain medical expenses with tax-free dollars. In 2024, you can contribute a max of $4,150 for yourself, or $8,300 for a family. For 2025, you can contribute $4,300 for yourself or $8,550 if you have coverage for a family.

Six, be charitable.

If not with your money, with your time, or with donations of food or clothes suggests Dave Ramsey. As noted by Ramsey Solutions, “Ramsey says that charitable donations can be tax deductible, which can help lower your tax bill. He also says that giving to a charity you’re passionate about can be fun and that you can make a difference in someone else’s life.”

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.