Personal Finance

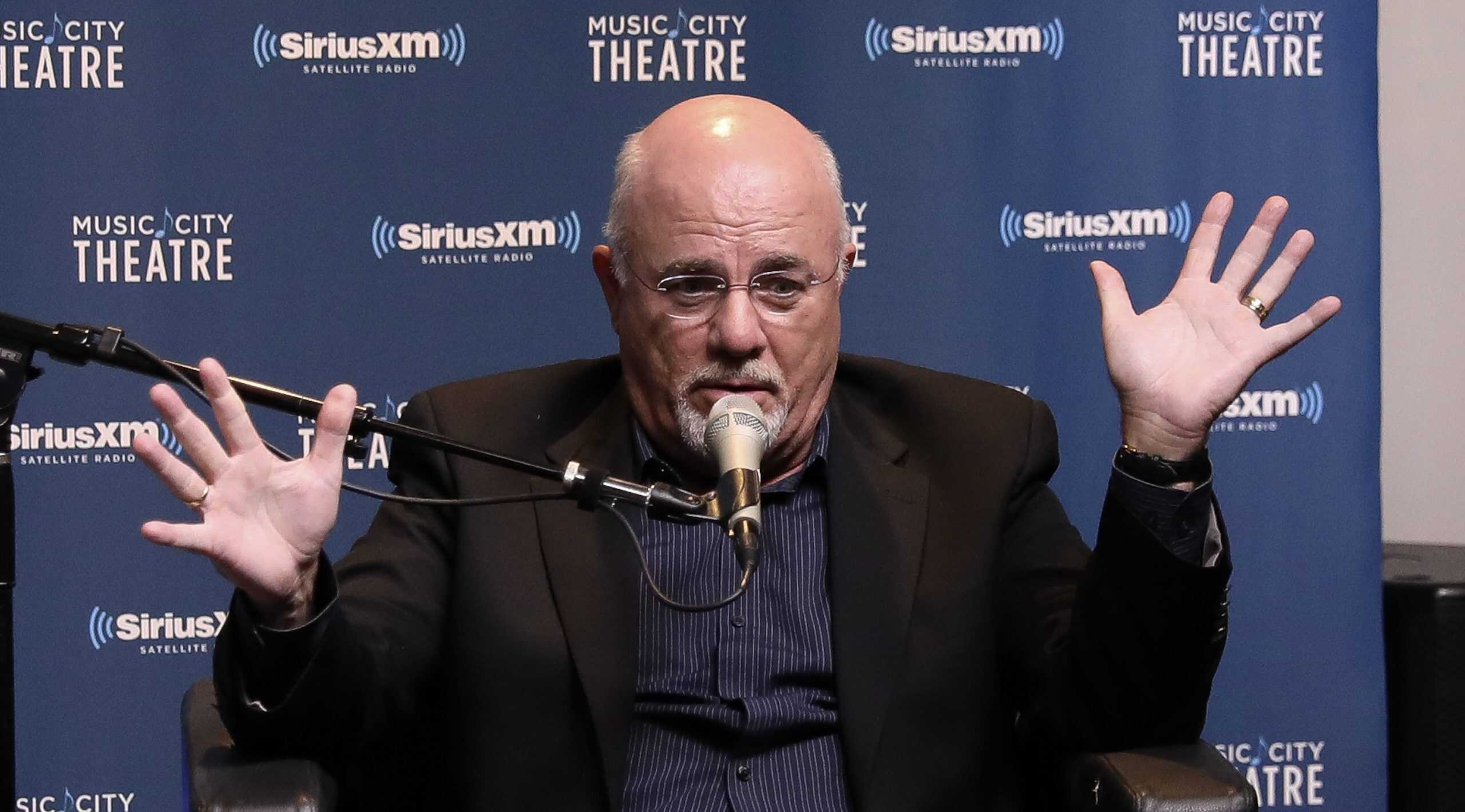

Dave Ramsey Says 'You've got to tell your money what to do or it will leave' and I Agree

Published:

When it comes to financial advice and helpful money tips, you can definitely do better than Dave Ramsey. We honestly doubt there is anybody who has become rich by following his advice, and how could they? Dave’s financial “tips and tricks” boil down to supporting big companies, handing over all your money to the existing monopolies, buying more index funds, and so on. Be a good capitalist cog and spend, spend, spend, consume, consume, consume.

Unless you proactively use your money, high inflation and corporate greed will quickly erase your purchasing power.

High-yield savings accounts are one of the easiest ways to preserve your wealth against high inflation rates.

The best high-yield savings accounts are paying way more than most Americans realize, with some offering cash bonuses for new accounts. Click here to see our top pick today. (Sponsored)

However, in this case, when it comes to using your money, Dave is correct. This is one of the few times we will ever agree — broken clocks and all that. That being said, what are the details, the nitty-gritty, when it comes to telling your money what to do? How can you do that in an effective and intelligent way? Most importantly, how can you do it safely? Where will it go if you don’t?

All that and more as we dive in together.

Banks don’t exist to help you. As private companies, they are self-interested and will take any action to make more money off of you and your money. Because of this, many people don’t know that high-yield savings accounts exist, how to take advantage of them, or where they came from. We want to help with that in our own way.

If you’ve spent any amount of time online, especially on LinkedIn, heaven forbid, then you’ve probably seen your fair share of Ramsey quotes. This is definitely among his most popular.

The quote comes from a discussion surrounding budgets and how to manage your money effectively. While the entire discussion is helpful and can be useful for many people, especially for those who struggle making ends meet even with a high salary, we will focus only on this portion.

The real inflation rate for 2024 was 2.53%, but since this is across all goods and industries and sectors, that doesn’t quite capture the increase in prices for everyday goods. If you feel like prices have risen far beyond this amount, and you find that paying for the same goods now costs much more and is harder to do, it’s because it is.

Companies have grown so large and powerful in America that they have begun to raise prices far beyond the inflation rate and have reported record-breaking profits in the last couple of years. If inflation were the only cause of price increases, this would not be the case.

This is true from food and groceries, entertainment, travel, and household goods to insurance, raw goods, chocolate, supplies, and more.

This is all after the largest wealth transfer in human history from the poor and middle-class to the wealthy during the COVID-19 pandemic, a trend which continues today.

If you are like most people who keep their money in a bank account, and that bank account isn’t beating the inflation rate by a large margin, then every year you will have less money than the year before.

This is particularly true for younger generations, especially the Millennial generation which is the first in recent history to have substantially worse life expectancy, financial prospects, and overall happiness and success than their parents. And while Generation X and the Baby Boomer generation are not entirely to blame for this situation, they contributed heavily to it and exacerbated the struggle of their children by blaming them for it.

Suffice it to say, if you aren’t active in making sure your money is earning a high return or at least a high interest rate, then it will gradually leave until you are left with nothing. But that can be easier said than done, especially for those who don’t have enough to make ends meet, which is an increasingly high amount in the world’s wealthiest country.

Some savings accounts today don’t even match the inflation rate, which means that the bank you use could be making money on your deposits and literally giving you less money back every year. They are robbing you.

Savings accounts used to be the mainstay of American life, but today they have been left behind as many people realized they were losing money while banks made it harder to access their own money. The good news is there are better alternatives.

The core message of the original quote is that unless you take an active role in managing your money, it will slowly disappear over time. This isn’t really advice as much as it is pointing out a universal truth of how money and the world work.

Fortunately, there are several ways you can tell your money what to do, and people have made their fortunes telling you their way is the right way. The fact that any of these gurus don’t actually have real jobs besides selling books, tickets to speaking opportunities or workshops, and talking on the radio, isn’t something they like to address.

The fact remains, however, that finding which way to tell your money what to do is part of the struggle, and the key ingredient of our modern hustle culture. Some have resorted to turning their hobbies into side gigs, taking all the joy out of their free time. Others take on more risk than they can afford by investing in risky stocks and speculation. Some people have started their own businesses, which is admirable, or taken to scamming others through drop-shipping or other deplorable sources of income.

Yet, there are safer and easier ways to tell your money what to do. Financial companies know this and have provided us with a plethora of guides and tips and tricks to get rich quick or make more money, which (of course) they will usually charge you a fee to use.

If you are reluctant to jump into the world of investments, trading, or other high-risk financial strategies, you are not alone. Luckily, there is still one option still available to people like us: high-yield savings accounts.

High-yield savings accounts won’t make you rich. In fact, they will barely help you keep your head above water as inflation rises, but they are better than traditional savings accounts, and far better than no savings accounts at all.

Traditional bank accounts began by keeping your money safe, and the bank pays you a small interest rate for the privilege of using your money for its own purposes. However, American banks have flipped that beneficial relationship on its head. Today, banks charge high fees for small account conveniences, often punishing the poorest among us, and pay the lowest interest rate possible. They make money from us through the companies they own while paying us pennies in return.

When the internet became a common feature in American households, however, some financial institutions saw this as a way to carve out a part of the banking sector for themselves. Enter the online-only bank.

Online-only banks didn’t have all the infrastructure, physical buildings, workforce, or massive debt that the larger banks did, so they could afford to pay a higher interest rate on their savings accounts, convincing millions of customers to switch companies. People migrated to online-only banks in droves. Even though these accounts didn’t have physical locations, regular account support, or other account features that other banks offered, the high interest rate was enough to convince them to leave their big banks behind.

Eventually, the larger banks caught on and began offering their own high-interest savings accounts. Even though they could afford to pay higher interest rates without cutting services, the banks offer these accounts with slim account support and no access to their physical locations, like the online-only banks.

Today, most large banks offer some form of high-yield savings account, with many offering different types. But while you might be tempted to compare only the interest rate and pick the highest one, the devil is in the details.

It would be irresponsible to tell you to pick the account with the highest interest rate or to list any specific bank or account, even if we have our favorites. (You should always be skeptical of any endorsement or recommendation in the financial world, you never know who is paying for it).

This is particularly true since the banks can change the interest rate on all these accounts at any moment and for any reason.

There are, of course, a few things you can do to make sure you pick the right high-yield savings account for you.

First, you should understand what kind of account you have and the interest rate you are earning. If, like many Americans, you set up your account when you were younger and haven’t looked at it since your bank is probably taking advantage of you. They have no incentive to tell you that they have better accounts available or that your current account is paying a very low interest rate. Banks will even allow you to keep an account years after they stop offering that account to new customers. If you don’t know what interest rate your bank is paying, you need to dive into the details of your banking agreement and find out. Only then can you compare it to the high-yield rates. You should also take a look at the fee schedule at your current bank.

Even the lowest rates on high-yield savings accounts are going to outperform the return on traditional checking and savings accounts, and are safer and more reliable than some investments. So you’re going to win even if you pick one of the lower rates.

Second, make a list of some of the high-yield savings accounts you are interested in. There are plenty of websites that list the highest interest rates or other features, and you can pick one that you trust. It is important to remember that many of these websites are owned or sponsored by the banks on these lists, so keep that in mind as you search.

Some of the best interest rates we’ve seen are between 3.5% and 5%.

Don’t stop at the highest rate, of course. Make sure to look at the account details, fee schedule, account minimums, limitations, and other things that might impact how you can use or access your money.

One of the more dangerous traps is signing up for a high-yield savings account that looks great, but only offers a high interest rate as an introductory incentive and then drops that rate to much lower levels after a few months. Some accounts only pay their highest rates for accounts that have a certain amount of money but won’t tell you this until after you’ve signed up. Always do your research!

Third, take advantage of sign-up bonuses but don’t let them be the determining factor in your decision. Banks really want your money, and the only thing they fear more than you withdrawing your money is another bank taking some of their market share. For this reason, banks often offer sign-up bonuses on new high-yield savings accounts. These can include a cash bonus after signing up, referral bonuses, special interest rates, or some other reward. While these are nice, and you should definitely take advantage of them if you can, you should not let these offers blind you to bad customer service or lower interest rates. A higher interest rate will always get you more money over time than a small lump sum today.

We’ve seen some sign-up bonuses as high as $300 for opening a new account.

Fourth, look at the details. If you require in-person banking, regular customer support, or other banking services, then you might not want a high-yield savings account. These accounts have fewer services and features than regular accounts, which can come as a shock to customers who didn’t do their research beforehand.

In today’s banking industry, the bank always wins. They will get their money back in some way. Look carefully at the fees and account restrictions. Are there account minimums? Transfer restrictions? Regular account fees?

We recommend you visit trusted review sites like Trustpilot or the app store on your smartphone to read reviews from real people and their experiences with a particular bank or account.

Once you have looked completed these steps and narrowed your list to a handful of options, it is safe to take the jump to a new account. Banks are always eager to make the transfer as easy as possible.

Yes. If you have an existing savings account that you are not happy with and can do without in-person banking and 24/7 account support, there’s no reason why you shouldn’t transfer to a high-yield savings account. With so many better alternatives, there is almost no reason to keep your money in a traditional savings account, and you will be hard-pressed to find an objective expert who recommends you keep one.

In the time it took you to read this article, you can open a new account for free at the bank of your choice. The good news is that you can usually close your account without a problem and pick a new one if you’re not happy.

If you have an older account, you could earn up to ten times as much money in interest payments just by switching your account. I’m sure even Dave Ramsey would agree that this is one of the easiest and fastest ways to tell your money what to do.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.