Personal Finance

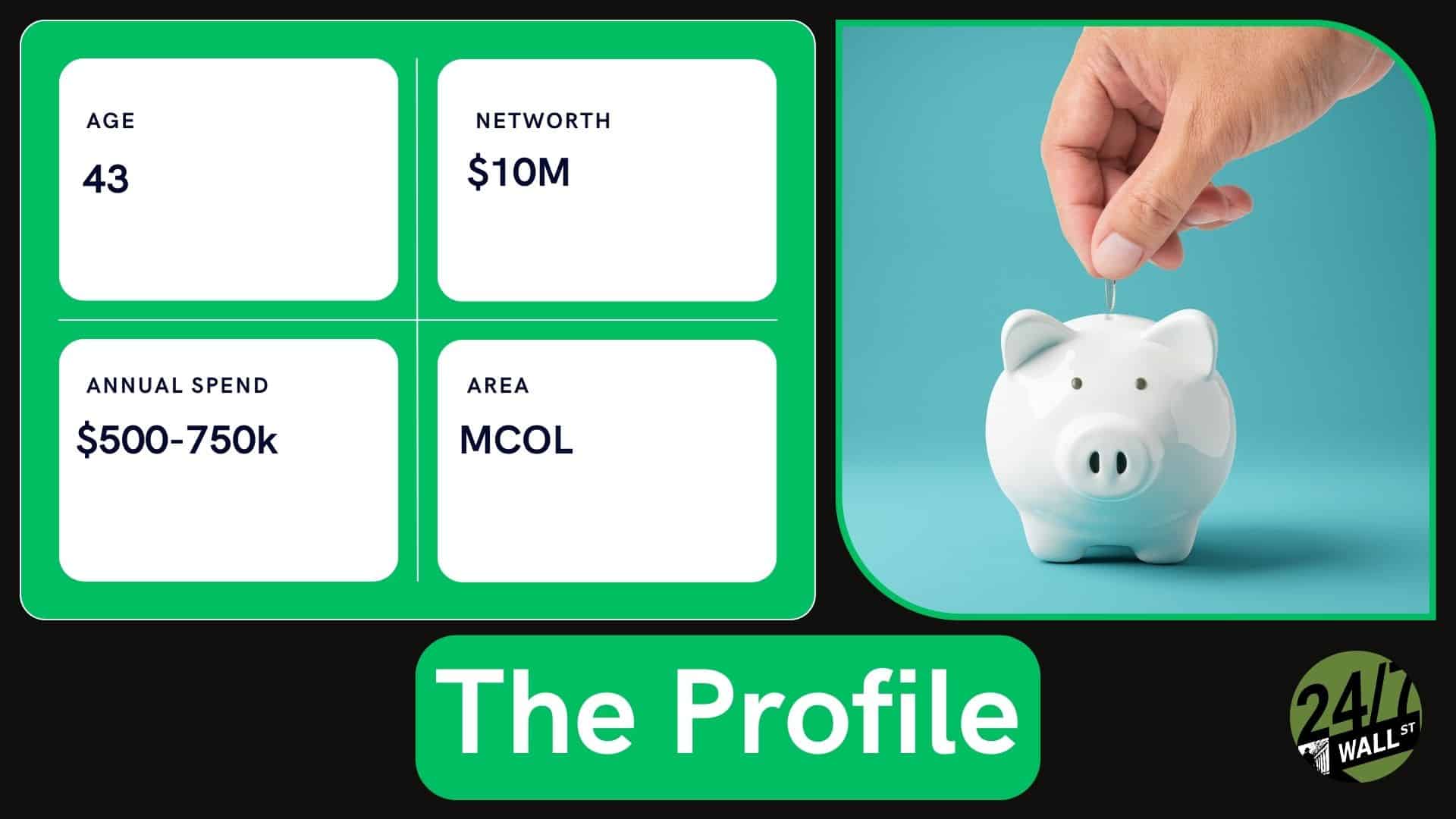

We're in our 40s with 3 kids and $10 million in liquid savings - we aren't going to retire yet so what should we do with our excess savings?

Published:

Retiring too early could backfire on you in many ways.

There are different legal arrangements you can use to pass wealth onto your heirs.

Your best bet is to consult with an estate-planning attorney and financial advisor for personalized guidance.

Retiring early is possible, and may be easier than you think. Click here now to see if you’re ahead, or behind. (Sponsor)

I have a lot of friends who are in their 40s with multiple kids and struggling to build up enough savings for retirement (plus college, home improvements, and the other many things that tend to eat up people’s money). So when I came across this Reddit post, I was impressed.

Here, we have a couple in their 40s with three children and a $10 million liquid net worth. And that’s on top of fully funded 529 plans for their kids’ education.

Clearly, this couple has done a lot of things right. They’ve obviously worked their way into successful careers, and despite spending a lot of money on a yearly basis, they’ve managed to save and invest a bundle of it.

Now a lot of people with that much wealth in their 40s would probably be looking to retire early. But not this couple. They don’t want to retire right away, but they do want to come up with a plan for their excess savings, which is smart. And I have some advice I hope anyone in their situation would take to heart.

I’ve come across my fair share of Reddit posts from people with millions of dollars to their name in their 40s wanting to retire in a year or two. And frankly, I tend to think that’s a little risky — not necessarily from a running out of money perspective, but from a mental health perspective.

It’s not necessarily an easy thing to be retired at an age where your mind is still sharp and your body is wired to want to move and be busy. I mean, sure, with millions of dollars in the bank, you could fill your days with social and fitness activities, and you could decide to only do volunteer work that’s meaningful to you.

But I like that this couple is thinking of continuing to work because they can. And I also appreciate that they’re able to acknowledge that they’ve saved enough and want to use their excess savings for their kids. But I think to tackle that piece of the puzzle, they need expert help.

This couple — and anyone in a similar situation — should be getting professional help in managing their vast amount of wealth and setting their children up to inherit some of that money in the most tax-efficient way possible.

One option this couple could consider is a living trust. With a revocable living trust, they could place assets into the trust and maintain control over them as long as they’re alive.

Another option is a Family Limited Partnership (FLP), which is a business structure that allows family members to own shares of a company and share in its profits. An FLP could make it possible to transfer assets to children in a tax-advantaged manner.

But wealth-transfer tools like these can be complex to both decide upon and set up. So if you’re in a position where you’ve hit your savings goals fairly early in life and are now more focused on setting your kids up for success, I’d say consult both a financial advisor and estate-planning attorney. You may, in fact, want to find an advisor and attorney who can work together to come up with a strategy for you.

I think the couple above could go a few different routes in passing on wealth, but it’s best for them to talk to someone who can review the details of their specific situation. And to be clear, I’d be making this recommendation even if their liquid net worth was a lot smaller than $10 million.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.