Personal Finance

If you're over 50 and make $500k per year, you should have this much saved for retirement - are you on track?

Published:

Last Updated:

If you earn $500K, you have a lot of income to replace in retirement.

By the time you are in your mid-50s, you’ll need around $3.03 million saved to be on track.

If you’ve fallen behind, you can save more or scale down your spending in retirement.

Retiring early is possible, and may be easier than you think. Click here now to see if you’re ahead, or behind. (Sponsor)

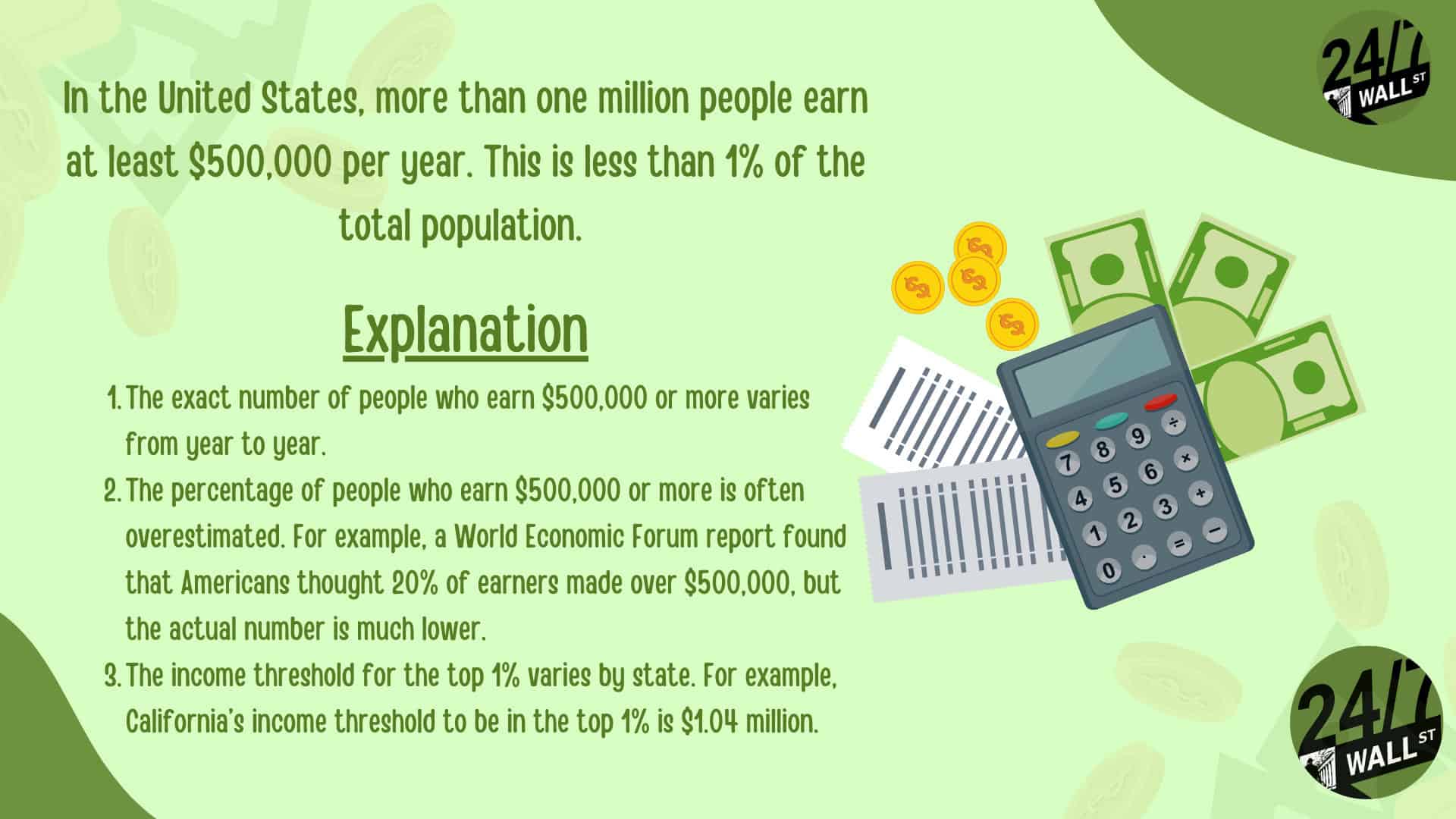

When you have a $500,000 annual income, you have a lot of money to replace as a retiree. The good news is that your current high earnings mean you should be able to invest a considerable sum to help ensure you have the funds you need.

So, how much should you have invested by the time you’re in your mid-50s? Here’s what you need to know.

The specific amount you’ll need to retire with is going to depend on a lot of factors, including your chosen retirement age and how much you plan to spend in your later years.

However, if you are hoping to maintain around the same spending level that a $500,000 annual income would allow, you’re going to need to have around $3.03 million invested by the age of 55.

This estimate is based on:

These numbers are adjusted for inflation, they take into account market volatility, and they are calculated to ensure your money lasts throughout your later years.

One of your best options is to save more aggressively. You’re getting near your retirement date at this age, so it’s time to get serious about investing for your future.

With a $500K annual income, you should be maxing out your 401(k) contributions if you are eligible for a 401(k) based on where you work. If you’re running your own business to earn your money, look into options like a Solo 401(k), Simple IRA, or SEP IRA to see which allows you to put away the most tax-free retirement funds based on how your company is structured. A financial advisor, accountant, or tax professional can help you to optimize your retirement investing to capture the most tax savings possible.

Because there are contribution limits, and sometimes income limits, on tax-advantaged retirement plans, you may also need to put some money into a taxable brokerage account to ensure you’re truly prepared for retirement. This can come in handy anyway if early retirement is on your radar as there are restrictions on withdrawals from tax-advantaged accounts until you’re 59 1/2.

If you don’t think you can invest enough in the time you have left to work, you could also explore whether reducing your spending after retirement is possible. It can be hard to invest enough to replace so much money, especially as Social Security benefits are capped due to an annual wage base limit so those benefits are going to replace only a tiny portion of what you were earning. You’ll need to rely heavily on savings, and if you don’t have enough, scaling down your lifestyle may be the way to go.

By exploring these options, hopefully, you can ensure you’re on the path to financial security in your later years. Your high income gives you a good opportunity to save for your future, so try to take advantage of it as much as you can as your career begins to draw to a close.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.