Personal Finance

Want the Biggest Possible Social Security Benefit? Here’s How to Get It

Published:

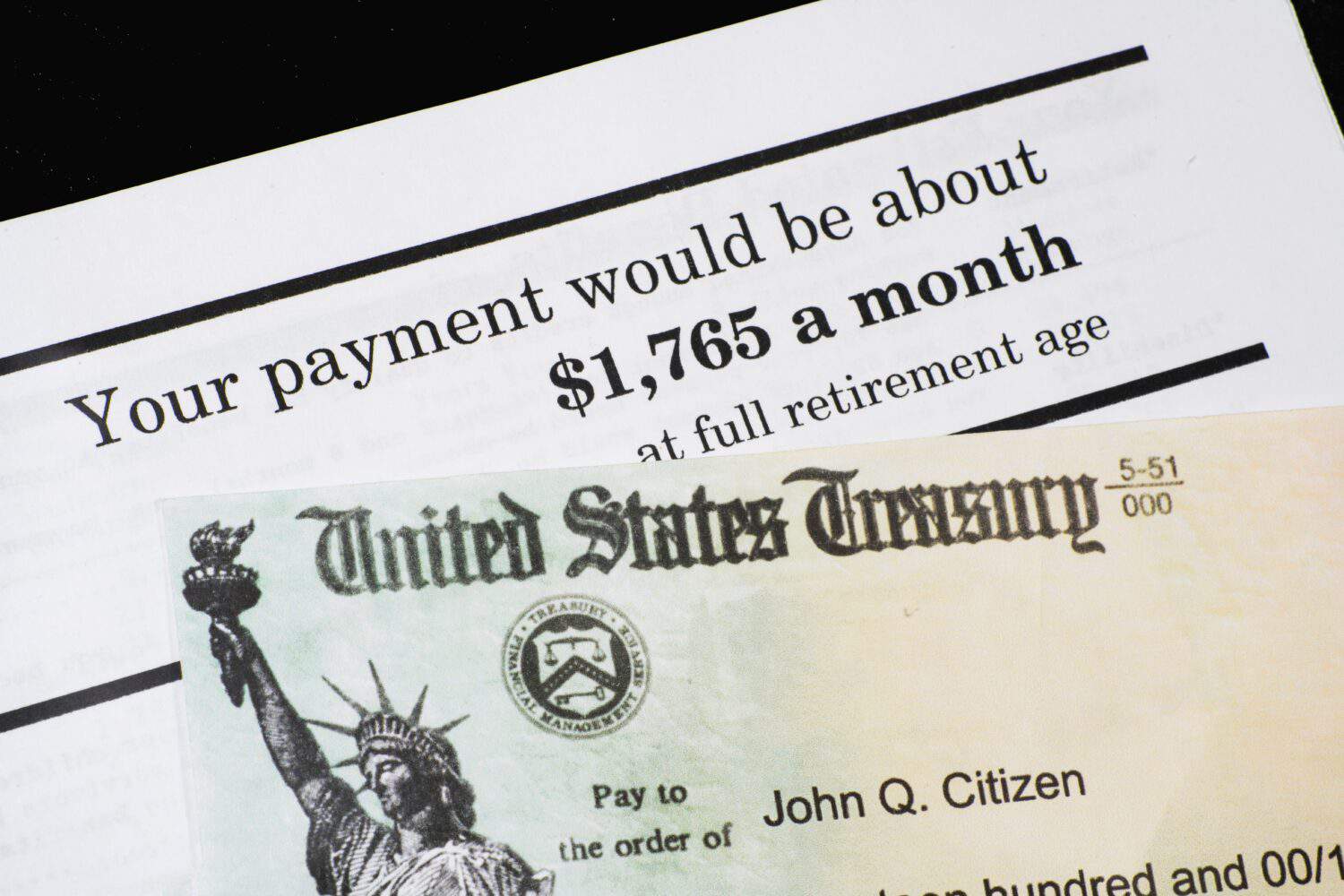

The maximum monthly Social Security benefit is $5,108 but it’s very difficult to get it.

You must earn the maximum taxable wage for 35 years or longer.

You also must not claim Social Security until you are 70 years old.

4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

In 2025, Social Security retirees can get a check worth up to $5,108 every single month. According to the Social Security Administration, this is the maximum benefit payment available. It’s also a lot of money, which goes a long way towards helping you to enjoy a comfortable retirement.

Sadly, very few people will end up getting a Social Security payment anywhere close to this amount. That’s because there are two very specific things that you must do to earn $5,108 in monthly retirement benefits — and accomplishing either can be a challenge. Here’s what it takes to max out your monthly payment.

The first key step you must take to get the largest possible Social Security check is to earn a lot of money for a long time. That’s because Social Security benefits are based on your average wage in the 35 years when your income is highest.

However, not all wages count. You pay Social Security taxes only on income up to something called the “wage base limit,” and any income earned above this limit is not subject to Social Security tax and is not counted in your benefits formula.

The wage base limit is the reason why there’s a maximum Social Security benefit. If you earn an amount equal to (or above) the wage base limit for at least 35 years, you will have maxed out your average wage and thus will get the highest benefit possible. Unfortunately, if even one year of lower earnings is included in the 35 years of wages that determine your benefit, then your average wage will be below the max and your payment will be smaller.

The wage base limit is very high. In 2025, it’s $176,100, up from $168,600 in 2024 and $160,200 in 2023. The amount changes each year to account for wage growth. But, the bottom line is, unless you earned the inflation-adjusted equivalent of $176,100 for a full 35 years, earning the maximum monthly Social Security check is off the table. Since it’s not easy to earn so much money for so long, it’s hard to get the maximum Social Security benefit.

Even if you do manage to earn the necessary amount, you aren’t done yet when trying to get your $5,108 monthly benefit. There’s one more crucial step to take. You need to also wait until 70 to claim your first Social Security payment. This is also challenging because you first become eligible at 62, and many people want or need to claim their payments well before 70 because they rely on Social Security to help fund their retirement and they don’t want to wait until they are 70 to give up work.

Waiting is essential, though, because earning the maximum average wage will only get you the maximum standard benefit or primary insurance amount. If you want the highest benefit possible, you also have to earn the most delayed retirement credits possible. Delayed retirement credits become available to those who wait beyond their full retirement age to claim benefits. They increase your monthly payment until age 70, which is when you stop earning these credits.

Every month you earn a delayed retirement credit increases your standard benefit by 2/3 of 1%. This adds up to an 8% annual increase. Those who receive $5,108 per month have earned the most increases they can, after starting with the highest possible standard benefit. When you consider how much they earned, and how long they waited to start getting Social Security, it’s easy to see why the payment is so high. It’s also easy to see why so few people receive the max Social Security check.

Of course, even if you don’t earn the maximum, you can still increase your benefit by earning as much as you can, working at least 35 years to avoid reducing your average wages, and waiting to delay Social Security for as long as possible until you hit 70. It’s worth aiming for those objectives since Social Security is going to be an important income source for most retirees.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.