Personal Finance

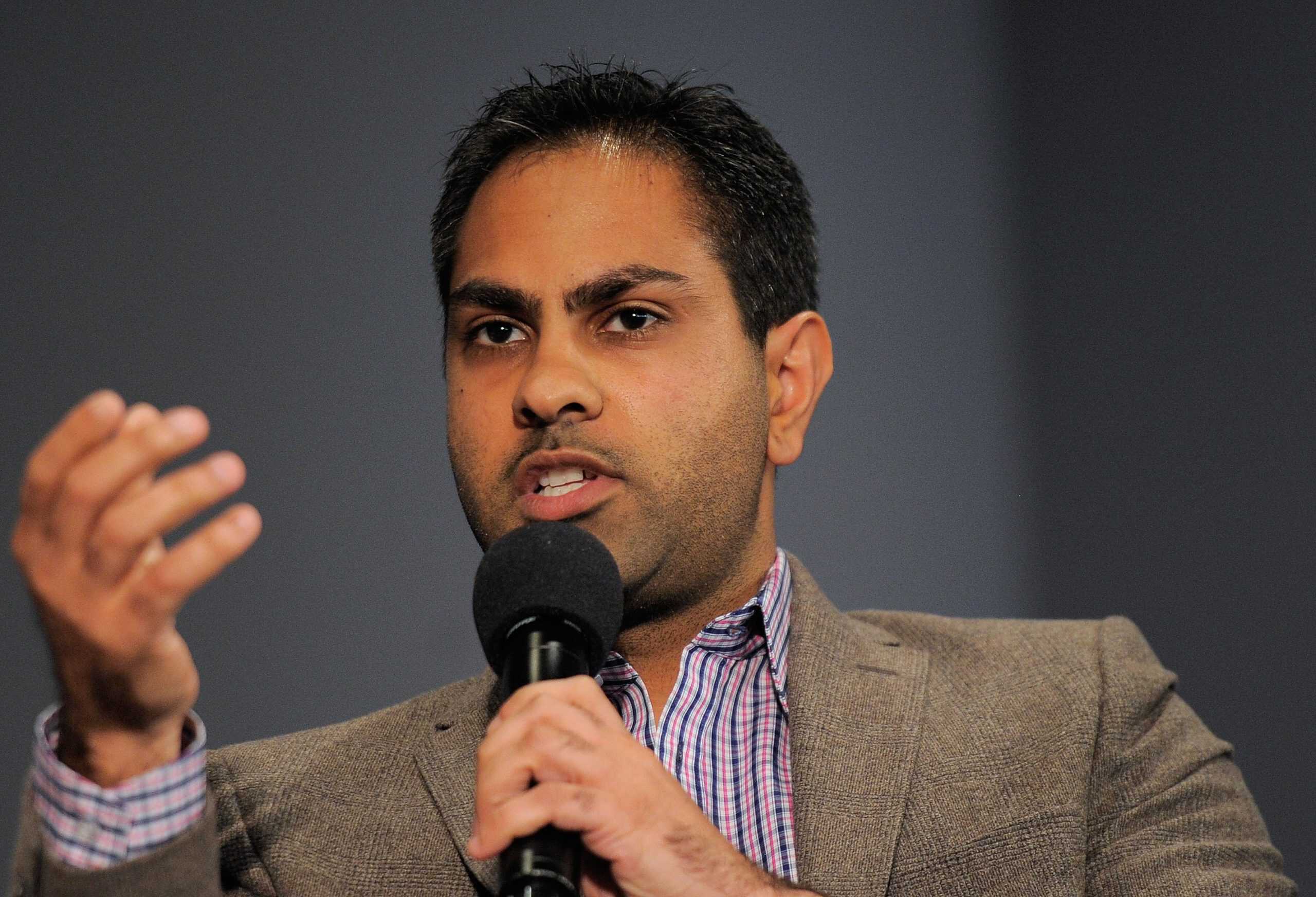

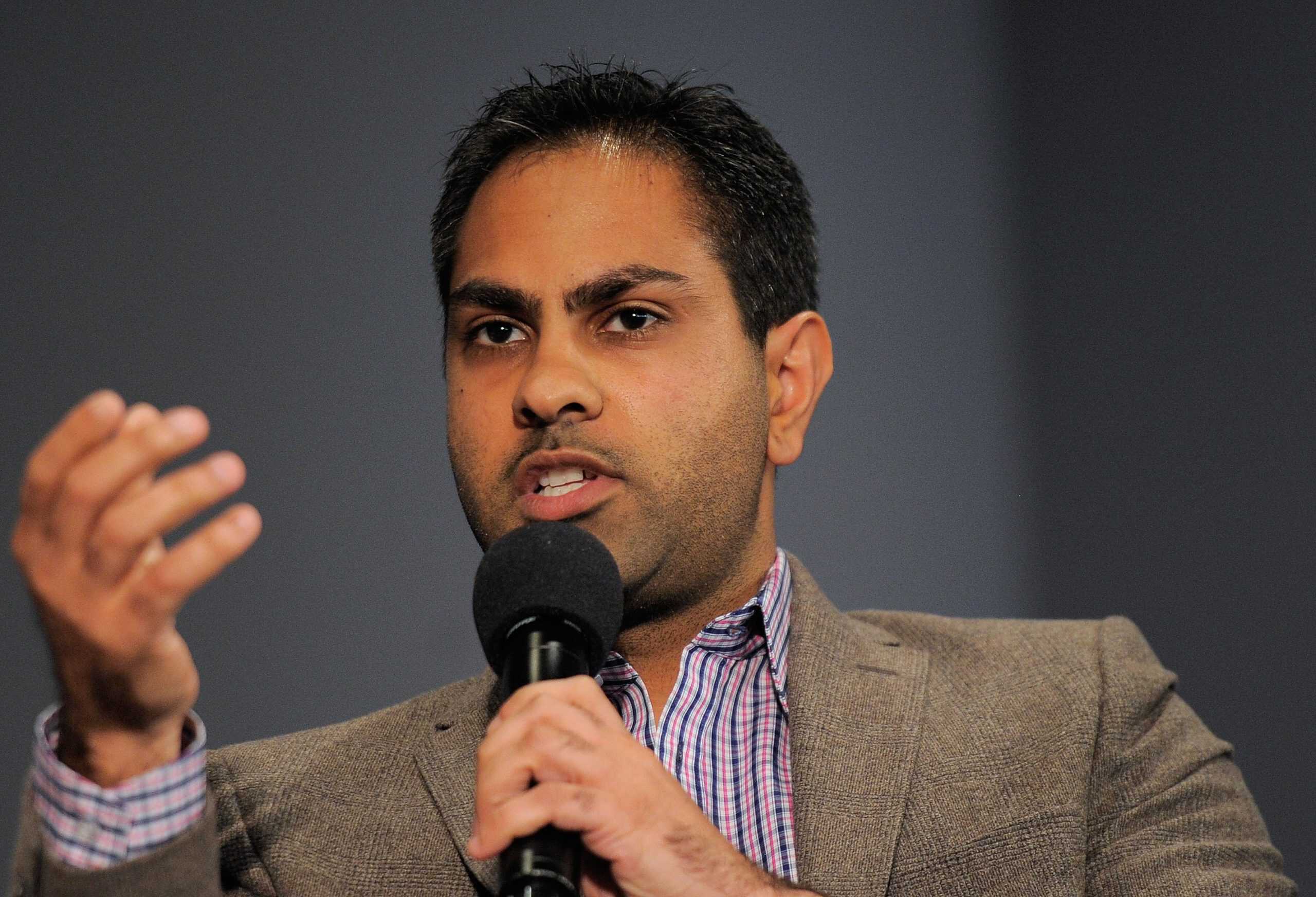

According to Ramit Sethi, Until You Do This, You Can Never Grow Your Finances

Published:

Ramit Sethi is a NY Times bestselling author, a podcaster, and the host of the Netflix series, I Will Teach You To Be Rich, which was taken from his 1 million copies sold book of the same title. While much of Sethi’s practical money management advice is echoed by a number of other financial advice speakers and authors, Sethi’s approach is somewhat different. Both his Master’s and Bachelor’s degrees from Stanford include Psychology as a minor or co-major component. The psychological aspects of his advice likely stems from this academic training.

Financial advice author, podcaster, and Netflix TV series host Ramit Sethi listed a 4-way division that he had advised for managing take-home pay.

Ramit Sethi’s advice combines a blend of common sense management with an understanding of human nature to create better odds of overall success.

Offering suggested percentage ranges instead of fixed numbers in Sethi’s advice allows people to feel comfortable customizing his concepts for their own situations.

million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

With a widespread media presence, Ramit Sethi frequently shows up on social media with snippets of his advice culled from his longer format programs and guest appearances. On one video segment, Sethi was citing his advice on personal take home pay money management. In 53 seconds, he quickly listed a four (4) way division of money allocation for one’s monthly paycheck. The suggestion combines a disciplined approach while acknowledging the temptation faced by everyone for instant gratification.

Sethi’s psychology background clearly appears at work in his “guilt-free spending” category. The discipline required to stick to a difficult regimen, whether it be a diet, an exercise program, or a money management routine, can become difficult for even the most dedicated-minded to successfully maintain. By wisely suggesting percentage ranges rather than a set number, there is an implicit flexibility to the money management program that allows each participant to feel more empowered in the decision-making process over following someone else’s rules.

Temptations to eat, vegetate in front of the TV or phone, or spend in ways that break discipline are omnipresent. The internal rationalization of “just this one” leads to backsliding, that, more often than not, results in failure.

By acknowledging human nature and the instant gratification component embedded in our DNA, Ramit Sethi’s suggestion to set aside a percentage of “mad money” allows for one to feed these pangs to break discipline in controlled segments while sticking with the core goals of saving, investment, and staying out of debt. While attaining the end objective might take longer, the odds of getting there will be improved over a total backslide and quitting altogether out of discouragement. Hence, he adds the “guilt-free” tag, so that one can psychologically justify indulging while sticking to the program.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.