Personal Finance

We're a couple in our 50s spending $180k year - is our retirement nest egg big enough to stop working?

Published:

Last Updated:

It’s smart to assess your savings before kicking off an early retirement.

Think about your spending and whether retiring early will force you to make cutbacks.

Consider a middle-ground solution that might preserve your nest egg and make your retirement more rewarding.

Retiring early is possible, and may be easier than you think. Click here now to see if you’re ahead, or behind. (Sponsor)

A lot of people dive into early retirement because they get tired of working or burn out. So I was happy to see this Reddit post, where a couple in their mid-50s is taking the time to crunch the numbers before embracing an early retirement.

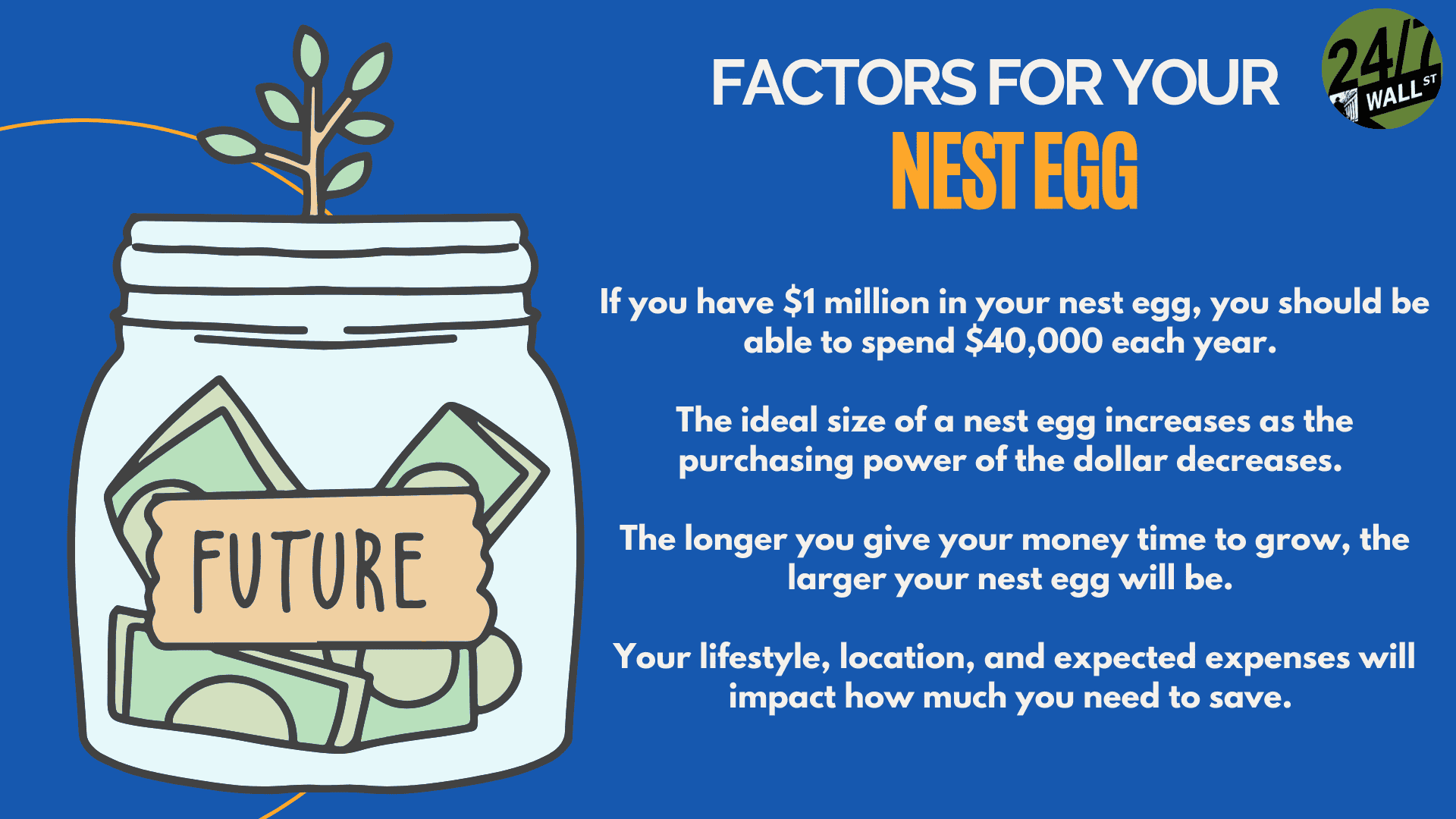

The couple’s net worth, excluding their home, is $7.5 million, and they typically spend $180,000 a year. The poster is wondering if they’ll be able to maintain that level of spending if they retire immediately. They’re also contemplating taking a year off or more to spend time with their aging parents and learn new skills.

I think it’s great that the poster is open to different options because that could lead them to their dream retirement without having to struggle in a high-pressure job any longer.

The poster here doesn’t seem too eager to make any spending cuts in retirement. But by my calculations, they shouldn’t have to.

If they retire in their mid-50s, they should probably limit their retirement plan withdrawals to 3% a year to be safe, as opposed to using the popular 4% rule. That’s because the 4% rule is designed to make people’s savings last for 30 years. In this case, the poster might need their savings to last for 40 years.

However, a 3% withdrawal rate gives them an annual income of $225,000. And that’s on top of whatever eventual income they get from Social Security. In fact, a pretty conservative 2.4% withdrawal rate gets them to $180,000 in annual income outside of Social Security, and that’s a more than reasonable rate for someone in this situation.

So based on all of this, I’d be inclined to tell the poster to go ahead and retire early. It doesn’t seem like they’ll need to make any sacrifices in the course of stopping work immediately. But there’s also another avenue I’d encourage them to explore.

The poster acknowledges that they’re in a golden handcuffs situation due to getting into management at a large company, but that they enjoy writing code, which is clearly a part of what they do. So what I’d tell the poster is that instead of retiring outright, they should perhaps mostly take a year off from work to spend time with their parents and learn new skills. At the same time, they could try their hand at consulting or starting a freelance business that would allow them to get paid for some amount of coding.

To me, this gives them the best of both worlds. If they can earn a bit of money in the coming year, they might manage to leave their savings largely untapped, which buys them more flexibility later on. It also gives them a chance to see what it’s like to be mostly retired and decide whether that really works for them.

Some people find that they miss doing the things they love professionally once they retire. So here, the poster has an opportunity to do a little side work to keep their skills current, all the while developing new skills and taking some time to reset.

They may find that after a year, they’d like to continue working a few hours a week, or maybe even full-time, but in a role that’s less stressful and more rewarding. And from there, they’d be able to preserve their savings even longer to perhaps upgrade their lifestyle once they kick off retirement for good.

I also think it’s a smart idea for this couple to sit down with a financial advisor. There’s a good chance an advisor would tell them that they’re okay to retire now based on their expected spending and the money they have saved. But an advisor might also help them come up with ways to maximize their nest egg as well as have insights on early retirement that help with this big decision.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.