Personal Finance

Dave Ramsey says if you meet these simple criteria, there is no excuse for not retiring a millionaire

Published:

Famed financial expert Dave Ramsey says that if you’re currently under 40 and don’t retire a millionaire, it’s your own fault.

“You made a freaking fortune in your working lifetime. You work your butt off your whole life, and you have nothing to show for it,” he says here.

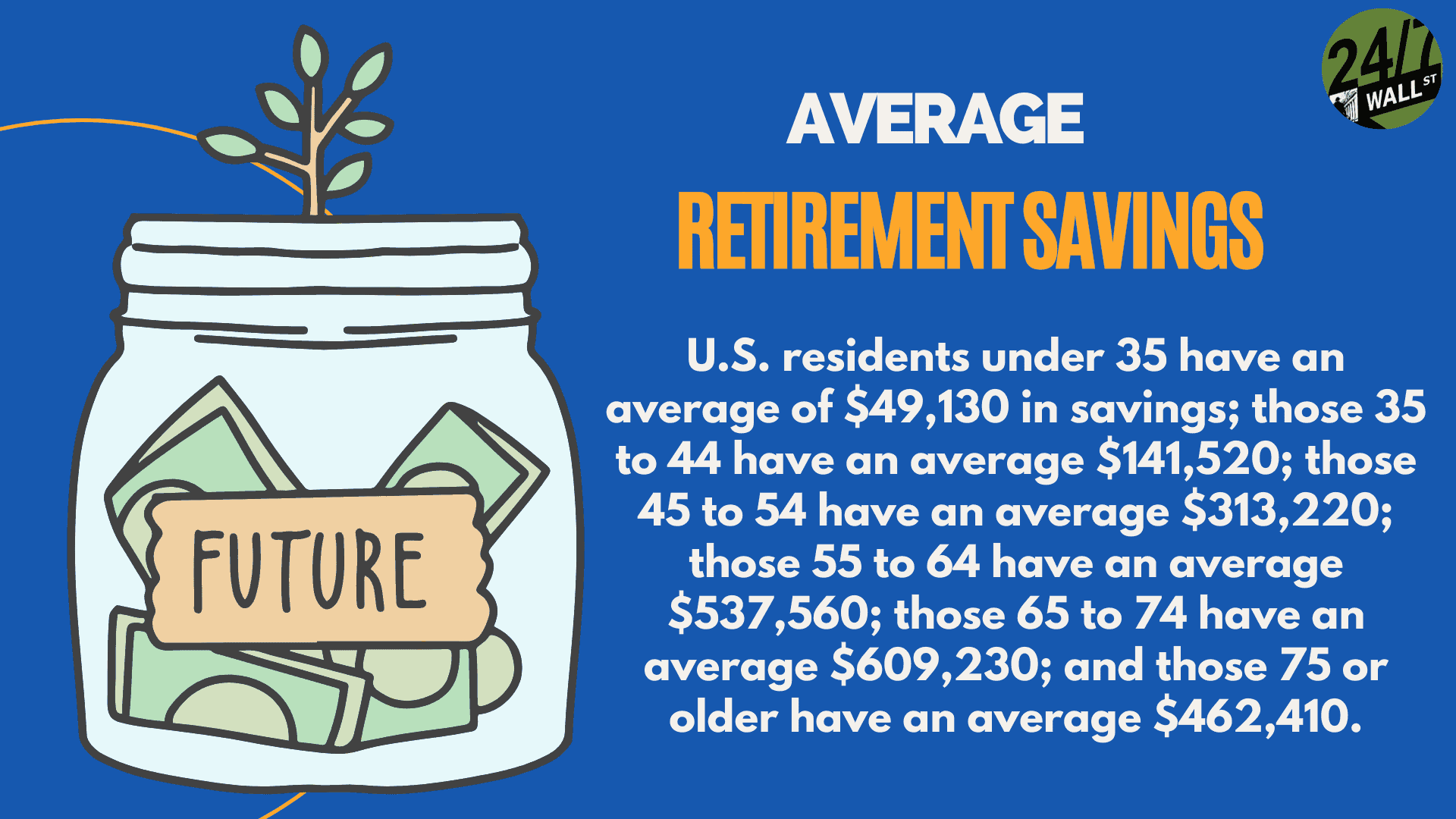

In fact, one of the top ways most Americans become millionaires by retirement is by consistently contributing to retirement accounts. According to a Fidelity survey, for example, there are more 401(k) millionaires on its platform than ever before.

“As of June, there were roughly 497,000 so-called retirement-created millionaires in the U.S., according to the wealth management firm, which analyzed balances across 26,000 of its customers’ accounts. Nearly 399,000 Americans also have a least $1 million in an individual retirement account. The key to stashing away such sums? Start early and contribute to your retirement plan consistently over many years, Fidelity said,” as quoted by CBS News.

If you aren’t even in the ballpark, there are ways to help yourself.

For one, if you’re older than 25, put away at least 15% of your household income into retirement (only after you become debt-free and have an emergency fund). Easier said than done. But start with something and work up from there.

Two, if your employer offers a 401(k) match, try to invest up to the full match. So, if your employer offers a match up to 6% of your pay, try to max out your contribution. According to Ramsey Solutions, eight out of 10 millionaires invested in their company’s 401(k) plan.

Three, do your best to stay out of heavy debt and make sure you have an emergency fund. Fourth, put extra money on hand into retirement instead of just spending it on anything.

“An example from Ramsey Solutions highlights how people under 40 can save $1 million for retirement. If someone is making $80,000 annually, they would need to invest $1,000 per month to reach that 15%. Putting that into “good growth stock mutual funds” could bring in more than $1.5 million in a retirement nest egg by age 65. Holding off retirement another five years could result in $2.8 million,” added Benzinga.com.

Plus, along the way, be sure to check in with a financial advisor for more advice. In the end, even if you’re behind on saving, there’s always a way to build a nest egg and eventually retire. And even if you don’t think you can do it, at least give yourself a fighting chance.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.